Global wheat and maize production overview: Grain Market Daily

Thursday, 1 October 2020

Market Commentary

- London Nov-20 wheat futures closed last night at £183.70/t, a gain of £3.50/t from the previous close. However, the premium over the May-21 contract narrowed to £0.15/t.

- Unexpectedly low US maize inventory figures released yesterday were the support behind grain gains. The USDA placed Sept 1 maize stocks at 1.995bn bushels (50.67Mt), 11% below pre-report estimates. This figure represents 2019/20 ending stocks and is the smallest Sept 1 inventory in four years.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Global wheat and maize production overview

In the run up to our Grain Market Outlook conference next week, our team will be running a series of articles aimed at preparing and equipping you with a wider outlook of the fundamentals in barley, maize and wheat markets. This article marks the beginning of the series and will take a look at the supply side for wheat and maize markets including last season figures, changes in this season and a look forward to next season.

Wheat

This season, the global estimate for wheat production is forecast at 763.4Mt, around 1.2Mt higher than last season. Significant declines in some major exporters year-on-year have been counterbalanced by rises in Australian, Canadian and Russian production figures. Global ending stocks are expected to rise 15.0Mt to 294.0Mt, according to the IGC. Though this figure could increase further, should additional global lockdown measures impact on wheat consumption figures. Tomorrow, my colleague James will examine a global consumption outlook for grain markets. This season there has been a multitude of weather events that have affected production estimates. Below examines the impact on both hemispheres of global production for wheat and maize.

Looking first at Northern hemisphere wheat production. The key exporters here are Canada, the EU, Russia, Ukraine and the USA. These contribute an estimated 327.16Mt to global wheat production of which, 132.54Mt is available for export markets.

Canada

Total wheat production for Canada is estimated at 34.10Mt, a 5.60% increase on last season. Though, this increase is driven by durum and winter wheat production figures, with their spring wheat estimates down 0.50Mt year on year. However, the spring wheat crop, valued for its high protein characteristics, is still the third largest estimate in ten years. With milling specification wheat in low availability in the EU, imports of Canadian wheat into the EU + UK at 199.56Kt, have increased +53.3% on last season up to 28 September. Charlie took a look at what this means for the UK here.

USA

With the US spring wheat harvest almost complete, the estimated 49.69Mt total US wheat production figure is the second lowest since 2006/07 at a 5.5% decline year on year. Though, US exports are expected to increase totalling an estimated 26.54Mt, up 0.26Mt from last season. China has been purchasing a greater volume of US agricultural commodities following the trade deal agreement earlier this year. US accumulated wheat exports to China as of 18 September totalled 792Kt, a two-year high for this point in the season. This increase seems to have come at the expense of other destinations though. US wheat exports into the EU + UK have struggled so far at 63.35Kt, a 13.5% decline from last season as at 28 September.

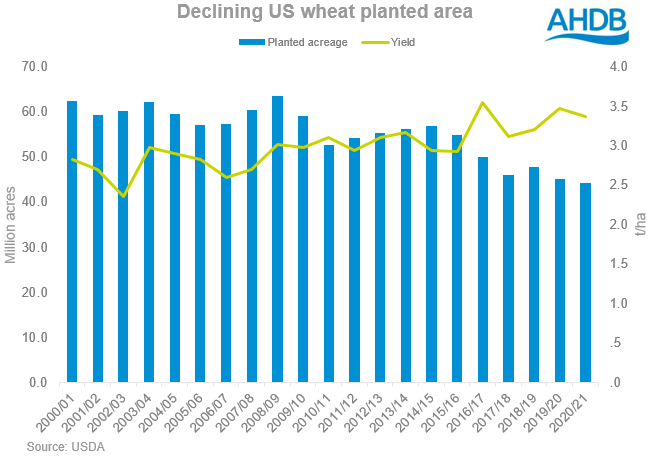

Last season saw the lowest US wheat planted area since records began, as farmers look to increase soyabean and maize acreages, in the hope of better returns. With both soyabean and maize markets enjoying high levels of Chinese purchases, US wheat acreages could fall again this season.

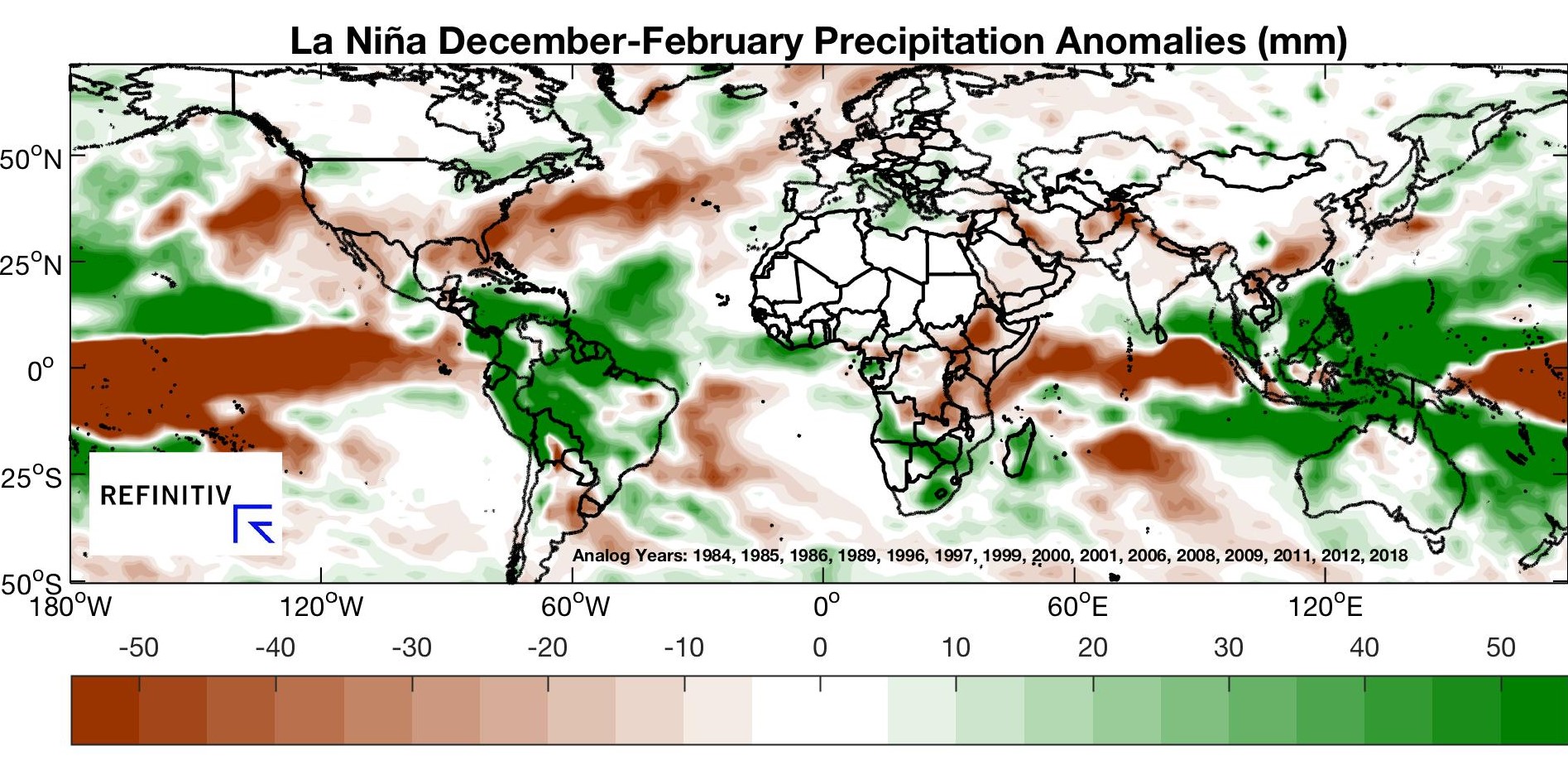

Favourable weather conditions has enabled US farmers to make a rapid start to winter wheat planting at 35% complete, with progress ahead of last year and the five year average. Though conditions are ideal currently, longer term global forecasts point towards the development of a La Nina weather event. Last time this occurred in late 2017, extended periods of dryness hit southern US states, including Kansas where some counties saw low rainfall levels throughout the months affected by La Nina.

EU-28

Parts of the EU suffered extended periods of dryness earlier this year, leading to reduced production figures this season. Last season, despite the third largest EU production figure on record, carryover volumes into this season were estimated at 13.40Mt, only 0.20Mt more than 2019/20 levels. EU-28 production was estimated at 147.20Mt in 2019/20. This season however, production is estimated at 129.30Mt. European grain prices have risen as a result of the reduced availability during the opening months of the season.

France was affected by similar weather patterns to the UK, with wheat production estimated at 29.50Mt. French soft wheat exports are expected at 6.60Mt this season, down 51% from the record 13.46Mt last season.

Ukraine

2019/20 was the season of records for the Black Sea country. Ukraine harvested a record 29.17Mt of wheat, enabling a record 21.01Mt of exports to occur, according to the USDA. A record level of maize exports at 30.5Mt in 2019/20 meant Ukraine featured heavily on import origins, particularly in the EU and North African regions.

This season, wheat production is estimated at 25.10Mt, affected by extended periods of dryness. Wheat exports are subsequently expected at 17.50Mt though already this season sales of 8.6Mtt have been exported as of 28 September, almost equal to last seasons at 8.7Mt for this point. EU imports of Ukrainian origin wheat have risen 12.5% to 349.2Kt as of 28 September.

Winter grain planting schedules in Ukraine have seen delays owing to soil moisture levels being at the lowest level in over three years for this point of the season. Reportedly 70% of intended winter planting area has no moisture in the topsoil layer as of 29 September. As of 28 September, only 25% of the intended winter wheat area had been planted. So far, farmers had planted an area of 1.5Mha vs 2.9Mha last year. I covered this in detail last week, focusing on the affected maize crop. Rainfall is in the forecast for this coming week for all regions may somewhat replenish soil moistures.

Russia

Finally, looking at Russia now. Last season an estimated 74.50Mt of wheat was harvested according to IKAR, an increase of 3% from the previous year. With greater investment in production, the country’s market share of wheat trade has grown, featuring often in global import schedules, Russia has increased its wheat production levels almost year-on-year from 2010/11. This season, the Russian Agriculture minister expects production to be no less than 82.0Mt. Russian wheat exports have started this season strong, winning 82% of Egyptian tenders so far. The country is expected to export 37.50Mt of wheat this season.

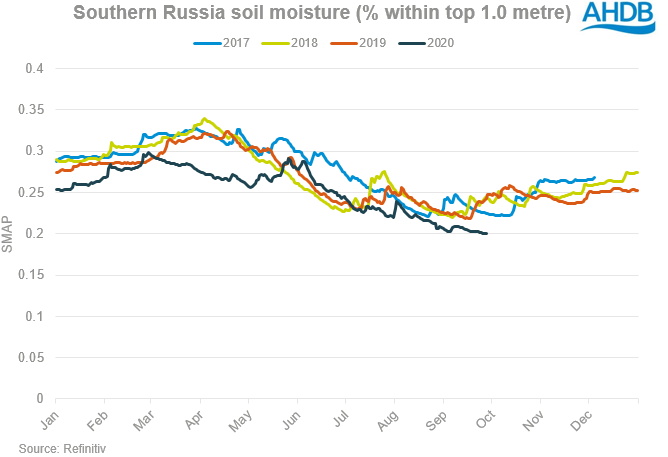

Similar to Ukraine, parts of southern Russia have experienced lower than average soil moisture levels. Planting of winter cereals has occurred though into dry seedbeds, with its effect a watch point over the next few months. Again, rainfall is in the forecast but will require frequent rainfall events to replenish soil moisture levels.

Australia

Australia has seen a resurgence in its position as a wheat exporter this season, owing to more frequent rainfall levels. After consecutive years of drought conditions, production reached a low of 15.2Mt in 2019/20, the lowest level since 2007/08. However, with production estimated at 28.5Mt this season, the exportable surplus will look to compete for North African and Asian demand.

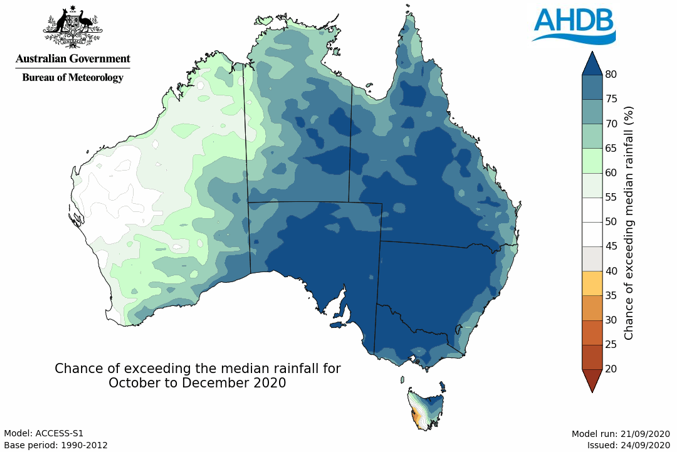

With the Australian Bureau of Meteorology declaring La Nina officially underway, above average rainfall is set to fall throughout the summer months in Australia. Whilst the risk of a flooded harvest isn’t likely, the rainfall could help yields in the run up to harvest in late October.

Argentina

This contrasts to the picture in Argentina. As at 24 September, an estimated 59% of the wheat crop was in poor/ dry moisture condition. With harvest set to begin in December, production estimates are now forecast at 17.50Mt, down from 21.0Mt estimated in July according to the Buenos Aires Grain Exchange. If realised, this would be below the 18.80Mt harvested in 2019/20. There was some rainfall recorded over the weekend, though it remains to be seen if it will help, localised reports suggest much more is needed. An estimated 44% of the wheat crop is in ‘Poor – Very Poor’ condition as at 23 September. The effects of a La Nina weather event are expected to exacerbate dryness concerns in Argentina with above average temperatures and below average rainfall levels anticipated.

Maize

This season, the global estimate for maize production is forecast at 1160.0Mt, around 39.0Mt higher than last season, according to the IGC. An estimated 6.0Mt was cut from maize estimates in the IGC monthly report from August. Production outlooks are lowered in China, the EU and the USA from anticipations earlier in the season. Whilst southern hemisphere producers have had production estimates raised over the course of the season.

Global ending stocks are expected to fall 16.0Mt to 285.0Mt season to season, according to the IGC. Tomorrow, my colleague James will examine maize consumption outlooks, especially identifying impacts from coronavirus on maize ethanol demand.

USA

The US is expected to harvest 378.47Mt of maize this season with harvest currently 15% completed, sitting 1% behind the five-year average for this point. In the September supply and demand estimates, US production forecasts were reduced 9.62Mt following the occurrence of drought conditions in areas and the ‘derecho storm’ that hit the state of Iowa in early August. If estimates are realised, the US will still likely harvest the second largest maize crop on record.

The US has seen strong export purchases from China, with 9.96Mt of maize booked for export to China in the 2020/21 so far this season. Reports indicate reductions to China’s domestic production of maize, following elevated levels of crop damage in the north of the country. This is likely behind an increase in maize purchases by China. The USDA estimate US maize exports of 59.06Mt this season.

Ukraine

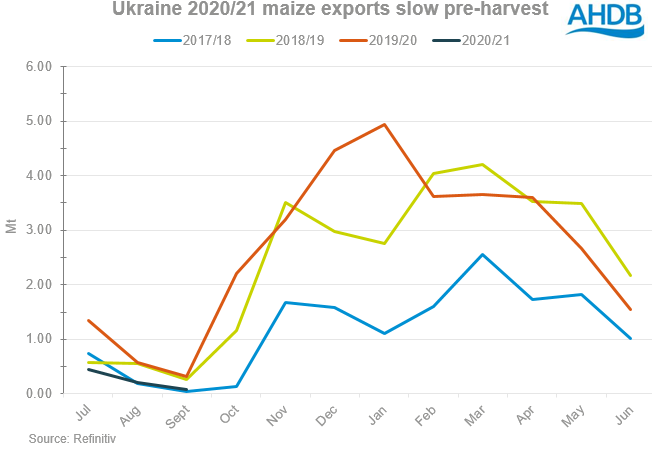

Ukraine has been subject to extended periods of dryness throughout the summer months. As such, frequent reductions have been observed for the maize crop. My colleague Helen examined the differences between different forecasts. The Ukrainian government anticipate a 33.0Mt production figure, whilst the USDA expect a 38.50Mt figure.

The Ukrainian maize harvest is 9.0% complete as of 28 September behind last year’s pace, with early yields at 4.5t/ha vs 5.94t/ha last year for the same point in the season. The early maize yield is the lowest in the last five years.

EU-28

The EU has also had its grain maize production estimates reduced following bouts of dry weather affecting France, Italy and Romania. Stratégie Grains estimate a figure of 64.9Mt, down from the estimate of 67.4Mt last month. Production last year reached 64.5Mt for reference. The EU balance sheet has tightened slightly as a result, despite expectations of large imports of third-country maize into the trade bloc this season.

France is reportedly 15% completed of its anticipated 14.14Mt maize harvest, above the 2019/20 figure of 12.32Mt. Though from an August estimate, the production estimate has declined 0.55Mt owing to the lack of rainfall throughout summer.

Brazil

Brazil harvested an estimated 102.5Mt of maize this season according to Conab, a new record for the country. An estimated 39.0Mt export figure will look to compete with the US for Chinese purchases. Farmers in Brazil have already planted the full-season maize for next season, accounting for 23% of the total maize area. The safrinha crop, which accounts for 73% of the total maize area will be planted from January – March next year. This planting could be impacted by the La Nina weather event that will likely bring dry conditions to southern parts of Brazil and Argentina as a whole. Rainfall levels will be an important watch point over the next few months for the Brazilian safrinha crop.

Argentina

Farmers in Argentina began planting 2020/21 maize earlier this month with the crop 11.0% planted as of 24 September, behind the five year average of 14.2%. The total maize planted area is estimated at 6.2Mha, down 0.1Mha from last year, according to Buenos Aires Grain Exchange. Similar to Brazil, a watch point will be the impact of La Nina on the development of the emerging maize crop. Persistent dry weather is expected over the next few months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.