Spanish pork market: Export opportunities improve in 2025

Tuesday, 10 June 2025

Key points

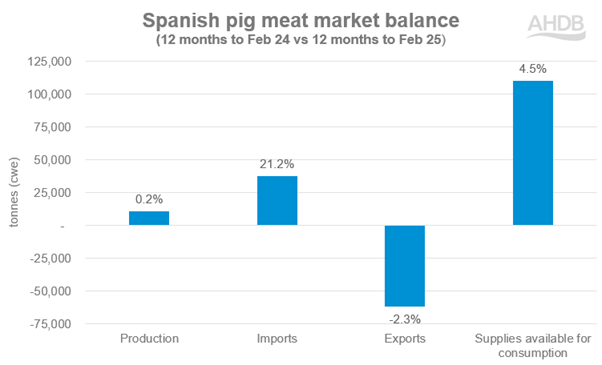

- Pig meat production in Spain in the 12 months to February 2025 remained flat on the previous 12 months at 4.93 million tonnes (Mt)

- Q1 2025 exports reached 687,000 tonnes, up 0.5% year-on-year

- Domestic consumption increased by 5.4% year-on-year to November 2024, indicating strong local demand

- New export protocol signed with China in April 2025 expanded authorised product list to include pork stomach

Production

As the world’s second largest exporter of pigmeat in 2024, behind the USA, pig production remains a long-standing pillar of Spain’s agri-food economy and continues to show robust performance in 2025 despite facing complex geopolitical crosswinds.

In the 12 months to February 2025, Spanish pig meat production reached 4.93 Mt remaining relatively flat on the previous 12 months. While seasonal fluctuations are expected in the coming months, the current pace of output suggests Spain’s position as Europe’s leading pig meat producer remains secure.

Despite this, slaughter figures are slightly down over this period at 53.50m head vs 53.47m head, highlighting the impact of increased average slaughter weights from 91.9kg/head to 92.1kg/head.

By combining production and imports, and subtracting exports, we can estimate supplies available for consumption. Based on this method, supply reached 2.57 Mt, an increase of 4.5% on the previous 12 months suggesting strong local demand with the latest consumption volumes from MAPA increasing by 5.4% year-on-year to November 2024.

Source: European Commission, Trade Data Monitor LLC

Exports

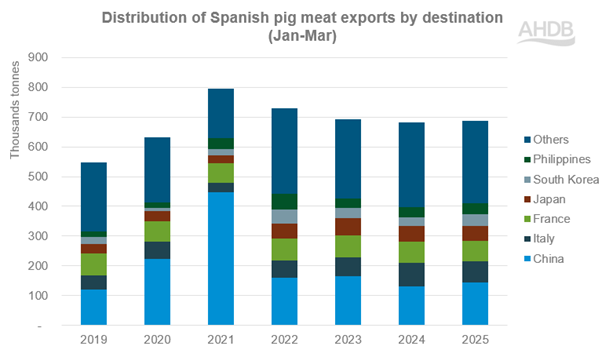

Spanish pig meat exports for 2025 Q1 totalled 687,000 tonnes, up 0.5% year-on-year likely benefiting from a diversification in trade flows. Volumes shipped to markets beyond China have continued to expand, with South Korea importing 40,300 t of Spanish pig meat between January and March of 2025, up 28,500 t from the same period a year ago.

Although not a key destination for Spanish pig meat, exports to the UK have also increased during Q1 2025, up 29% to 19,500 tonnes, benefiting from Germany’s loss of market access due to the recent outbreak of foot and mouth disease (FMD). This is despite imports of pig meat into the UK declining by 1% year-on-year in Q1 2025.

As of 14 March 2025, Germany has regained its FMD free status without vaccination from the UK government and has therefore regained access to export markets. This may mean that the increase in Spanish exports to the UK is temporary as supply chains adapt.

Source: Trade Data Monitor LLC

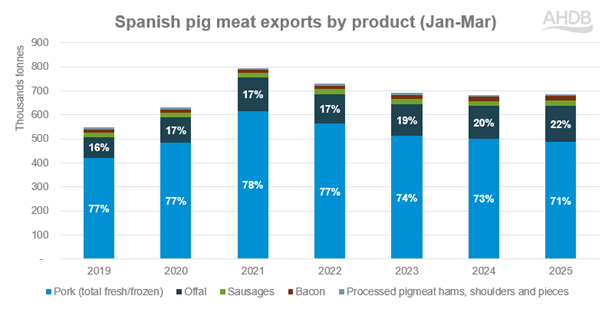

China continues to be the largest importer of Spanish pig meat, totalling 144,300 t in Q1 2025. In April 2025, Spain and China signed a new export protocol, expanding the list of eligible products for trading, such as pig stomachs which was not previously authorised. As offal is a growing export market for the Spanish pig meat industry, rising from 20% to 22% of total pig meat exports for Q1 2024 compared to Q1 2025, this is likely to give the industry a boost in the coming months.

Widley seen as a political gesture in response to ongoing tariff negotiations between China and the USA, this export protocol could suggest China may delay or ease its anti-dumping investigation into EU pig meat which began 17 June 2024, in response to EU tariffs on electric vehicle imports from China.

Nevertheless, Spanish exporters appear to have positioned themselves for such headwinds.

Source: Trade Data Monitor LLC

Prices

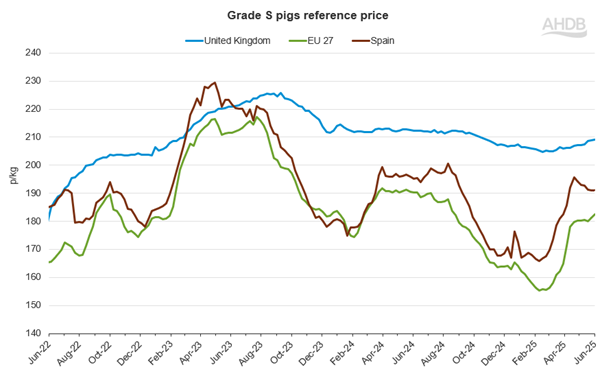

Spanish pig prices trended downward from mid-2024 through early 2025, with the decline likely accelerating at the start of this year following the announcement of an FMD outbreak in Germany, one of Europe’s key pork producers.

Prices reached a low point in January at €1.67/kg, before beginning a gradual recovery across the continent as the outbreak was brought under control. By the week ending 1 June 2025, grade S Spanish pig prices have risen to €1.91/kg, still 4p/kg below the same week in 2024 and more in line with 2022 levels than the recent peaks of 2023.

Although a temporary uplift in Spanish exports to the UK occurred during Germany’s restricted market access period, it's difficult to isolate this as a primary driver of Spanish prices, particularly as similar price recoveries were observed across other major EU producers, including Germany. General market commentary suggests that the recovery has been underpinned by tighter supplies and firmer demand across the EU and in key export destinations.

Germany’s regaining of regionalised access to the UK market at the end of March, and the restoration of FMD-free status in May, have helped stabilise trade dynamics, but prices remain supported for now by the broader European market balance.

Source: Eurostat

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.