Rape oil prices to pull rapeseed prices even lower? Grain market daily

Wednesday, 22 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £199.75/t, down £4.75/t from Monday’s close. This is the first time since February 2022, that the May-23 contract has closed below £200/t. New-crop futures (Nov-23) closed at £212.55/t, down just £1.95/t over the same period.

- Today, UK feed wheat futures (May-23) are trading at £192.50/t as at 13:15. For new-crop futures (Nov-23), these are trading at £206.00/t recorded at the same time.

- Domestic futures followed global wheat contracts down yesterday, on improved weather across the US grain belt as well as the extension of the Black Sea Initiative (Ukrainian grain export corridor) easing concerns over Black Sea supplies. Cheap Russian supplies especially continue to provide tough export competition for EU wheat.

- Financial market concerns, following news on Swiss bank Credit Suisse, weighed on global grain markets too.

- Paris rapeseed (May-23) fell €12.75/t yesterday, to close at €441.00/t, driven by pressure from the wider oilseed complex.

- Chicago soyabean futures (May-23) continue to feel pressure as the Brazilian harvest progresses. Yesterday, the contract closed at $538.98/t, down $6.98/t from Monday’s close. This is the lowest close on this contract since the start of December 2022.

Spring Grain Market Outlook webinar

When: Tuesday 25 April 2023, 10:30 - 12:00pm.

Following on from November’s in-person Grain Market Outlook Conference, this farmer-focussed spring webinar looks at price direction for the new season, as well as looking to fill the funding gap created by reduced BPS payments to arable farmers.

Schedule:

Part 1: Market Outlook for the new season (2023/24)

Part 2: Filling the funding gap: The Sustainable Farming Incentive and Countryside Stewardship.

Part 3: An insight into carbon markets

For more information and to sign up, please follow this link. We look forward to seeing you there.

Rape oil prices to pull rapeseed prices even lower?

In recent weeks and months, we have been seeing pressure across grain and oilseed markets. Rapeseed markets especially have been feeling significant pressure.

Since the start of March, Paris rapeseed (May-23) futures have lost €87.50/t (17%), to yesterday’s close at €441.00/t. The Winnipeg canola contract (May-23) has fallen by CAD$89.20/t (11%) over the same period, to close yesterday at CAD$729.40/t.

The discount of Paris rapeseed to Winnipeg canola continues to grow too.

So, what has been causing this pressure? Well, fundamentally rapeseed is well supplied globally, and demand concerns rumble on for oil and vegetable oil markets, considering recessionary and financial market concerns globally.

While we have seen support recently from Argentinian drought trimming the global soyabean outlook, and firming Chicago soyabean price levels, rapeseed prices have continued to fall. Following on from the mentioned well-supplied rapeseed global market, Australia’s record rapeseed crop continues to be offered on world market at a discount to other major origins . This is currently one of the key bearish factors weighing on rapeseed markets currently (Oilworld.biz).

Rape oil pressuring rapeseed prices

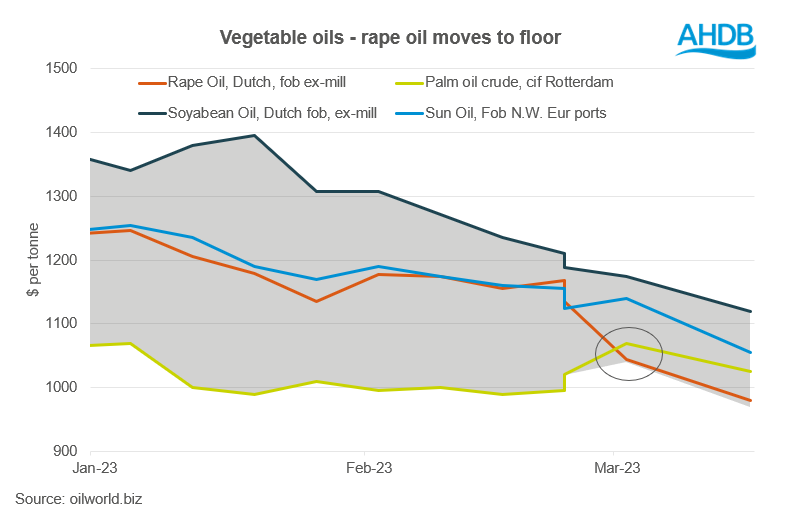

Another key element pressuring rapeseed prices is weakness in rapeseed oil (rape oil) markets.

Most vegetable oil prices overall recorded declines this month. Reasons for this are large stocks and large crushing of rapeseed and sunflowerseed, energy markets weakness as well as increased export supply from EU and Black Sea (Oilworld.biz).

Rape oil prices especially have led the pressure in vegetable oil markets. Earlier this month rape oil fell lower than palm oil prices. This is significant as it is rare for another vegetable oil to fall below palm oil prices and reflects the bearish tone in the EU rape oil market currently. Especially since last year rape oil was at the ceiling of the vegetable oil complex. Though it is important to note that palm oil prices have felt some support from seasonal low production in top producing countries Malaysia and Indonesia (Dec-Feb/Mar).

Since late August 2022, soyabean oil has been at the ceiling of the vegetable oil complex, supported by trimmed soyabean production in Argentina as well as slower biodiesel production in Argentina and Brazil, keeping soyabean oil exports high (Oilworld.biz).

Will pressure continue?

The EU is expected to have a rapeseed surplus by the end of the marketing season, with a build up of stocks in Romania and Poland, due to exports from Ukraine. Australian rapeseed is very competitive into the EU, and rapeseed is in competition with sunflower and soyabeans at crush plants (Stratégie Grains). Especially with soyameal prices elevated on a smaller Argentinian soyabean crop.

As a result, EU rapeseed stocks are expected to jump up this season. Looking ahead to next season, we are also expecting a large availability from harvest 2023. Therefore, rapeseed prices are expected to continue to feel pressure, short and longer term.

Watchpoints remain Argentina’s soyabean crop, and how low forecasts can go. Additionally, as the La Niña changes to an El Niño, what impact might this have on Australian production next season? Finally, as low production phases end for palm oil in Malaysia and Indonesia, how much palm can we expect to enter the market? Things to consider.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.