The challenge of a second 8.0Mt+ UK barley crop – UK barley outlook: Grain market daily

Thursday, 8 October 2020

Market commentary

- UK Nov-20 feed wheat futures slipped back yesterday (-£1.60/t) to £183.90/t after undergoing a two-day climb. In contrast, the May-21 contract gained £0.40/t closing at £183.90/t, a new contract high. Meanwhile, Chicago wheat futures closed yesterday at their highest price since July 2015, with continued concern in impact of dryness on US and Black Sea planting.

- Yesterday, Moscow increased their forecasted Russian 2020/21 grain exportable surplus by 5Mt to 50Mt, with the looming January to June grain export quota. The Russian government said yesterday that a quota was planned but did not give details.

- Today, Defra released provisional UK cereal areas, yields and production for harvest 2020. Production figures were set as 10.1Mt of wheat (-38% from 2019), 8.4Mt of barley (+4%), 1.0Mt of oats (-6%) and 1.1Mt of OSR (-39%).

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Delay to publication of AHDB 2020/21 early balance sheets

The AHDB 2020/21 wheat and barley early balance sheets were scheduled to be released on Monday 12th October 2020. We will be delaying the publication due to concerns around the accuracy of the opening stocks figure for wheat as a result of the large residual identified in the 2019/20 final UK cereal supply and demand estimates. The early balance sheets will be published by Monday 26 October 2020. We will confirm the actual release date over the coming week, following conversations with Defra around the data concerns.

The challenge of a second 8.0Mt+ UK barley crop – UK barley outlook

In the run up to our Grain Market Outlook 2020 webinar next week, we’ve so far looked at:

- Global production of wheat and maize

- The situation for global wheat and maize demand

- and the global oilseeds outlook.

Yesterday Thomma focused on the outlook for wheat in the UK and today it’s the turn of barley. This article focuses on some of the factors affecting UK barley in 2020/21.

A second 8.0Mt+ UK crop

We started the 2020/21 season with stocks 24% higher than 2019/20 because of a large (8.1Mt) 2019 crop, plus the impact on malting demand by the coronavirus pandemic.

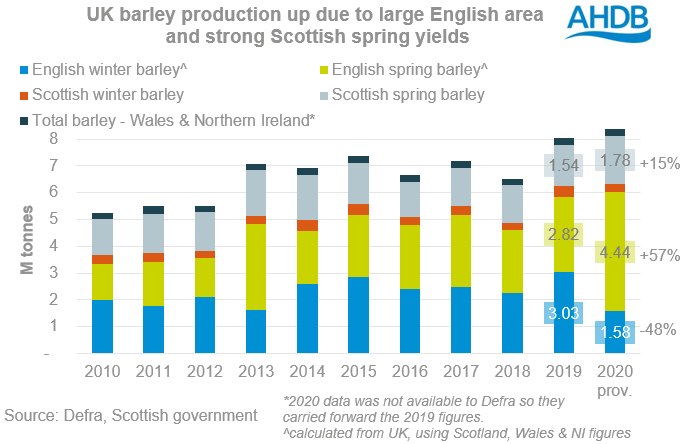

We’ve now just harvested potentially the largest crop in over 30 years, provisionally estimated at 8.363Mt. The year on year increase follows a sharp rise in spring barley planting, especially in England, after wet weather last autumn limited all winter cropping.

English production is estimated to be high by Defra, up 3% from 2019 to 6.01Mt (UK 2020, minus Scotland, Wales & Northern Ireland). However, nitrogen levels are higher than last year in eastern England, and there are reports of rain damage to later harvested crops, which could limit the suitability of some crops for malting. This has potentially contributed to limited support for English spot ex-farm malting barley prices in September, which averaged £144.80/t compared to £138.60/t in August.

Meanwhile, the Scottish government peg their crop at a new record (since 1995) of 1.75Mt due to provisionally record yields based on industry reports. The size of the crop, combined with good quality, has pressured spot malting prices and in September ex-farm spot prices averaged £11.80/t less than in England and Wales, the largest discount reported since November 2014.

Pandemic pressure persists on malting demand

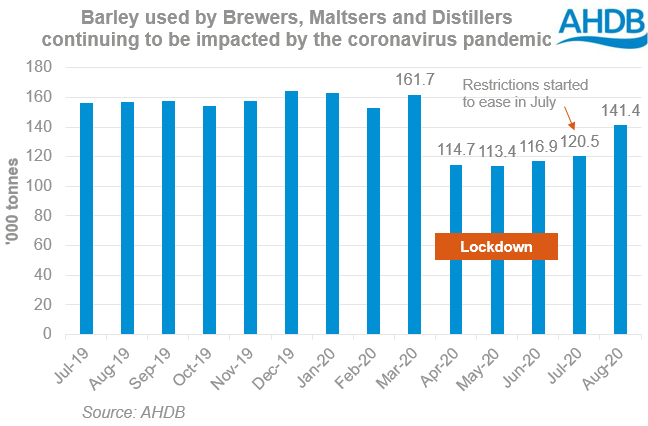

During ‘lockdown’ from April – June, the amount of barley used by Brewers Maltsters and Distillers dropped sharply as demand from the food service sector was severely limited. The situation improved slightly into July as venues began to re-open, but barley usage was still 23% lower than July 2019. In August, the situation had improved further, potentially linked to the ‘Eat Out to Help Out’ scheme, with barley usage down 10% year on year.

That scheme ended on 31 August and more restrictions have been introduced recently as coronavirus case numbers have picked up. There’s a lot of uncertainty but it’s hard to imagine life returning to ‘normal’ anytime soon, malting demand seems set to be reduced through much of this season.

Animal feed usage to stay high?

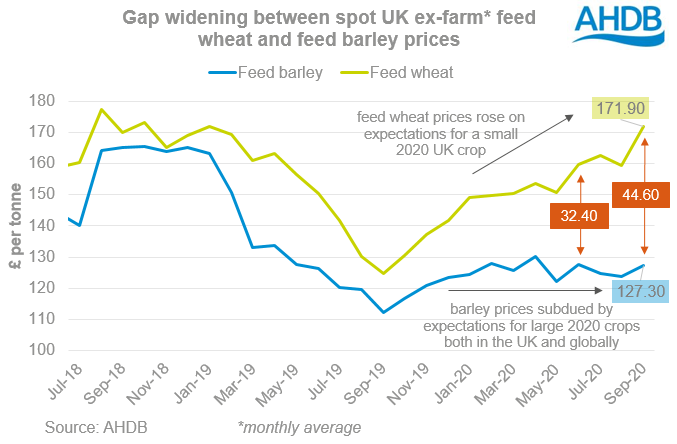

Last season, total animal feed usage of barley reached 4.12Mt, which is the highest level on our electronic records (dating back to 1999/00). The gap between UK average spot ex-farm feed barley and feed wheat prices widened steadily through 2019/20, reaching £32/t on average in June. This was the widest gap since July 2012, giving the incentive to use barley as animal feed where possible, both on farm and in compound feed production.

UK feed barley prices are not only under pressure from the size of the UK crop but also from high global barley supplies, and international competition for feed demand from maize.

Barley inclusions in compound animal feed production crept up through last season and they’ve started this season even higher. Barley accounted for nearly 12% of all raw materials used in compound production in July and August, the highest levels since the mid 1990’s.

The gap between spot feed wheat and feed barley (spot ex-farm) has widened further still since June and averaged £44.60/t in September. This is the widest monthly average gap on our electronic records, which go back to October 1975. So depending on forage availability we could again see strong or potentially even higher usage in 2020/21.

Could exports help reduce the carry-out?

Exports look set to play an important role in avoiding large build-up of stocks and alleviate some pressure on barley prices next season.

Many of the major importing nations are expected to require similar amounts of barley to 2019/20 in 2020/21. However, changes to global trade flows (more on this next week) and the large crop expected to be harvested soon in Australia, mean that the competition into these markets looks to get tougher in the second half of the season.

Over the past five seasons, 82% of UK barley exports went to EU countries. Unless a trade deal is struck between the UK and EU, UK barley shipments into the EU could potentially face high tariffs from 1 January. The bottom line is that due to the uncertainty over an EU-UK trade deal, plus changing global trade flows there’s greater incentive to ship barley in the first half of 2020/21 where possible.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.