China’s hunger for wheat supporting markets: Grain market daily

Thursday, 7 December 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £197.00/t, gaining £0.75/t on Tuesday’s close. New crop futures (Nov-24) closed at £208.45/t, also gaining £0.75/t over the same period.

- The domestic market followed rises in Chicago markets on U.S. wheat sales to China – read more on this below.

- However, Chicago wheat markets ended yesterday mixed. The market initially gained after the USDA reported a further 372 Kt of soft red winter wheat sales to China, but pressure ensued as brokers took profits, after the market hit a four-month high.

- Paris rapeseed futures (May-24) closed yesterday at €438.00/t, down €8.00/t on Tuesday’s close. This pressure came from Chicago soyabean futures which ended down as rains were forecast in Brazil, which eased soyabean crop condition concerns.

- Market attention is also on the latest USDA World Agricultural Supply and Demand Estimates (WASDE), which are released tomorrow. The trade doesn’t expect much change to US ending stocks of wheat, maize and soyabeans. However, all eyes are on the potential revisions to South American maize and soyabean crops, which could lead to a tightening of global ending stocks.

China’s hunger for wheat supporting markets

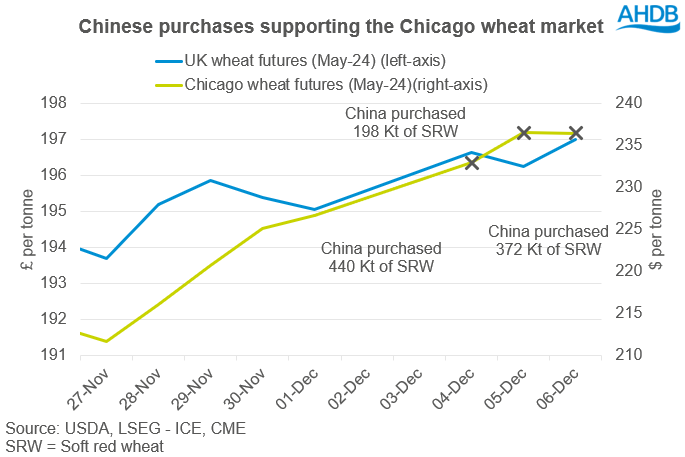

There has been large demand for US origin wheat across the week from China. The USDA reports that China has purchased over 1 Mt of soft red winter wheat (SRW) in its daily reporting system, with the latest purchase being 372 Kt, yesterday. This is the biggest weekly purchase from China for US wheat since 2014 and has led to support in prices.

Longer-term there are still expectations that grain markets will subdue from large Brazilian maize supplies expected into 2024. But, in the short-term China’s hunger for wheat is causing support in Chicago wheat markets as this flurry of purchases has caused short coverings by financial investors, who hold large short positions in wheat.

This support in Chicago markets has filtered into global grain markets and UK feed wheat futures (May-24) closed yesterday at £197.00/t. This contract has gained 1.7% (£3.30/t) since 27 November, when the contract was at a near six-month low. The gains have been more pronounced on Chicago wheat futures (May-24) as the contract has gained near 13% ($26.64/t), while gains on Paris futures (May-24) have been 4.5% (€10.25/t) over the same period.

However, note that this support has been more muted on our domestic market and Europe, as the large Black Sea supplies currently coming to the market is constraining gains.

All eyes will be on Chinese demand for wheat going forward as this purchasing of wheat is in response to its domestic wheat harvest being damaged by rainfall. Currently the USDA peg Chinese wheat imports at 12 Mt in the 2023/24 marketing year, down from 13.3 Mt last season. But the last three years China’s reliance on imported wheat has increased compared to before the 2020/21 season, so could this damaged harvest lead to even higher imports?

However, this is still a watch point as it was reported at the start of last week that several cargoes of French wheat destined for China that were due to load in December have been postponed until March. This could dampen some of France’s export hopes. With China’s recent purchasing of US wheat, it raise the question of could these French postponements lead to cancellations into 2024? This would put a further dent in France’s export campaign, which is facing pressure already from cheaper Black Sea origin wheat.

Recently we have discussed a lot about supply, but the demand is equally important in driving this market. Absent or lacklustre demand going into 2024 from key buyers could add further to the bearish outlook.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.