Global oilseeds outlook - 2019/20 and 2020/21: Grain market daily

Tuesday, 6 October 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £184.50/t, gaining £2.00/t on Friday’s close.

- Gains were also encapsulated in Paris (Dec-20) and Chicago (Dec-20) wheat futures, up €1.00/t and $4.04/t, respectively.

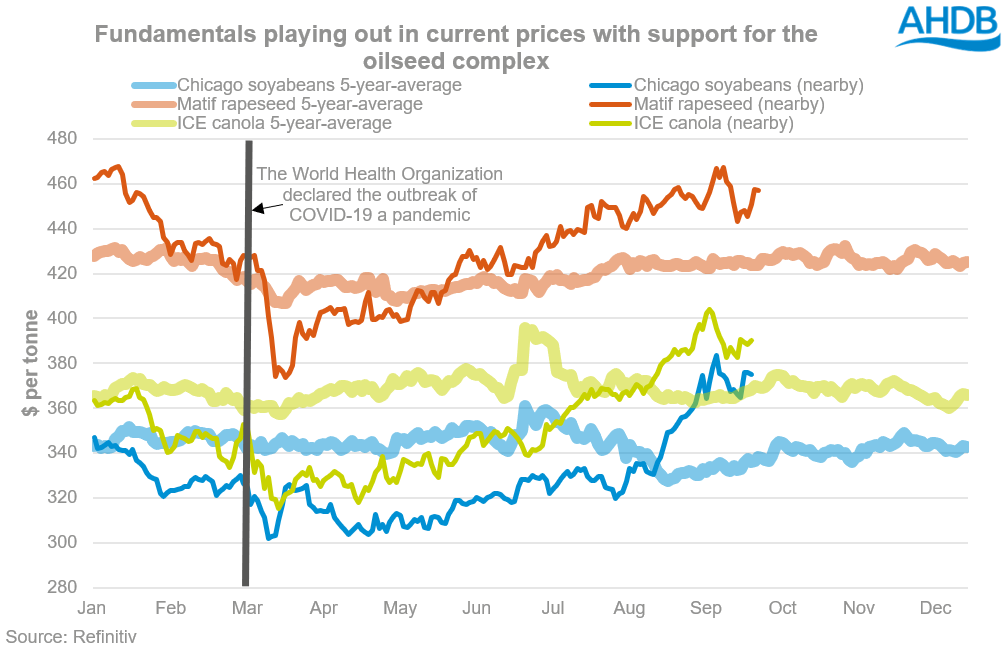

- Brent crude oil (nearby) opened the week strongly, gaining 5.14% on Friday to close yesterday at $41.29/t, providing some support to the oilseed complex.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Global oilseeds outlook - 2019/20 and 2020/21

Last week, we reviewed the global wheat and maize markets, today, I turn our attention to oilseeds.

A challenging year for oilseeds

It was certainly a volatile season for the global oilseed complex. As the market was posed with a sizeable reduction in EU rapeseed production. Further to that, the US’ soyabean area reduced as excessive rain disrupted planting intentions, while Brazil’s area grew with a pressured Real which provided a planting incentive.

The 2020/21 marketing year in Europe only got worse as the harvest was harmed by a washout winter and spring droughts. Coupled with pest damage, EU rapeseed production for 2020/21 looks to be well below the five-year average, and for the UK potentially the lowest production figure since 2001.

The coronavirus pandemic has had a sizeable impact on demand for all commodities, and oilseeds are no exception. Due to EU mandates bio-diesel demand is only expected to marginally reduce by 6% for 2020. As the global economy kick-starts there has been muted recovery, however it could be some time yet until pre-pandemic volumes are achieved.

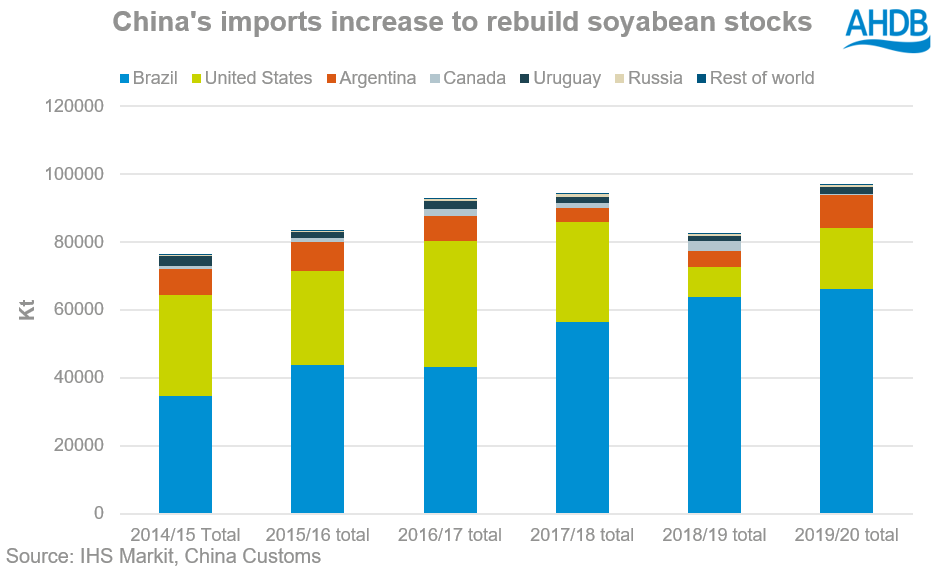

Since the summer, global soyabeans have recorded continued support off the back of increased Chinese demand. With China looking to both fulfil its commitment to the Phase 1 trade agreement and feed its growing pig herd, we’ve seen record shipments of US soyabeans to China.

Given the rollercoaster experienced over recent times, what might be expected in the months ahead?

What could happen this year in the oilseed complex?

The race for rapeseed

Given the growing conditions EU rapeseed has faced over the past 12 months, it comes as little surprise that the outlook for European rapeseed in the short term is extremely tight. A combination of a poor harvest, lower carry in stocks for 2020/21 and marginally declining demand has led Strategie Grains to forecast EU stocks to contract by 0.7Mt over the season. A greater emphasis will need to be placed on imports this year.

Where could the supply of rapeseed be sourced?

In the near term, the EU has been, and will continue to, turn to Ukraine to shore its requirements.

There may not be the abundance of Ukrainian rapeseed available as we saw last season. Ukrainian production is forecast to be at 2.7Mt, down 21% from last year. Yields for the 2020 crop have been revised down to 2.4t/ha, from 2.6t/ha.

By 27 September, the EU had already imported 967Kt of Ukrainian rapeseed – c.40% of Ukrainian exportable surplus. As EU import are forecast at 5.5Mt, it is clear that additional origins will be increasingly more important. Any impacts on their export volumes could well directly impact the UK price.

Looking further down the road, Ukrainian planting for 2021 commenced at a time when strong demand for OSR, combined with a short domestic supply, has inflated prices. Under favourable growing conditions, this could well lead to an increase in planted area. However, recent dryness in the Black Sea region may put paid to this. Current expectations are for a reduction in area, although the size of this is not yet fully realised.

The emphasis on Canadian canola imports could be greater this year should Ukrainian imports fall short of requirements. While recent weather conditions in some key Canadian growing regions have curbed yield expectations, a crop of 19.5Mt is still expected. This is 5.4% back on the year.

These recent downward revisions to production, in addition to forecast increased crush demand, have supported Canadian canola prices. Despite a flurry of early purchases from the EU, the price could well begin to reduce its attractiveness compared with other origins.

The tightening outlook for Canadian canola has led Statistics Canada to reduce the export forecast by 3%, to stand at 9.9Mt (10.2Mt in 2019/20).

With harvest currently underway in Canada, the full realisation of any weather-related impacts will become more certain. Should they be more severe than anticipated, this could well support rapeseed prices, although the reverse is true if the crop fares better than predicted.

After successive droughts, improved conditions in Australia mean that its canola area increased by 32% in comparison to 2019. The 2020 production is expected at 3.4Mt, up from 2.3Mt last year, and an 8% increase on the 5-year-average.

With this resurgence in production, Australia’s exports are forecast to increase by 42% to 2.4Mt in 2020/21. Given the forecast increase in production, an increased presence of Australian canola in the global marketplace could well subdue prices, with the country set to look at taking back some of the European market share lost to Canada over the last two seasons. However, should La Nina impact Australian crop yields, a bullish sentiment could play on the market.

What could the supply of soyabeans be?

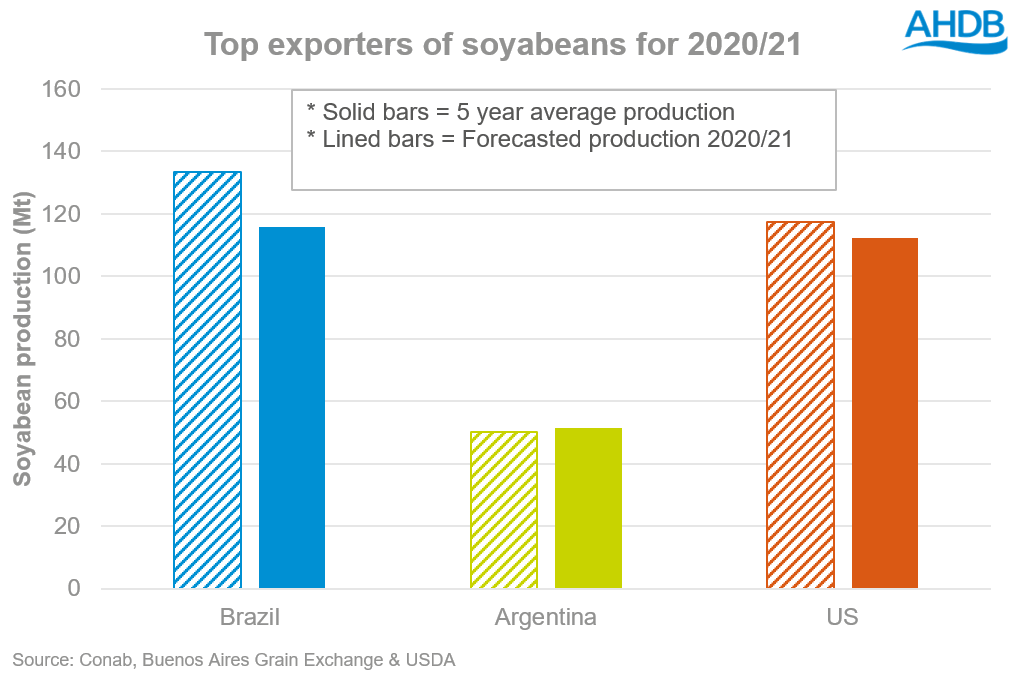

Global soyabean production is forecast to rebound this year, with strong Chinese demand driving the marketplace once more. The three major exporters, Brazil, Argentina, and US are all predicted to increase production.

With a devaluing Real, Brazil’s export campaign for 2019/20 was significant. This, combined with attractive local prices, diminished their closing stocks for 2020/21 to just 0.8Mt (IGC). Given the tightness of stocks, continuing global (Chinese) demand and the weak Real, growers are incentivised to plant.

Planting for this season is currently underway and is anticipated to increase by 3%. However, the current dryness in the region, courtesy of La Nina, might affect the final area planted.

Conab estimates that exports will increase by 5.8% in 2021 to 86.7Mt, with expectations that China will consume c.80% of those exports.

Growers in Brazil have reportedly been aggressively selling forward due to inflated prices. It is anticipated that by the New Year, c70% of the crop would have been forward sold, which could pose a risk if production doesn’t come into fruition.

The moderate La Nina weather event has caused excessive dryness in Argentina. The Rosario Grain Exchange expects soyabean production down at 50Mt (50.7 Mt in 2019/20). This is lower than the IGC’s expectations of 53.0Mt in September.

With planting due to commence in the middle of this month (October), the current dryness could alter growers planting decisions and some may choose to switch to maize.

The Argentinian economy is also in a rocky period, with devalued currency and recession affecting the nation. Last week, the government announced a temporary reduction in export tariffs from 33% to 30% on soyabean exports to help stimulate sales and build reserves of US dollars. This has the potential to see a greater volume of Argentinian soy on the global market, which given the devaluation of currency, could prove an attractive option.

The US harvest is now progressing at pace, standing at 38% complete as at 4 October – 26 percentage points ahead of this time last year. With 64% of the crop currently rated “good/excellent”, production looks set to rebound from last year’s rain-hit season. Current forecasts put production at 117.4Mt.

So far this marketing season, 66% of the US exportable surplus has been sold. Volumes of 38.1Mt have been booked with 20.6Mt sold to China. This is the first time since the “trade war” that China’s share has exceeded those of other export destinations.

Will demand rise to meet increased global supply?

Now the supply situation has been discussed, I will lay the foundation oilseed demand and what is critical to watch for in this marketing year.

The coronavirus pandemic has had a depressive effect on biodiesel demand, due to the reduction in on-road transport rather than reductions in blending mandates.

Although it remains uncertain whether second waves and subsequent lockdowns will need to be implemented, largely the EU will still have mandates to fulfil. Total use of biodiesel in the EU for 2020 is pegged at 18 billion litres, down 13%, but still above the 5-year-average of 17 billion litres.

Further down the line, the dry conditions that impacted much of Northern Europe during planting of the crop for the 2021/22 marketing season could see the EU rapeseed area showing minimal change this season. With crushing demand set to only fall slightly back on the season, another challenged crop will continue reliance on imports, and support EU rapeseed prices.

One of the key drivers that will dominate the oilseed complex this season will be Chinese demand for soyabeans.

African Swine Fever (ASF) had a devastating effect on the Chinese pig herd, with some reports that up to 50% succumbed. However, the country has now turned the corner and is looking to rebuild the pig herd to 95% self-sufficiency. With current estimates of 27 million sows in China against pre-ASF counts of 45 million sows, there is room for much growth.

With the Phase 1 trade deal on the table between the US and China, soyabean prices have largely been driven by China’s commitment to purchase US agricultural goods. The Phase 1 deals sees China committing to purchase $36.5bn of agricultural goods, $12bn more than 2017 base line levels. With US sales to China early in this marketing season happening at pace, China looks set to honour this commitment. However, with the impending US election, and a large Brazilian crop providing a new floor for global soyabean prices, this purchasing pattern is by no means set in stone.

A bullish outlook

In conclusion, while global soyabean production is in growth, this is to meet the ever-growing demand from China. This price driver will continue to provide support to prices should the buying behaviour continue. In a season of supported demand for the whole oilseed complex, despite coronavirus, and reduced rapeseed production in the EU, we may feel the bullish sentiment across the whole oilseed complex for some time to come.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.