The UK will not be over supplied with Malaysian palm oil: Grain market daily

Thursday, 6 April 2023

Market commentary

- UK feed wheat futures (May-23) closed at £198.85/t yesterday, down £2.00/t on Tuesday’s close. New crop futures (Nov-23) closed at £214.85/t, down £0.35/t over the same period. Increasing the gap between old and new crop futures.

- Our domestic wheat market followed both the Chicago and Paris market down yesterday. Improved weather forecasts across the northern plains with warmer and drier conditions are forecast later this week for spring planting.

- Paris rapeseed futures (May-23) closed yesterday at €453.00/t, down €25.25/t on Wednesday’s close. Paris rapeseed futures have recently been gaining of the momentous support in crude oil. However, rapeseed felt pressure as crude oil prices have stabilised, and attention has been turned back to the ample supplies of rapeseed in Europe.

The UK will not be over supplied with Malaysian palm oil

As outlined last week, there is an agreement in principle for the UK to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). As one of the largest free trade agreements in the world, it facilitates trade between members by harmonising regulations and reducing tariffs, full information and an overview of this agreement can be read in this article here.

There has been some press coverage in recent days suggesting that palm oil will see a change in trade patterns, so we have reviewed the evidence to counter this view. The new deal is unlikely to see a change in trade patterns. Nine out of the eleven other members in this trading block already have an existing trade deal with the UK, apart from Malaysia and Brunei.

So, the main implication of joining this block for the UK oilseed market will be dropping the (up to) 12% tariff that is applied to palm oil imports. With Malaysia being the second largest global producer and exporter of palm oil, after only Indonesia, will this really change things domestically?

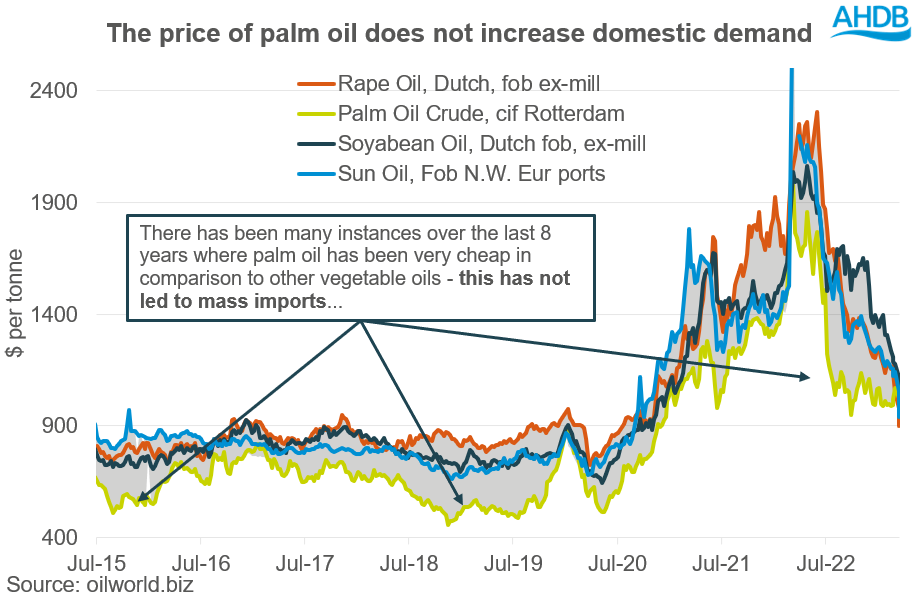

Conventionally, palm oil is the cheapest vegetable oil on the global market, usually acting as a floor to vegetable oil prices. This is until recently when rape oil has hit a historical discount to palm oil due to large supplies of rapeseed on the European market.

Malaysian palm oil imports in the UK

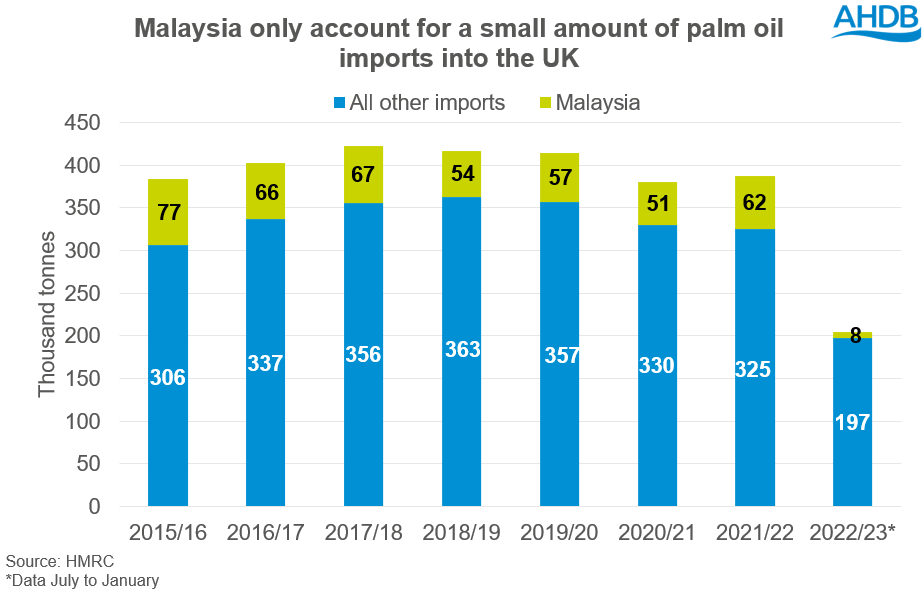

Analysing trade data going back to 2015/16, the UK’s imports of palm oil has remained quite static, ranging from 380Kt to 425Kt (2015-2021), over that period Malaysia have only accounted for 15% of origin on average.

Much of the UK’s other origin source outside from the EU is from Papua New Guinea and Indonesia. However, as the data shows, the demand for palm oil is relatively stable and price doesn’t seem to have much of an impact on that.

As displayed in the graph above there are several instances where palm oil has been at a huge discount in comparison to other vegetable oils, but domestic demand has remained stable. This is pointing unequivocally to the fact that demand for this commodity is not solely price driven.

There is difference in the properties between vegetable oils, and if very cheap palm hasn’t been flooded into the UK market even when palm oil has been at a huge discount in comparison to other vegetable oils, will the removal of the tariff cause a surge in imports?

As the vegetable oil market showed in 2021/22 rape oil demand to some extent is inelastic. This means regardless of the price in comparison to other oils, demand does not change significantly, and the properties of palm oil cannot replace that.

Further to that, there is a stigma around the use of palm oil, questions over its sustainability. The EU have implemented regulations to guarantee that the products EU citizens consume, do not contribute to deforestation or forest degradation worldwide, which is inherently reducing their demand for palm oil.

Conclusion

In the short-term, the removal of this tariff will not have much of an impact on the UK’s imports or consumption of palm oil. A larger proportion of Malaysian origin palm oil may be imported, but that will be dependent on pricing at the end of the day. Newspapers easily over sensationalise without presenting all the facts of what actually joining the CPTTP means for our domestic vegetable oil industry. Conclusions show that the demand for palm oil is not price driven.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.