What is the UK impact from Black Sea dryness? Grain Market Daily

Wednesday, 23 September 2020

Market Commentary

- London wheat futures (Nov-20) jumped £3.20/t up from Monday to close at £182.00/t yesterday, a new high for the contract. May-21 increased £2.25/t from Monday to close at £183.00/t yesterday. Prices were supported primarily by the Egyptian tender, with dryness affecting planting across the Black Sea regions also contributing.

- Egypt bought 405.00Kt of wheat in its latest tender yesterday, all of Russian origin, with the cheapest FOB offer accepted at $242.00/t (£190.71/t) for Nov delivery. The average tender FOB price was $9.00/t more expensive than the previous tender.

- Chicago soyabeans (nearby) futures have declined this week to close at $10.19/b ($374.69/t) down $0.23/b ($8.72/t) from its peak on Friday. The latest US crop report released on Monday indicated the US soyabean harvest was underway at 6% completed. With favourable weather conditions over the next few weeks, harvest pressure will likely continue.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and recieve the recording afterwards, click here.

What is the UK impact from Black Sea dryness?

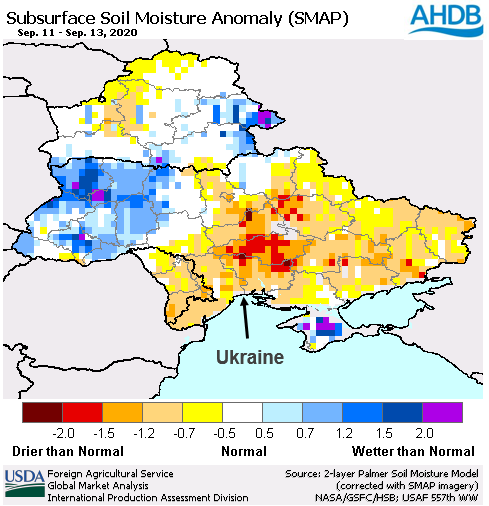

The maize harvest in Ukraine is underway, though question marks for achievable production figures have developed in recent weeks. Below average soil moisture levels have been a common occurrence this season not just for Ukraine but for the Black Sea region as a whole. Concerns have been raised too for autumn planting schedules with emerging rapeseed crops in Ukraine beginning to be affected.

Back when the UK wheat production figure was hit by the summer drought in the 2018/19 season, Ukrainian maize and Romanian wheat were prominent import origins in UK cereal markets. This season, the feed market import requirement is theoretically higher, raising the question of whether Black Sea maize could move in volume to UK markets once again.

The two previous seasons have both seen a tonnage of 900Kt+ of Ukrainian maize imported to the UK. In the 2018/19 season, imported Black Sea maize was at a significant discount to domestic grain prices. The import volume was enough to cause a decline particularly in domestic feed barley prices.

As you can see from the picture above, Ukrainian sub-surface soil moisture levels are at severe deficit levels across central and eastern regions (oblasts). The weather forecast for the next seven days points to a dry rain-free outlook, exacerbating concerns. Delays to autumn cereal drilling are reported, awaiting a pickup in moisture levels.

What's the impact on our domestic prices?

The dry conditions have worsened expected yields for the maize harvest that has recently started. Maize production estimates from Ukrainian analyst firm UkrAgroConsult have been downgraded this month to 35.0Mt from 36.0Mt last month. Their maize exports for the season, whilst also reduced, are still forecast at 28.5Mt. There are questions around production estimates, given USDA are projecting high at 38.5Mt, with an export figure of 32.5Mt. My colleague Helen examined the range of Ukraine maize production estimates last week.

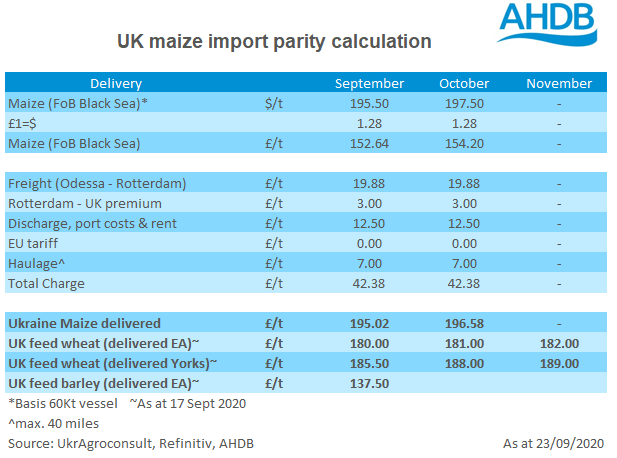

Therefore support from weather impacts on Black Sea supplies could look to increase the theoretical lower end of imported maize prices, and potentially reduce the discount pull on domestic feed grain prices in the future. Last Friday (18 Sept), the Matif maize Nov-20 contract closed at its highest price since 31 March at €173.25/t (£155.73/t). Currently, Ukrainian maize for October delivery to a UK compounder calculates at £196.58 (FOB £154.20/t + £19.88/t + £22.50/t). With feed barley (East Anglia – Sept delv) quoted at £137.50/t, the large discount offers a degree of ‘security’ for UK feed barley at the moment.

However feed inclusion rates do limit the use of barley to an extent and are reportedly maxed out on barley. Earlier this season, Ukrainian imported maize for Sept delivery to a UK compounder was its cheapest earlier in the season at £167.13/t. Questions then arise as to how much volume was booked at this range for the UK.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.