Rapeseed continues to be pressured: Grain market daily

Friday, 17 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £212.00/t, down £3.25/t on Wednesday’s close. New crop futures (Nov-23) closed at £218.50/t, down £2.55/t over the same period.

- Our domestic market followed both the Chicago and Paris market down yesterday. Wheat markets closed lower after the UN backed both Turkey and Ukraine for a 120-day extension of the Black Sea grains corridor. Russia have only initially agreed to a 60-day rollover.

- Further to that, top US wheat producer Kansas welcomed overnight rains, which will alleviate some drought concerns for US winter wheat.

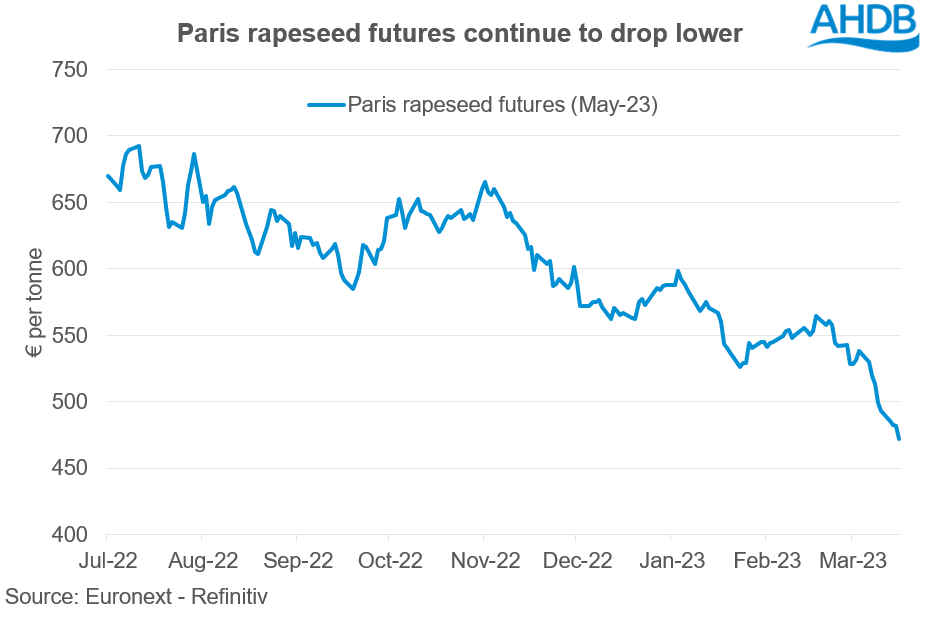

- Paris rapeseed futures closed yesterday at €472.25/t, down €9.25/t on Wednesday’s close. Ample supplies in Europe continue to weigh on prices – read more about this below.

Rapeseed continues to be pressured

Despite the Argentinian soyabean crop continuing to be revised downwards from the disastrous drought, the fundamentals of rapeseed markets seem to be overshadowing these revisions. Pressure continues for rapeseed prices.

Yesterday, Buenos Aires Grain Exchange further slashed Argentina soyabean crop to now be estimated at 25Mt. This crop was initially estimated to be 48Mt, I think it’s fair to say…the damage is done.

However, this week rapeseed prices continue to be pressured. Paris rapeseed futures (May-23) closed yesterday at €472.25/t (£414.73/t). This will be the 4th consecutive week of weekly pressure, it seems the £500.00/t+ days may have passed.

Large Australian crop pressuring prices – will this continue?

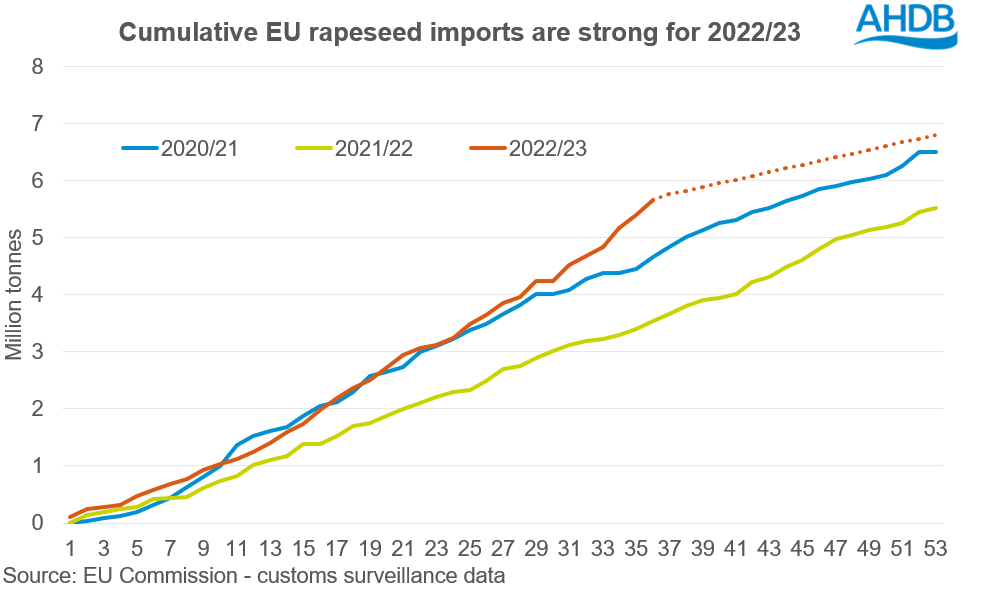

Australia have produced a record canola (rapeseed) crop of 8.3Mt for the 2022/23 marketing year, which has been very attractive to import into the EU. Australian canola exports have been strong with over 2.1Mt exported globally between Nov 22 – Jan 23 (Australian Bureau of Statistics). According to Stratégie Grains, EU rapeseed imports are expected to be at 6.8Mt for the 2022/23 marketing year.

Currently (up to 12 Mar) the EU has imported 5.8Mt of rapeseed in 37 weeks, up 56.9% from over the same period last year. Of this, Australia’s market share into the EU has been 41.2% (2.375Mt), behind Ukraine accounting for 49.8% of these total exports (2.866Mt). At the same point last year this was 34.0% and 44.1%, respectively.

If Stratégie Grains import estimate of 6.8Mt is realised, the EU is still expected to import over 1Mt of rapeseed until the end of June. With much of Ukraine supplies dried up, its likely this will be Australian origin. Could we possibly see Australian origin have the largest market share for 2022/23? With plentiful supplies of rapeseed, Australia has the ability to plug that gap.

In recent months we have seen rapeseed prices continue to drop. This is likely to continue as going into 2023/24, the global market is looking to be well supplied with another large European crop. The bullish news from South America, notably Argentina, will tighten global oilseed supply, however much of this damage is priced into the market now.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.