Analyst Insight: A longer-term bearish sentiment for grain and oilseed markets?

Friday, 1 December 2023

Market commentary

- UK feed wheat futures (May-24) closed at £195.40/t yesterday, down slightly (£0.45/t) from Wednesday’s close. The Nov-24 contract fell £1.65/t over the same period, ending the session at £206.40/t.

- Global wheat markets generally saw minimal movement yesterday, as support from larger-than-expected US export sales was weighed on by forecasts of a large Russian crop next season. Russia’s IKAR consultancy said yesterday that is expects Russia’s wheat crop in 2024/25 to reach 92 Mt, up from 91.6 Mt in 2023/24 (Refinitiv).

- Paris rapeseed futures (May-24) ended yesterday’s session at €452.25/t, down €2.00/t. The Nov-24 contract fell €3.00/t over the same period, closing at €454.25/t.

- Paris rapeseed futures followed pressure in the wider vegetable oil market yesterday. Malaysian palm oil futures continue to fall on the back of weak demand from the biodiesel sector, dropping to their lowest since October this morning. Chicago soya oil futures (May-24) were down 0.8% over yesterday’s session.

A longer-term bearish sentiment for grain and oilseed markets?

On Tuesday, AHDB held our annual Grain Market Outlook (GMO) Conference in York. The day focused on optimising business potential, and the first session of the day looked at the outlook for global grain and oilseed markets moving forward. So, what were the key takeaways from this session?

Grains

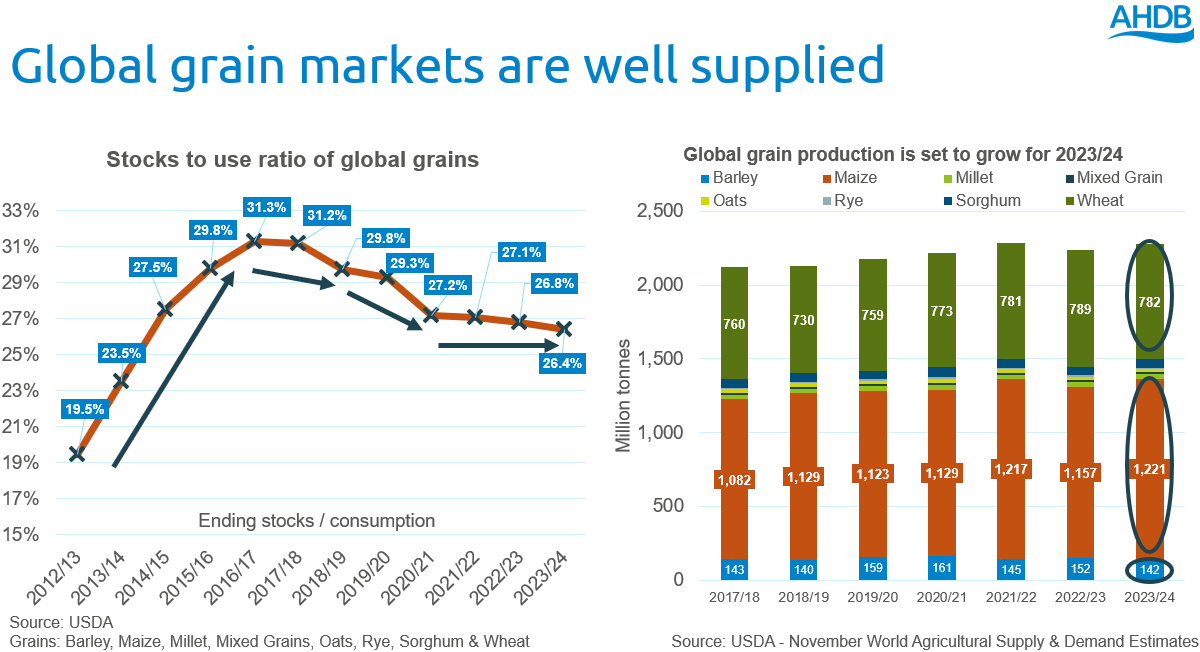

For grains, the session began by outlining that markets expect ample supplies of feed grain this season. In 2023/24, despite losses in global barley and wheat production, total global grain production is expected to grow; a rise in maize output outweighs other declines. Global maize production in 2023/24 is pegged at 1,221 Mt by the USDA, up from 1,157 Mt last season.

The stocks to use ratio of global grains, however, does look to be slightly tighter on the year at 26.4%, the tightest since 2013/14.

The grains session also highlighted the downwards pressure that Black Sea supplies are applying on grain prices at the moment, with strong and competitive Russian wheat exports expected to continue. Ukraine also looks to be exporting more through their ‘humanitarian corridor’ in November, keeping the flow of grain coming out the country.

At the end of the session, it was made clear that the El Niño weather event was the key watchpoint moving forwards, with much of the maize crop still yet to go in the ground in South America. Presented data also showed that in years of El Niño and La Niña weather events, yields tend to be impacted, so production estimates have room to be revised down. The size of any downward revisions will be important; cuts larger than 10 Mt could tighten the outlook.

However, as it stands currently, the longer-term outlook is for a feed grain surplus this season and therefore a mildly bearish outlook over the next six months at least.

Oilseeds

Similarly to grains, the oilseeds session started by outlining expectations of heavy supplies for the rest of the season. The stocks-to-use ratio of major oilseeds (incl. rapeseed, sunseed and soyabeans) is the highest since 2018/19 at 23.8%. This is largely due to an increase in global soybean production this season, despite a downturn in Canadian and Australian rapeseed production.

.png)

Again, Ukrainian exports are currently weighing on prices, with rapeseed exports from the country expected to reach 3.4 Mt, relatively in line with last season (UkrAgroConsult). Looking ahead though, El Niño is also a factor to watch in oilseed markets, with the Brazilian soyabean crop in focus. If larger cuts are made to the Brazilian crop, it could start to outweigh the higher stocks and support markets.

Ultimately however, the heavy supply of soyabeans expected this season (should only smaller revisions be made to Brazilian output) is likely to weigh down on the wider oilseed market longer-term.

Download the full set of slides from the Grain Market Outlook Conference markets session here

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.