Domestic wheat outlook - 2019/20 and 2020/21: Grain Market Daily

Wednesday, 7 October 2020

Market Commentary

- Nov-20 feed wheat futures continued their acceleration yesterday, closing at £185.50/t, a rise of £1.00/t. Nov-20 futures are becoming increasingly obsolete with open interest of just 1,769 contracts at yesterday’s close versus 5,517 on 4 September. As a result, spot/ Nov physical values may well move out of line with futures movements.

- There is now an increasing volume being traded on the May-21 contract, which closed at £183.50/t yesterday, also up £1.00/t on the day. The carry from old crop (May-21) to new crop (Nov-21) now stands at -£26.50/t.

- Support was seen from a fall in the value of sterling relative to the dollar. The weakness was partially driven by dollar strength. The dollar had fallen to a two-week low on poor economic performance. Sterling volatility will be key to domestic pricing in the short term particularly with the clock ticking on Brexit.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Domestic wheat outlook - 2019/20 and 2020/21

Last week, we reviewed the global wheat markets, today, I take a look at the UK domestic picture.

Review of 2019/20 balance sheet

Last month, we published the final 2019/20 balance sheet estimate. For wheat, there was a much higher total availability versus the previous season, driven by a larger production and also opening stocks. Despite coronavirus and the subsequent lockdown, wheat used in animal feed was relatively unchanged year on year and there was just a 1% reduction in wheat used for human and industrial uses. A key point of interest was an 824kt residual, what may have caused this figure was discussed here.

Production harvest 2020

On Monday, Defra released the provisional harvest 2020 wheat production figures, pegging wheat production at 10.133Mt. This is 37.5% lower than harvest 2019 and would be the smallest wheat crop since 1981. However, as Wales and Northern Ireland do not produce provisional results, their 2019 figures have been carried over to produce a UK estimate. Our harvest progress report suggests that wheat yields for 2020 are well below average, meaning it is likely that Wales and Northern Ireland figures will be lower than suggested, decreasing UK production.

Defra will be releasing regional area and yield estimates tomorrow to give us a more in depth breakdown.

Quality of the domestic crop (CQS)

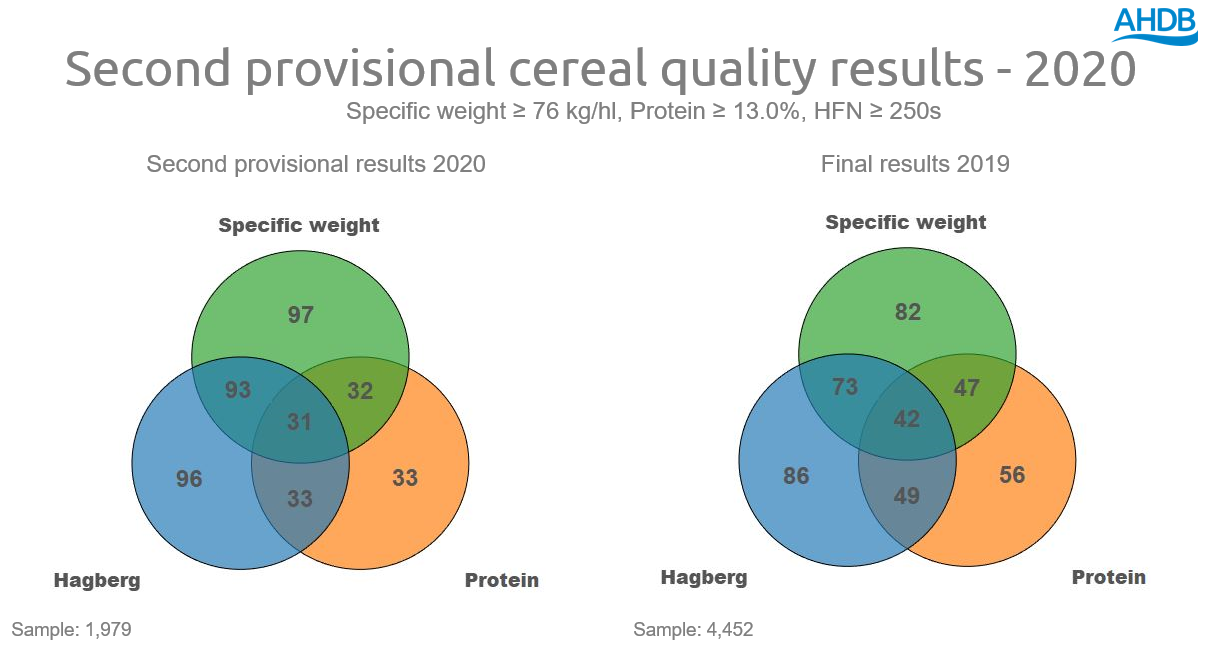

The results of AHDB’s second provisional cereal quality survey for the 2020 harvest shows wheat quality, unsurprisingly, lower than last year. Putting further pressure on an already small domestic crop.

As at 07 October, only 31% of nabim group 1 milling wheat sampled has made full spec bread wheat with the biggest problem being low protein. Just 33% of samples hit the 13% protein specification, compared with 42% at this stage last year.

The average protein of nabim Group 1 samples, in the latest release stands at 12.7%, compared to 13.0% at this point last year.

GB average hagberg falling numbers (HFN) have also declined between the first set of results, released in September, and now. This is a reflection of the increased rainfall seen in August, and the inclusion of samples from later harvested regions in the results. The average HFN of Group 1 samples in the second provisional result at 328s is above the same point last year (321s)

This said, the size of the domestic crop is currently thought to as big of a problem as the quality. With the need for imports already high, the low quality is likely to increase the need for imported high protein wheat. This causes potential problems with tariffs due to apply to wheat imports of below 14.6% protein after 31 December 2020.

Consumption – from different sector angles what are the big risks?

Flour Millers

A big risk to the domestic wheat crop this year is the quality of the milling wheat available. As discussed above, it looks like it will be of a lower than average quality, putting even more pressure on supply in a small crop year. Imports are already coming in and will likely continue doing so for the remainder of the season. This poses a risk due to the tariffs mentioned above.

Which raises the question, will we start to see millers widen the specification on milling wheat to allow them to accept lower protein wheat? This is only likely to happen if it is more financially viable than importing high protein North American or German E wheat.

Another risk is the potential for a second Covid-19 lockdown and the closure of restaurants. This would wipe out demand for flour destined for food service, however, as we saw last time it would also boost demand for flour in retail. This means as long as processors can adapt and produce small flour bags for retail then they should be able to capitalise on this changing demand.

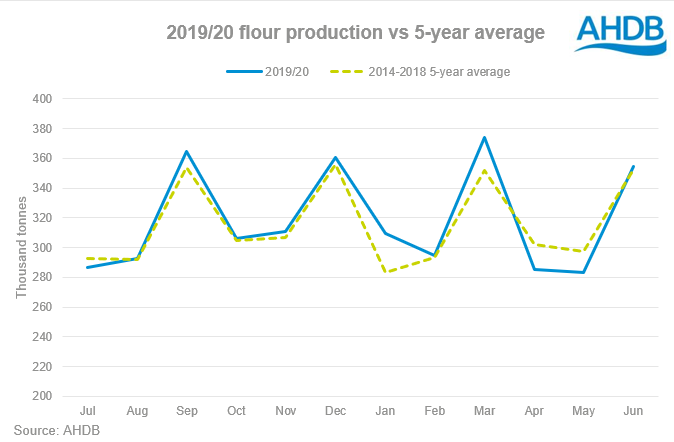

The graph below shows total flour production minus other flour to remove tonnages produced in the biofuels and starch sectors. There was good demand for flour throughout 2019/20, despite the lockdown restrictions. In March, production even exceeded the previous 5-year average, again confirming that despite the lack of food service, demand remained very strong.

Biofuels

As it stands Ensus is the only bioethanol plant up and running in the UK at the moment. With no noises regarding Vivergo opening back up again it is likely that this will remain the case for the remainder of the season, which will limit demand for wheat into biofuels. There is also the possibility that the cost of the raw materials (i.e. price of wheat) becomes too expensive when compared to the price of the end product and therefore makes it unviable to keep the plant up and running.

The price of maize could also be a key factor this season. Ensus has the capacity to run off wheat, barley or maize, so should wheat stay firm and cheap maize imports start to arrive, we may see a swap from wheat to maize and therefore see a decline in demand.

Animal feed

For the poultry sector, a second Covid-19 lockdown is the largest risk posed for the coming season. We have already taken a look at how coronavirus has affected the poultry sector so far, and how the knock on effects of reduced egg setting and chick placings may impact the sector. Another consideration would be a lockdown over Christmas leading to smaller family gatherings. This could reduce the demand for poultry as a whole, and therefore limit the amount of feed used.

For sheep, feed demand for lambs is currently very good, however, the biggest current risk will be the outcome of the EU exit trade agreement. This could lead to increased slaughterings which will reduce demand for sheep feed. There may also be a shortage of forage due to dry weather during the spring. Meaning there is increased demand for compound feed to be included into the diet to make up for reduced forage availability.

In the cattle sector, dairy was most affected by coronavirus restrictions, with milk destined for airlines, food service and hospitality hardest hit. Another factor posing a risk to the dairy sector is our exit from the EU and the implications of the trade deal we strike (or don’t). Beef will be less impacted by these trade negotiation outcomes and therefore less at risk. Cattle, like sheep, may also need to counteract reduced forage availability with increased compound feed.

Pigs are expected to be stand on compared to last season, as they are less exposed to threats from the EU exit or a coronavirus lockdown. This said, there is currently ASF in the wild boar population in East Germany, should this find its way into the domestic pig herd we may see increased demand for our pork to be exported to Germany, therefore increasing feed demand in the pig sector.

Another issue for the animal feed sector would be how much barley may be kept and fed on farm, given its current relative price. Should we see more barley kept for feed, this may reduce the demand for compound animal feed and therefore the raw materials. Wheat being the key component in all animal feed rations.

So, to summarise, wheat demand into flour millers is likely to remain firm this season, so long as coronavirus or the EU exit and logistics do not provide too much of a challenge. Looking at the animal feed sector, the pig sector is expected to remain strong, ruminants to be fairly similar to last year, and poultry maybe to be slightly weaker.

This means that due to the small production year, imports will be key to ensuring continued supply of usable quality wheat into all sectors.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.