Global wheat and maize consumption overview: Grain market daily

Friday, 2 October 2020

Market commentary

- UK Nov-20 feed wheat futures eased slightly yesterday, closing at £183.35/t: a fall of £0.35/t. May-21 also sustained a drop in value, closing at £182.50/t, a discount to the Nov-20 contract of £0.85/t. Uncertainty surrounds a post EU-exit trade deal for the UK and EU, with talks continuing into next week.

- Demand for Australian wheat from Asia is expected to gain momentum in coming months, with the 2020/21 Australian crop estimated to be the largest crop in the past four years. Approximately 1.5Mt is reportedly scheduled to leave Australia in December, destined mostly for China, Vietnam and the Philippines (Refinitv).

- Chicago maize futures (nearby) have so far gained more than 3% this week: the biggest weekly gain since the week ending 28 August. With robust export demand and lower than expected stocks supporting US maize prices, the market is trading close to a seven-month peak.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Global wheat and maize consumption overview

Yesterday, Alex looked at trends in global grain production, looking at the changes in grain supply last season (2019/20), this season (2020/21) and brief look forward to 2021/22. Today I’ll complete the supply and demand picture, looking at trends in consumption of grains.

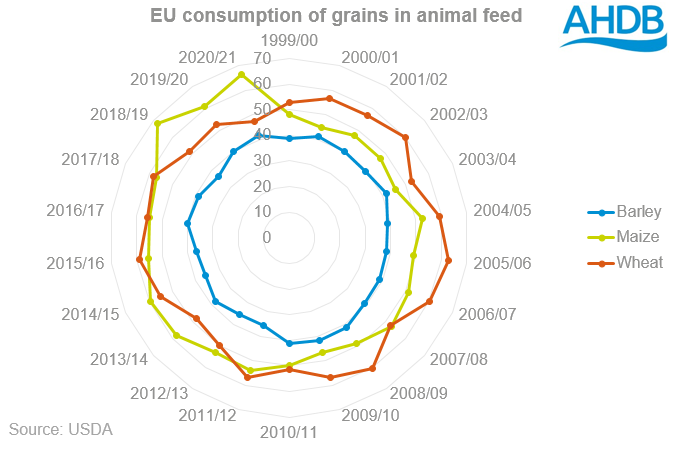

First, this article will cover the global consumption overview for each of the primary grains (maize, wheat and barley), it will then look at some of the key drivers in the feed, food and fuel markets which could change the direction of prices over the next six to twelve months.

Maize overview

Following a drop in global maize consumption in the wake of the coronavirus pandemic, particularly in the US, maize consumption is seen recovering in 2020/21.

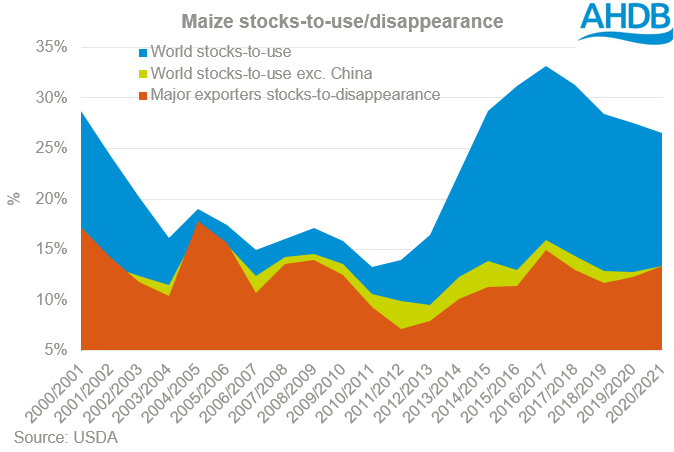

As a result of increased consumption global stocks are restricted in 2020/21 according to the USDA. This doesn’t necessarily give the full picture, excluding China from the stocks-to-use equation shows improved supplies year-on-year. Similar is true looking at major exporter’s stocks-to-disappearance.

The largest increase is seen in global animal feed consumption, up 25Mt year-on-year. There is also expected to be a recovery in the consumption of maize in the food, seed and industrial sector, year-on-year.

The largest growth in maize consumption for animal feed is seen in the EU, with maize displacing the smaller wheat crop. Growth in consumption of the grain is also seen in the US.

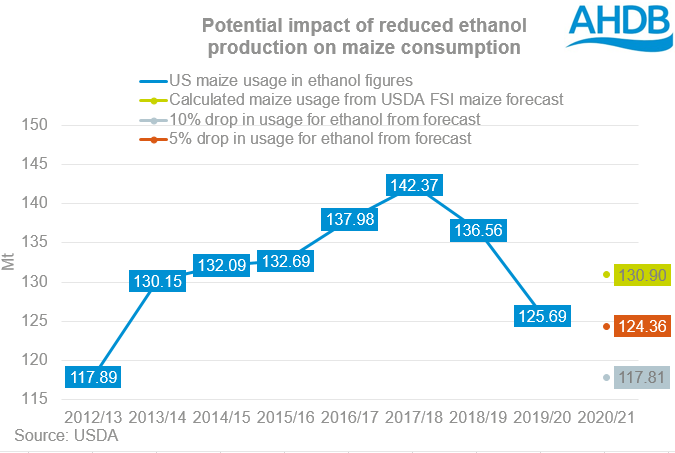

The growth in maize in industrial use is a point to watch over the course of the next year. USDA data assumes that we have seen a recovery in maize consumption in the final quarter of 2019/20 and a strong recovery in 2020/21. This is something to watch, any contraction in maize consumption for industrial purposes or political restrictions worsening in the wake of rising Northern Hemisphere coronavirus cases could pull some of the support for maize. Read more on this in the human and industrial section below.

Maize consumption in industrial sectors has been a major talking point during the coronavirus pandemic. This was particularly true for consumption for the purpose of bioethanol production. Production of fuel ethanol fell from 91% of capacity as stated in 2019, in the week ending 20 March, to 49% at the height of the pandemic in the week ending 24 April.

Translating that drop into maize usage, USDA data shows that total maize used for ethanol production fell from 34Mt in quarter two of 2019/20 (Jan-Mar 2020) to 24Mt in quarter three. Present USDA forecasts suggest that a total 125.7Mt of maize will be used for ethanol production in the US during the 2019/20 season, which would mean a return to average level in quarter four. However, with US fuel ethanol production running at 83% of capacity during June-Aug, this seems unlikely and further cuts to human and industrial maize usage in the US seem plausible.

Away from the US it will be no surprise that consumption of maize for human and industrial purposes is forecast by the USDA to have declined in 2019/20, down 9.9Mt, at 413.4Mt. Usage in the food, seed and industrial sector is seen rising to record levels in 2020/21, and as such the likelihood of a second wave of coronavirus will need watching closely.

Maize is playing an increasingly important role in animal feed, both globally and in the UK. Of late we have seen a large proportion of demand pull inflation in maize values, driven by the high volumes of maize imported by China.

Last month Helen covered this in more detail, with the USDA currently estimating US exports of maize to China in 2020/21 lower than the level already booked to be exported to China in the next calendar year. This is something which will require monitoring. China is increasing its consumption of maize, despite this the USDA currently estimate Chinese animal feed consumption and imports to be unchanged with a contraction of stocks year-on-year. As a result, with such a large volume booked, export cancellations or origin switches could pull support from prices.

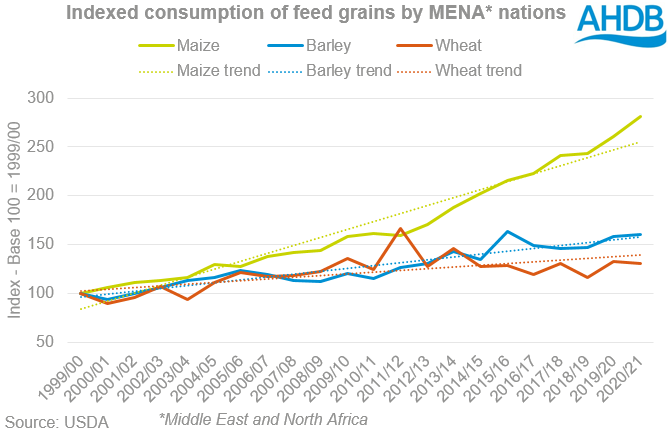

A developing trend to watch in maize consumption for animal feed, is the increased consumption of the crop in North Africa. There has been an increased shift in recent seasons away from traditional grain consumption, to increased usage of compound feed.

This has been specifically noted in Saudi Arabia, where the government is increasing the cost of barley, and incentivising the use of compound feeding.

Wheat overview

World wheat consumption is seen rising by both the USDA and IGC in the 2020/21 season. The rise is primarily thought to be coming from the food, seed and industrial sectors. Growth in consumption is especially noted in the major importers, India and China.

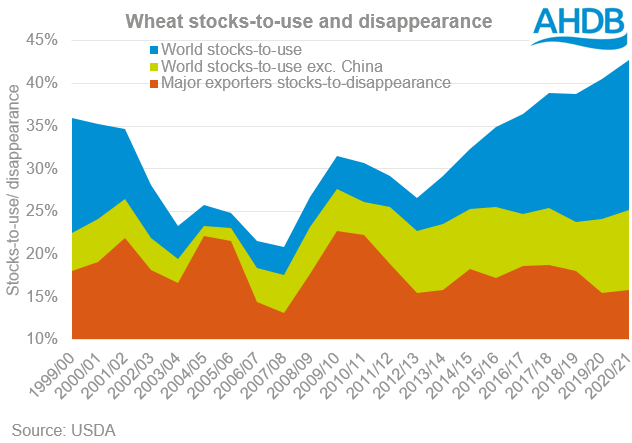

The wheat market as a whole is viewed as being better supplied in 2020/21. However, the stocks-to-use picture in its purest form is deceiving. Taking China out of the equation, as we often do, the market is far less well supplied, with Chinese stocks-to-use projected to reach 120% this season.

Taking this a step further to look at major exporter’s stocks-to-disappearance the market is only just better supplied year-on-year at 15.9% versus 15.5% last season. As such a reduction in production in the southern hemisphere or a sharp rise in consumption could tip the balance of the wheat market.

In 2019/20 human consumption of wheat really came to the fore, particularly for UK consumers, with lockdown increasing demand for flour and bread to levels that tested the markets ability to provide.

A second wave of coronavirus globally must be watched in relation to demand for wheat, a staple of human consumption. The latest International Grains Council (IGC) report shows year-on-year growth in Indian food consumption and stocks. The Indian government increased state buying during coronavirus and, as with China, this must be watched closely if we see a second wave of panic buying.

Similarly it is worth highlighting the tightness in rice markets that was felt during height of the pandemic which added further support to grain values.

In the global market, wheat tenders, in particular from North Africa, are playing an increasing role in price determination. North African consumption patterns need to be monitored. Looking at USDA data for MENA region consumption of wheat for food, seed and industrial purposes suggests a continued pattern of growth going forward.

With the competitiveness of maize during late 2019/20 as the new crop developed, consumption of wheat for animal feed will have been pressured. The USDA estimate a year-on-year fall of 3.6Mt in feed wheat usage.

The largest drop is seen in the EU, with a 5.0Mt fall year-on-year, reflecting the tighter supplies of wheat and increase in forecast maize production and animal feed consumption (+5.8Mt). With tighter wheat production the propensity to use wheat in feed is lower than it is for human consumption, as such human consumption is only expected to decline by 200Kt.

Conclusions

In 2020/21 consumption of wheat and maize is seen rising. However, there are a number of key watch points, particularly in relation to coronavirus. Should we see a second wave of increased infections globally, consumption of maize could well be restricted in relation to ethanol production.

There is a growing trend for consumption of maize for animal feed and this is something further that needs to be monitored. Growth is seen in the EU although this is potentially a short term reaction to restricted wheat availability. Longer term we are seeing increased growth in consumption of maize as a feed grain in North Africa, this likely caps barley consumption (read more about this next week).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.