Arable Market Report - 18 December 2023

Monday, 18 December 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Christmas publications

This is the last AHDB market report before Christmas. So, we would like to take this opportunity to wish you all a happy Christmas, and a prosperous 2024.

The next Market Report will be published on Tuesday 02 January 2024.

The last Grain Market Daily of 2023 will be published on Friday 22 December. It will then resume on Wednesday 03 January 2024.

There will be no UK delivered prices published on Friday 22 December. The next publication will be Friday 05 January 2024.

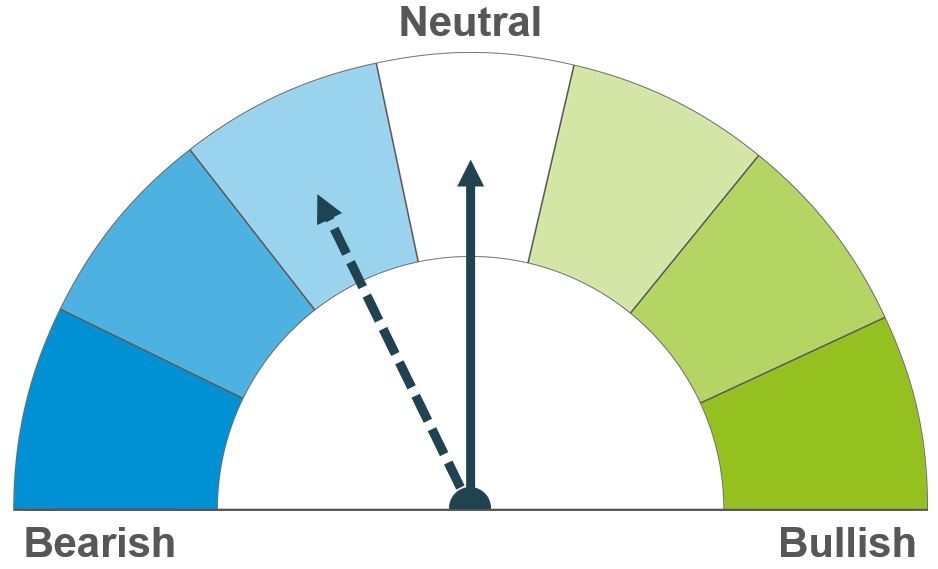

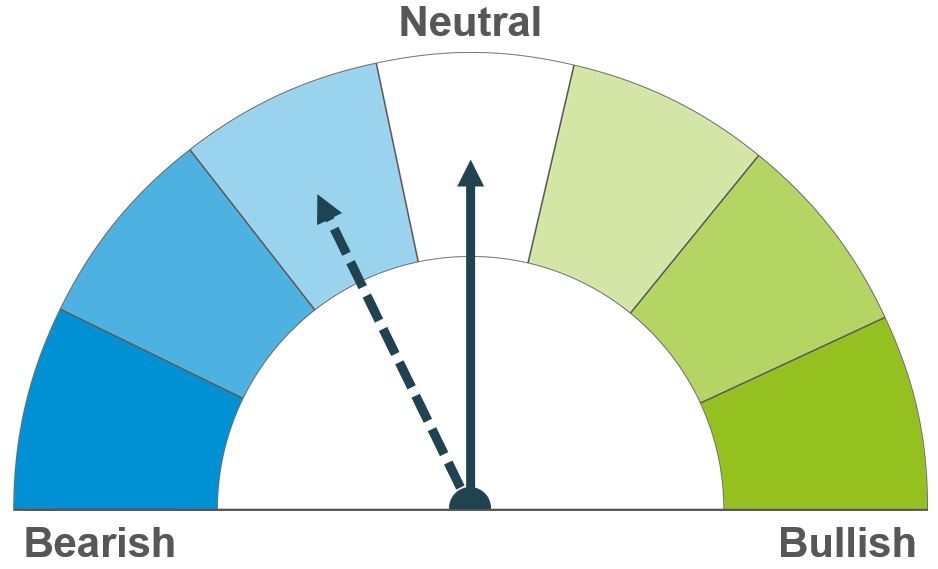

Wheat

Heavy maize supplies are still expected to weigh on the global grains complex longer-term, as long as the Brazilian crop is as forecast. Short-term, export demand and new crop plantings and conditions remain in focus.

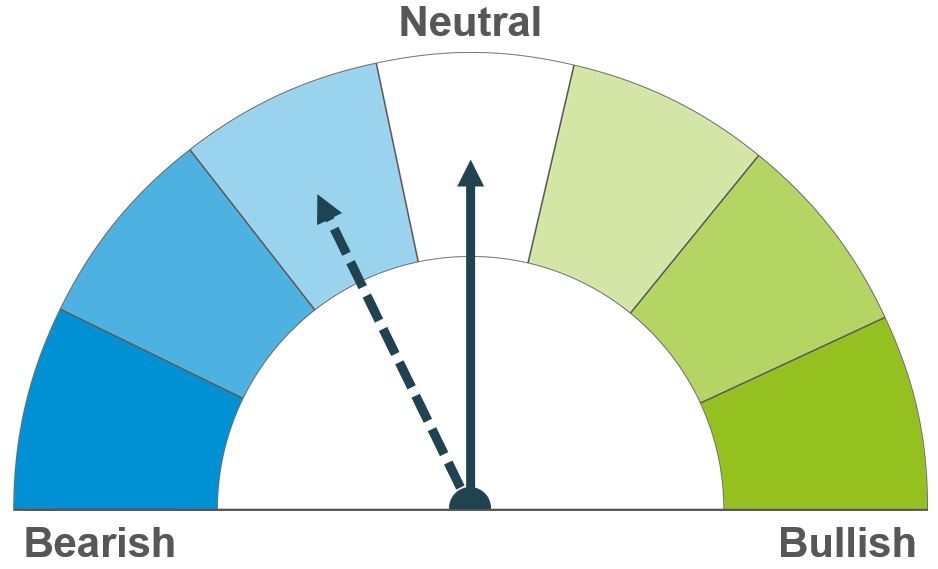

Maize

Brazilian conditions are a key driver both short and long-term. Though as it stands ample maize supplies are expected to weigh on prices longer-term.

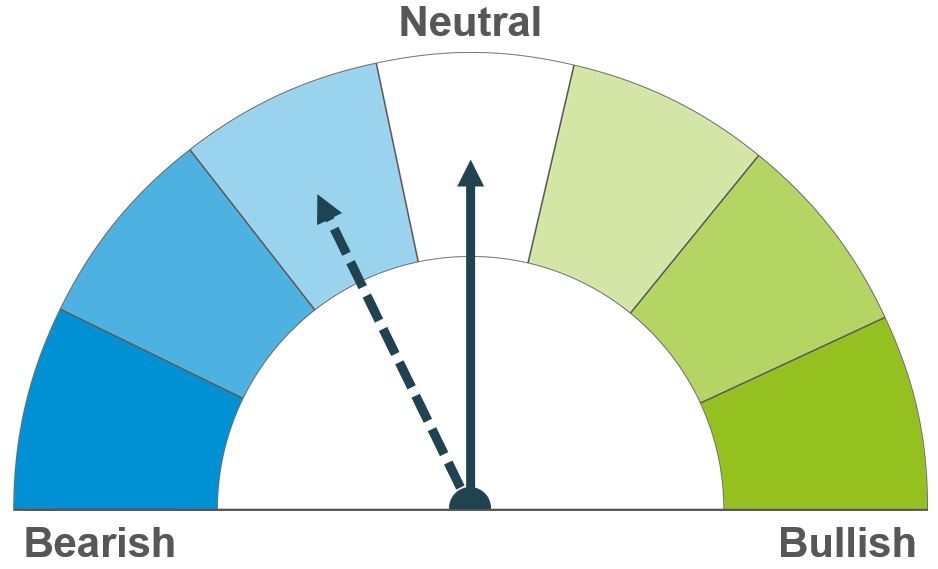

Barley

Barley prices continue to follow movement in the wider grains complex, planting conditions are of concern in western Europe, though more focus will be on the spring crop.

Global grain markets

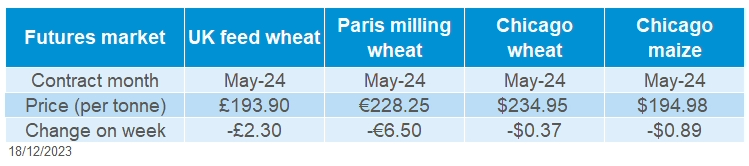

Global grain futures

Global grain markets were overall pressured last week on the back of limited export news following a rally of US wheat sales the week prior, as well as forecast rains in Brazil. Downwards pressure was limited however by a slight rise in Russian grain prices, concerns over Northern Hemisphere new crop plantings and news of a rise in export tax on wheat and maize in Argentina.

Much like the UK, new crop plantings in other parts of western Europe remain a concern due to unfavourable drilling conditions. On Tuesday, France’s Farm Ministry released the first sowing estimates for harvest 2024. Soft wheat area is forecast to decline 5.1% on the year to 4.49 Mha, the lowest in four years. The winter barley area was pegged at 1.31 Mha, down 4% on the year, though above the five-year average. Planting progression over the rest of winter will remain something to watch.

On Wednesday, it was reported that Argentina’s new government, led by President Javier Milei will seek to raise export taxes on wheat and maize exports to 15% from the current tax of 12%. The Argentine Rural Confederations (CRA) said it had met with the government and flatly rejected the proposals (LSEG).

Forecasts of rain in key maize growing regions of Brazil over the coming days could ease concerns over dryness, ahead of the start of the Safrinha planting window in the new year. Brazil’s maize production will be largely determined by the planted acreage in the coming months. According to an analyst at Agrinvest, purchases of seed and fertiliser for the 2023/24 Safrinha crop are down 18-20% on the year, perhaps unsurprising with the late soyabean plantings pushing maize plantings past the ideal window.

UK focus

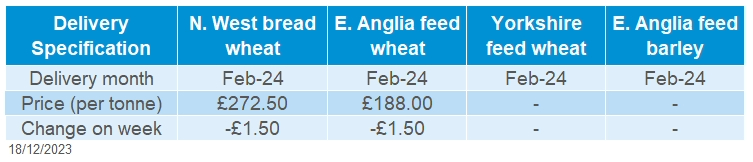

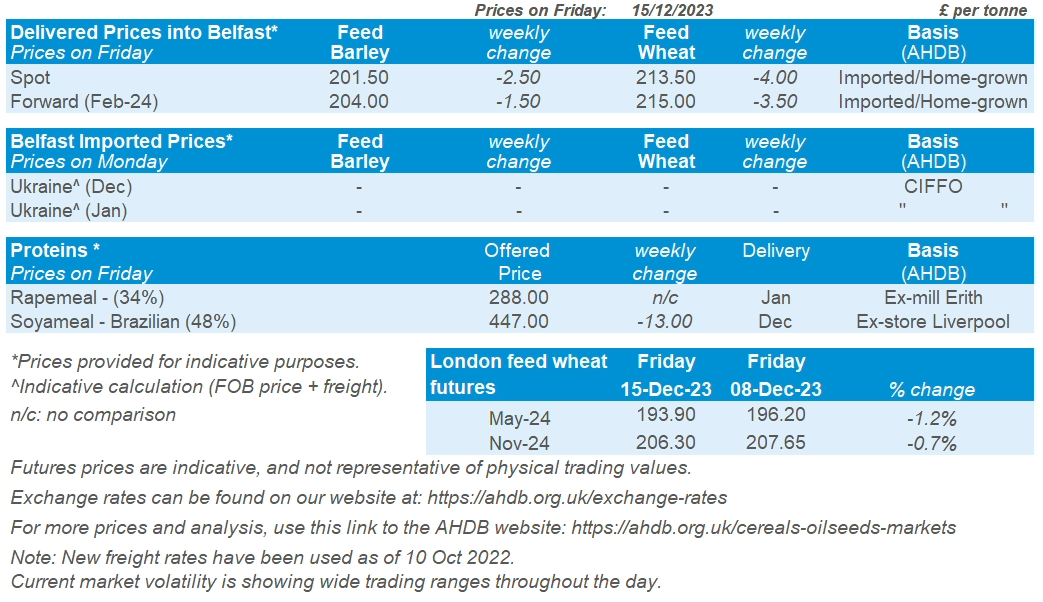

Delivered cereals

Domestic wheat futures followed global price movement down last week (Friday-Friday). UK feed wheat futures (May-24) ended Friday’s session at £193.90/t, down £2.30/t on the week. The Nov-24 contract was down £1.35/t over the same period, closing at £206.30/t on Friday.

Delivered prices followed futures down last week (Thursday to Thursday). Feed wheat delivered into East Anglia for February delivery was quoted at £188.00/t, down £1.50/t on the week.

Milling wheat premiums remain historically firm. Bread wheat delivered into the North West for January delivery was quoted at £271.00/t on Thursday, down £1.00/t across the week.

On Thursday, Defra released the final estimates for 2023 UK cereal and oilseed production. There wasn’t much change for the final UK production figures in comparison to AHDB’s ‘provisional’ estimates made in October. However, wheat, barley and oat production were all lower both on the year and on October’s estimates, which could lead to some tightening of the UK supply and demand balance. Read the full analysis

Oilseeds

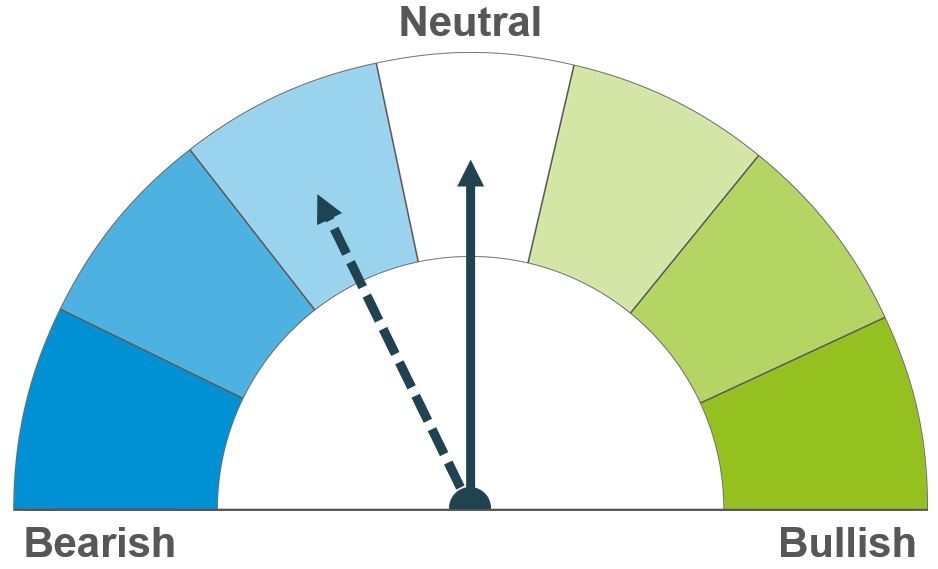

Rapeseed

Global rapeseed supply remains ample, though markets continue to react to wider oilseed and vegetable oil news closely. With forecast rains in Brazil, expectations of large Brazilian soyabean supplies continue to weigh on the outlook longer term, though this also remains a watchpoint short-term.

Soyabeans

While strong US soyabean demand and a weaker US dollar offers support, forecast rains in Brazil offset gains. Longer-term, weather in Brazil remains a key watchpoint as well as the competitiveness of Argentinian soyabeans on the global market.

Global oilseed markets

Global oilseed futures

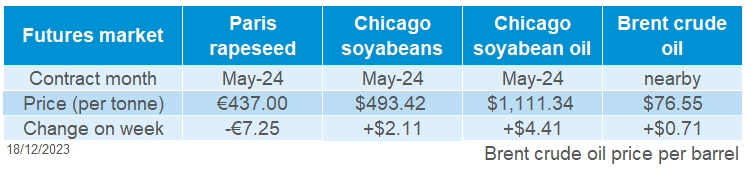

Chicago soyabean futures started the week supported following strong US exports, alongside a lack of rainfall in Brazil causing concern over the impact the drought is having on the soyabean crop. While futures fell in the latter half of the week following forecast rains over Brazil, this did not offset earlier gains. The May-24 contract rose $2.11/t on the week (Friday – Friday) closing at $493.42/t. The US dollar weakening over the week also helped to support soyabean prices.

US soyabeans exports were strong last week, as the US reported consistent soyabean sales since 06 December. There was also speculation that China may continue their recent flurry of purchasing of US soyabeans for delivery early next year. Alongside improved export demand, domestic US soyabean crushing for November reached 189.04 Mbu, the second greatest crush volume on record for any month and up 5.5% from last year’s November volume.

As of 9 December, 89.9% of Brazil’s soyabean crop had been planted, down 6 percentage points (pp) from planting progress this time last year. The challenging planting season has caused some Brazilian farmers to replant soyabeans due to the ongoing drought conditions (LSEG). However, forecasted rainfall across northern and central Brazil has alleviated recent drought concerns as the El Niño weather events continues to influence growing conditions.

While Argentina’s president Javier Milei is expected to increase the export tax for wheat and maize to reduce the country's current fiscal deficit, the export tax for soyabeans is expected to remain the same. In addition, the recent 50% devaluation of the Argentine peso could see the increase of attractiveness of Argentina’s agricultural products and could weigh on global soyabean prices according to UkrAgroconsult. Soyabean planting in Argentina is 59.5% complete, up 9 pp from last year’s progress for December with 90% of the crop in ‘normal to good’ condition.

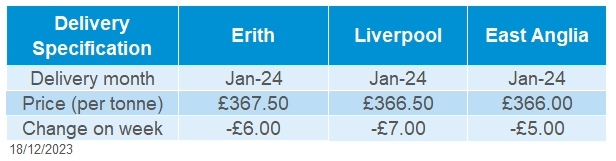

Rapeseed focus

UK delivered oilseed prices

Despite Chicago soyabean futures gaining on the week (Friday – Friday), Paris rapeseed futures fell €7.25/t, closing at €437.00/t on Friday. While Chicago soyabeans benefited from a weaker US dollar and strong soyabean demand, Paris rapeseed futures fell alongside Winnipeg canola futures as Malaysian palm oil weighed on the vegetable oil market. Though today, Malaysian palm oil has regained some strength.

Rapeseed delivered into Erith for January 2024 delivery was quoted at £367.50/t, falling £6.00/t over the week (Friday – Friday).

Agreste, the Ministry of Agriculture and Food for France, published their estimated winter planting for 2024. Rapeseed is currently forecasted at 1.35 Mha, up 5% from last year and up 17.3% over the 5-year average (2019 – 2023).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.