Rapeseed widening premium over soyabeans: Grain market daily

Friday, 22 October 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £204.25/t, down £3.00/t on Wednesday’s close. The May-22 contract closed at £215.50/t, down £1.75/t. Reasons for these falls were the Paris and Chicago markets dropping.

- One of the reasons why Chicago wheat futures (Dec-21) were pressured yesterday was due to a firming dollar, which strengthened against both Sterling and the Euro.

- Stratégie Grains increased its forecast for 2021/22 maize crop in European Union to 67.5Mt, up from 64.9Mt in its previous report.

Rapeseed widening premium over soyabeans

On Wednesday, Nov-21 Paris rapeseed futures set a record high closing (in euro terms) at €698.25/t. The price has since dropped slightly, to close yesterday at €686.25/t.

The Nov-21 contract traded as high as €700.00/t on Wednesday, matching the highest trade set on April 30 2021 by the May-21 contract.

Similar to last April, the nearby prices have been squeezed by short-coverings before contract expiry.

These high futures values have support domestic prices too, which poses opportunities for domestic growers with 2021 crop left to sell. Last Friday, rapeseed (15 October) delivered (into Erith, Nov-21) was quoted at £567.50/t.

However, despite all this recent support in rapeseed markets, global soyabeans prices have slowly been drifting downwards.

Rapeseed and soyabeans

We knew global rapeseed supplies were going to be tight for 2021/22 as drought in the Canadian Prairies had significant implications for Canadian canola production.

However, these record high rapeseed prices can be hard to believe when soyabean prices have been dropping due to a bearish longer-term outlook from a large Brazilian crop.

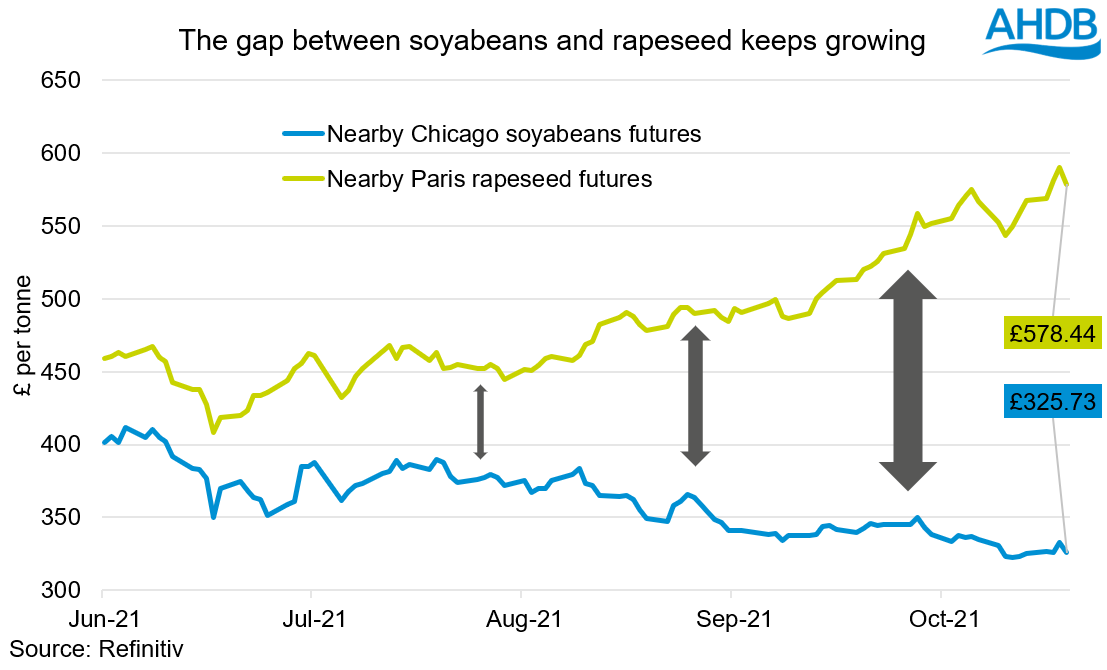

Often, a fall in soyabean prices can pull rapeseed prices down too. But, this hasn’t been happening in recent weeks. In Sterling terms, nearby Chicago soyabean prices have dropped 11.3% since the start of August 2021. Meanwhile, over the same period (1 Aug – 21 Oct) nearby Paris rapeseed futures have gained 29.9%.

Paris rapeseed futures are significantly supported currently, and this support is anticipated to last until large quantities of new crops come online next summer.

There is a 5.0Mt Australian canola (rapeseed) crop coming to market this winter, this crop is set to increase 11.3% on last year’s production of 4.5Mt. This could temper prices as the crop is exported, but fundamentally the rapeseed picture is still looking tight. With a more bearish outlook for soyabeans, we could see rapeseed’s price gap over soyabeans widen further.

Demand to continue for rapeseed

Although this Australian crop is huge, it’s not enough to balance the global supply and demand. Global stocks are expected to drop to as low as 6% of annual demand in 2021/22 (USDA).

So far, even with record high prices, demand for rapeseed remains relatively stable or inelastic. Demand remains high due to the oilseeds’ characteristics, whether to fulfil bio-fuel mandates or in its use as an edible oil in food products. E.g. if a processor has a unique product with a distinct flavour with the help of rape oil, how can they use alternative oils?

The prices of rapeseed and soyabeans usually is closely correlated, with soyabeans being a large sentiment driver of all oilseed prices. This marketing year we are seeing inelastic demand for rapeseed come into play. This ignores the bearish fundamentals of soyabeans and has widened the price gap between the two oilseeds.

Inelastic demand for rapeseed (and rapeseed oil) could possibly widen the gap further between the rapeseed and soyabeans. This could especially be seen if we are faced with a large Brazilian soyabean crop and/or Chinese soyabean demand is not as strong as anticipated. But, neither of these has transpired yet.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.