UK final 2023 production lower: Analyst Insight

Thursday, 14 December 2023

Market commentary

- UK feed wheat futures (May-24) closed at £195.10/t yesterday, down £1.00/t from Tuesday’s close. The Nov-24 contract was also down £1.00/t over the same period, ending the session at £207.25/t.

- Domestic wheat futures followed global wheat price movement down yesterday on the back of profit taking and no sign of fresh demand after last week’s strong sales campaign to China.

- Paris rapeseed futures (May-24) were down €3.25/t yesterday, closing at €438.50/t. The Nov-24 contract ended yesterday’s session at €444.25/t, down €3.50/t over the same period.

- Paris rapeseed futures followed the wider oilseed complex down yesterday with pressure in the US soyabean market following forecasts of rain in Brazil settling concerns over dryness in key producing regions.

- The latest trade and agriculture commission report has been published by the Depart for Business & Trade. This report is the advice to the Secretary of State for Business and Trade on the UK’s Accession Protocol to CPTPP. AHDB fed into this work providing impartial knowledge and market information on what this meant for the UK edible oil market following a potential change in the trading relationship with Malaysia.

UK final 2023 production lower

This morning, Defra released the final estimates for 2023 UK cereal and oilseed production. This is the first full UK release from Defra. So, to fill the gap AHDB published a “provisional” UK crop production estimate for 2023 in October, read more on that here.

There isn’t much change for these final UK production figures in comparison to the provisional figures. The data has confirmed lower national yields in comparison to 2022, with notably larger annual downgrades to spring barley and oilseed rape (OSR).

However, what we can take away from these final figures is that there is some slight tightening of UK cereals supply. Wheat, barley and oat production are all lower, both on the year and lower than expected in the October provisional UK estimates. This may lead to some slight tightening of the UK supply and demand balance.

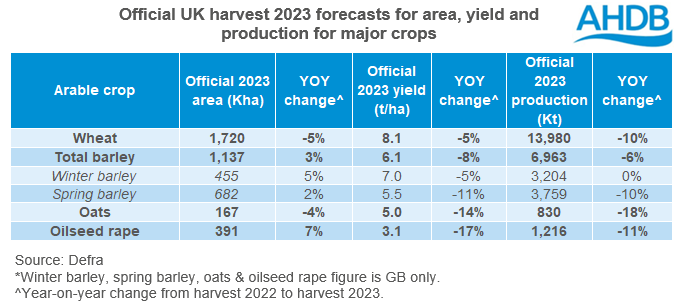

Highlights from the release include:

- Total UK wheat production is estimated at 14.0 Mt for 2023, down 10% year-on-year. The lowest UK wheat production since 2021.

- Total UK barley production is estimated at 7.0 Mt, down 6% year-on-year. With UK winter barley production estimated marginally lower year-on-year at 3.2 Mt, a majority of the downgrade is from UK spring barley production, which is estimated at 3.8 Mt, down 10% year-on-year. Despite an increase in spring barley area for 2023, UK national yields are estimated at 5.5 t/ha, down 11% year-on-year.

- UK oat production is estimated 830 Kt, down 18% year-on-year.

- UK oilseed rape production is estimated at 1.2 Mt, down 11% year-on-year. Like spring barley, despite the annual growth in area for 2023, production is lower due to poor yields, which nationally are estimated at 3.1 t/ha, down 17% year-on-year.

Below is a table summarising the data from Defra’s release this morning.

How could this change the domestic supply and demand balance?

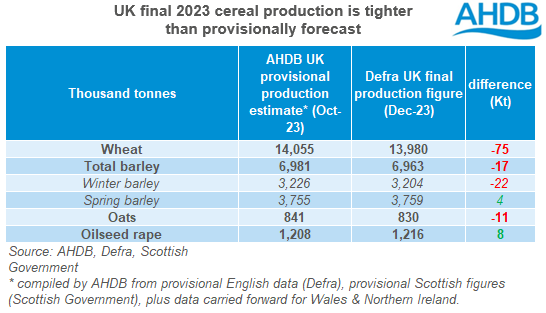

For the first official UK cereal supply and demand estimates, which were released in November, the provisional crop estimates compiled by AHDB were used for wheat, barley, and oat production. With the official Defra figures released today, how do these differ from the provisional AHDB production forecasts?

As the table above shows, there is a tightening of output when compared to the figures published in October 2023. Spring barley production is slightly higher than initial forecasts (+4.3 Kt), but total barley production is outweighed by the reduction in winter barley (-21.8 Kt).

UK wheat production is estimated 75 Kt lower than October 2023, which could tighten UK supply and demand (S&D) further.

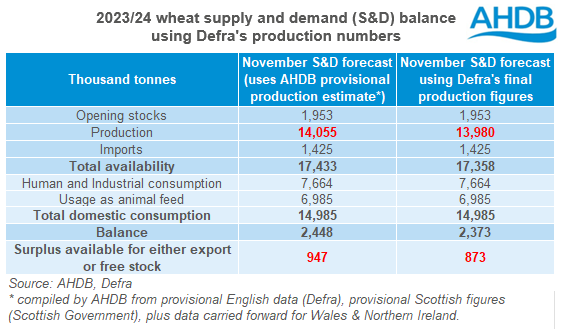

If the UK final production figure is applied to the latest November S&D estimates with no adjustments are made to demand or imports, we can see the potential impact. With just the downgrades to production, it suggests that the surplus available for either for export or free stock is 873 Kt.

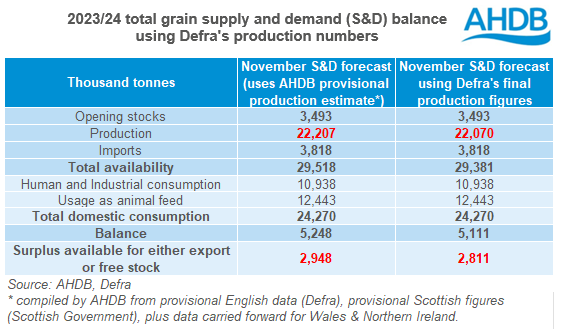

Taking into account all of these figures we can see that there is a lower overall production for UK cereals, with total UK production now estimated at 22.1 Mt, down 137 Kt from provisional estimates. If these figures are applied to the latest UK S&D estimate, with no change to demand or import levels, the surplus available for either export or free stock would stand at 2,811 Kt.

What could this mean?

For the wheat situation supplies are getting tighter, although without other changes there would still be as marginal surplus for this marketing year. This latest reduction to estimated wheat production indicates that wheat supplies going into 2024 harvest may not be as plentiful. This is on the back of the lower estimate area of wheat going into the ground for harvest 2024 and the potential for tightening of closing stocks for the 2023/24 marketing year.

The new crop market is already pricing that tightness into the market, as new crop UK feed wheat futures are trading at a premium to the continent. However, this does not explicitly mean new crop domestic wheat prices are going to keep climbing as at the end of the day we are price takers in the global market, not makers.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.