Australian crop production could see a reduction in 2023/24: Grain market daily

Friday, 3 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £227.50/t, gaining £2.50/t on Wednesday’s close. New crop (Nov-23) futures closed at £228.55/t, gaining £1.05/t over the same period.

- Domestic wheat market followed both the Paris and Chicago wheat market up yesterday. The market was supported from bargain buying and some concerns over the Black Sea export deal continuing. Russia continues to question the West’s approach to the deal, with sanctions on Russia impacting the export of their own commodities. As news evolves, this will cause short-term volatility to grain markets, but prices have been dropping since mid-February on optimism of the deal continuing.

- Yesterday, Graincorp estimated that Australia’s 2023/24 wheat crop is likely to be around 25-26Mt as the crop could face risks from the potential El Niño weather event – read more information below on this.

- Paris rapeseed futures (May-23) closed at €531.00/t yesterday, gaining €2.50/t on Wednesday’s close. Rapeseed followed the gains in the Chicago soyabean market.

- The Buenos Aires Grain Exchange announced yesterday that there will be further cuts to Argentina’s soyabean crop from drought impact – currently the Exchange forecast the crop at 33.5Mt, down from the 48Mt estimated that the start of the cropping cycle. Further cuts are expected.

Australian crop production could see a reduction in 2023/24

As we head deeper into the second half of the 2022/23 marketing year (July to June), markets are becoming more and more concerned on the grain supplies for the 2023/24 marketing year (next season). We have had three successive years of La Niña weather events in the South Pacific, and it’s anticipated that in the coming months the El Niño–Southern Oscillation (ENSO) will turn into a “neutral” phase (90% chance). There is an increased likelihood of an El Niño (warming of ocean temperatures) event for the 2023/2024 season, but currently this is still early days.

Why is this transition important? The La Niña event we have been experiencing for the last three years has meant that Australia have produced large record crops of wheat, barley and canola (rapeseed) for the last three years, which to some extent has been a supply plug to the global market and stopped stocks-to-use tightening further.

If the South Pacific does warm into an El Niño weather event this year this could potentially have impacts on Australia’s crops. The event usually means that rainfall is reduced through Australia’s winter and spring, particularly across the Eastern and Northern parts of the continent. Also, warmer-than-average temperatures across most of Southern Australia, particularly during the second half of the year (ABARES).

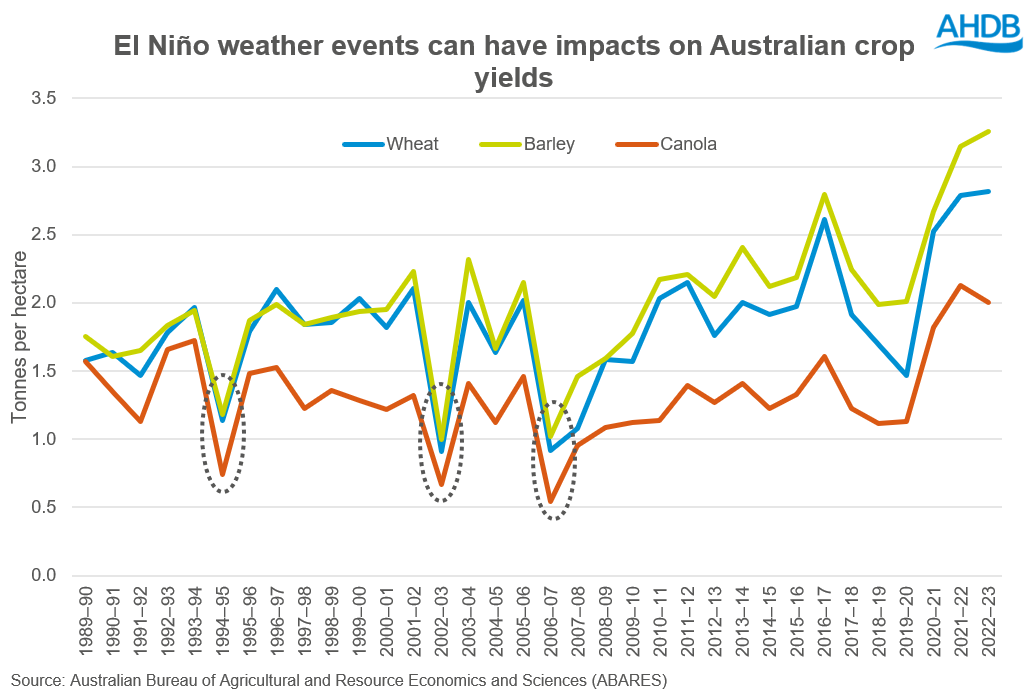

As the graph above shows, there is a correlation between El Niño and Australia’s yields of major crops. We can see that these years there is a reduction in yields, such as 1994/95, 2002/03 and 2006/07 appear to see the largest reductions, which were all El Niño years. However, what is worth noting, the link is not absolute. For example, 2015/16 was a “very strong” El Niño year and Australia’s wheat crop marginally reduced on the year and their barley actually increased year-on-year.

To conclude, if the South Pacific does enter an El Niño, there could possibly be impacts on Australian crop production which will give the potential to add some support to global grain prices, due to Australia’s market share of the exports. Winter cropping plantings will start in April, and by that point there will be more information on whether the ENSO “neutral” will be turning towards an El Niño. However, it’s too early currently to over sensationalise whether there will be colossal cuts to Australian grain output for 2023/24 marketing year, as there is a lot of weather to play out.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.