Coronavirus hits the poultry sector: Grain Market Daily

Friday, 4 September 2020

Market Commentary

- After rallying £2 last Thursday to £168.75/t, UK feed wheat futures (Nov-20) have traded in a narrow range this week, only gaining £0.75/t to Thursday’s close of £169.50/t as they seem to be struggling to break the £170/t mark.

- The Russian grain harvest is reportedly now 77% completed, with 75.4Mt harvested.

- CBOT soyabeans are continuing their rally, closing last night at $354.94/t, up $5.70/t since last Friday’s close.

Coronavirus hits the poultry sector

The release of the latest AHDB usage data has shown that poultry feed production was the only total animal feed sector to decline on the year in July. The reduced demand from the poultry sector is something that we have been seeing since May and has been driven mainly by declines in demand from broilers.

Poultry makes up the largest share of animal feed demand within the UK and roughly 60% of the ration is made up of cereals. With this in mind the decline in poultry feed production is likely a contributing factor to the fall in wheat demand in July (down 3.3% year on year).

There are a number of reasons that may be causing reductions in poultry feed production. It is likely that there was a decrease in poultry meat demand due to the closure of restaurants during lockdown. We have seen some producers reacting to the lack of demand of chicken into food service by reducing the number of broiler eggs they set.

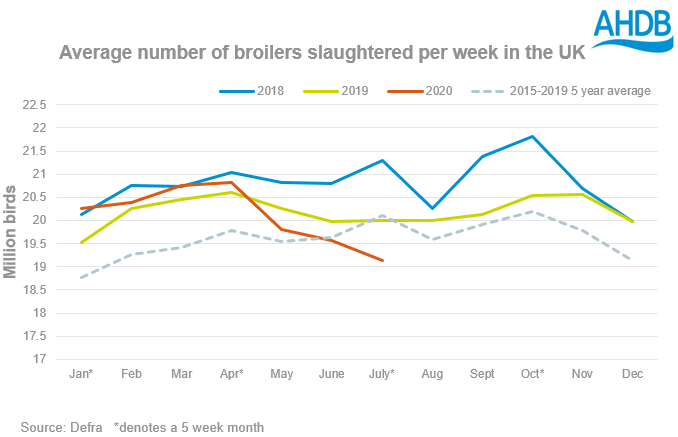

In the UK, in May, broiler eggs set were down 5.5% year-on-year, at 94.4 million eggs, according to the latest Defra poultry placings data. With birds typically slaughtered between 30 and 40 days old, the reduction in placings had a knock-on effect to the number of slaughterings in July which were 4.3% lower than in July 2019. However, it is likely that the reduced demand for poultry by food service was capped somewhat by increased in home purchases. In the 12 weeks ending 9 August the volume of chicken sold through retail increased 8.8% on the year, according to Kantar Worldpanel.

In the news, it has been reported that a number of food processing facilities, including a poultry processing plant, have had to temporarily close due to coronavirus. It has also been reported that some plants aren’t easily set up to fully function whilst maintaining full social distancing measures. This will likely have a knock on effect on processing capacity in the short to mid-term as well as future farm placings.

Looking forward, broiler eggs set in July were 3.3% down year-on-year meaning we are likely to continue seeing this reduced poultry feed demand for at least a couple more months. However, as we know in home demand has stayed firm and with food service back up and running it is likely that this will just be a short to mid-term blip.

How long this will continue will largely depend on coronavirus, but it is thought that the biggest risk to the poultry sector would be a second wave leading to another lockdown and reinstated closure of the food service.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.