Top 3 questions from last Friday’s USDA estimates: Analyst’s Insight

Thursday, 17 September 2020

Market commentary

- Paris rapeseed futures (Nov-20) gained €5.75/t to €393.25/t yesterday because of rising soyabean prices and concerns about delays to the canola (rapeseed) harvest in Canada.

- Nov-20 Chicago soyabean futures set a new contract high after the USDA confirmed further 327Kt of private export sales to China. There was also support from buying by speculative traders.

- UK feed wheat futures dipped yesterday despite gains in Chicago and Paris futures as sterling picked up against the euro and solar. The Nov-20 contract lost £0.50/t to close at £174.00/t, while the Nov-21 contract fell £1.10/t to £152.00/t.

- French wheat exports outside the EU are now only expected to total 6.6Mt in 2020/21 by FranceAgriMer, instead of the 7.75Mt forecast in July and 13.5Mt in 2019/20. The sharp drop reflects the export pace to date and is due to the 25.5% year-on-year drop in production.

Top 3 questions from last Friday’s USDA estimates: Analyst’s Insight

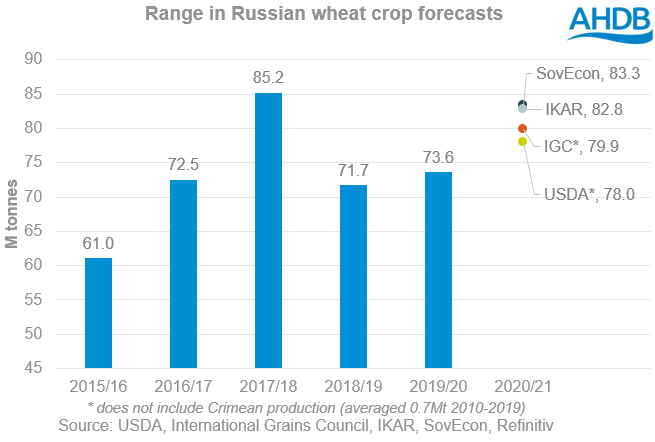

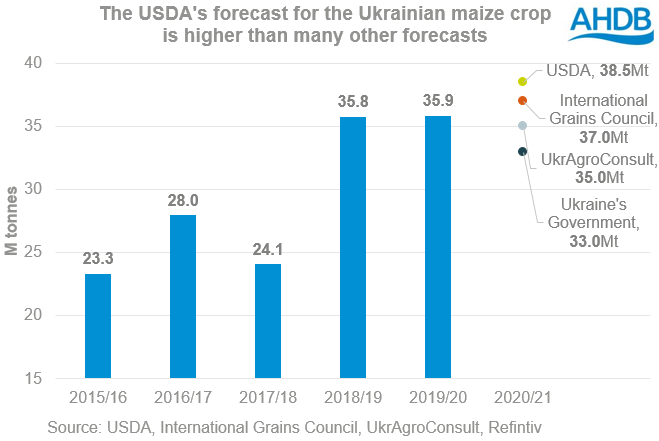

The USDA is often cautious when it comes to revising forecasts, using what can be evidenced. Last Friday, the forecasts for Russian wheat production plus Chinese imports remained unchanged though there was some industry expectation for increases. Meanwhile Ukrainian maize output was expected to decrease but also didn’t change.

For Russia, there is definitely potential (see below) for the wheat production forecast increase, which would potentially add pressure to global wheat prices. In contrast, there looks like potential for support for global maize prices from the Ukrainian crop - potentially reducing the spread between wheat and maize prices.

From a UK perspective, this could increase the cost of importing maize and so offer support to UK feed wheat prices, depending on how exchange rates evolve.

Will Russian wheat production rise?

The USDA left its forecast of Russian wheat production at 78.0Mt. While up from 2019, it is still below many other forecasts of the 2020 crop – see below.

One of the possible differences in figures is production in the disputed territory of Crimea which is not included in the USDA’s Russian production figures. However, between 2010 and 2019, Crimean wheat production has only averaged 0.7Mt so only accounts for a little of the difference.

One factor which may be driving the difference is that harvest is ongoing in some of Russia’s major spring wheat areas. As a result there is limited evidence of final yields. However, unless evidence of lower yields emerge, the market will expect the USDA’s forecast to rise in future months. Last week SovEcon further increased its forecast based on results in Siberia, a mainly spring wheat area.

The global wheat surplus is already forecast at 23.6Mt in 2020/21 by the USDA. Further increases to Russian production (if no corresponding increase in demand) could push the surplus towards the record 29.9Mt set in 2014/15.

Ukrainian maize production to fall further?

Dry weather since June has reduced Ukraine’s wheat production and led to uncertainty over maize production. The Ukrainian government’s estimate, at 33.0Mt, is 5.5Mt lower than the USDA.

The USDA currently predicts a big recovery in global demand in 2020/21 (+36.7Mt) and this means only a small surplus (4.3Mt), despite a record global 1,162Mt crop. A cut to the Ukrainian crop could further reduce the small surplus, or even potentially push the market into deficit. That is, unless any reduction for Ukraine was offset elsewhere by perhaps larger South American crops or reduction to the demand figure.

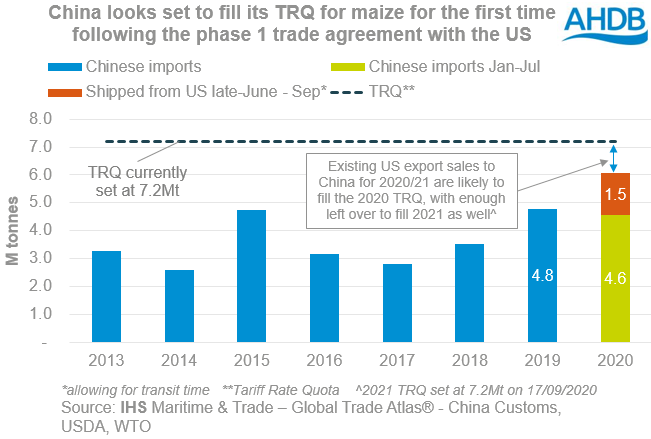

How much maize will China import?

The US has already reported 8.8Mt of maize sales to China for the 2020/21 marketing year (Oct-Sep). With this in mind the USDA’s forecast for 2020/21 imports by China (all origins) seems low at 7.0Mt, especially given the phase 1 trade deal. This deal committed China to increase its imports of US cereals (inc. maize) and allocate all its tariff rate quotas (TRQ).

The TRQ system means that up to 7.2Mt of maize and maize flour can be imported per calendar year into China at a low tariff. After that a much higher, arguably prohibitive, tariff applies.

When looked at on a calendar year basis, the maize imported by China January-July, plus that already shipped by the US in July and August would leave only 1.1Mt of TRQ for the rest of 2020.

Most of the maize imported into China in 2011-2019 and in Jan-Jul 2020 was from Ukraine. However, US exporters alone have so far sold enough maize to China to fill the reminder of the 2020 TRQ and all of the 2021 TRQ (confirmed this morning at 7.2Mt), plus extra in the region of 0.5Mt.

This suggests that either US export sales to China would be expected to slow considerably, or that China may expand their TRQ for 2021. An increase to Chinese demand and imports for 2020/21 could add support to global maize prices, whilst a reduction to imports could pressure prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.