Smallest domestic wheat crop since 1981: Feed market report

Thursday, 29 October 2020

By Alex Cook and Megan Hesketh

Grains

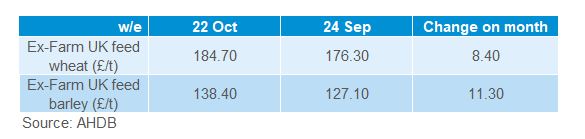

Domestic feed wheat and feed barley prices have increased over the course of October, with the UK ex-farm price (nearby) quoted at £184.70/t and £138.40/t respectively as of 22 October. The increases follow wider gains in global wheat and maize markets, and are further supplemented by the shortages of wheat domestically.

Despite barley availability being much higher against wheat in the UK so far this season, the gap in feed prices between the two grains has narrowed slightly from the last report, though at £46.30/t is still significant. UK barley prices have tracked closer to export parity levels which have seen global gains recently. Persisting demand for feed grains has supported a slight rise in domestic barley prices.

In October, DEFRA released provisional production estimates for the 2020 harvest. UK wheat production was estimated at 10.1Mt with barley at 8.4Mt. For our wheat crop, this is the smallest production figure since 1981 and has meant feed manufacturers require a greater level of imports for wheat derived feed. Reportedly, barley rations for feed manufacturers have moved to near maximum levels due to increased availability of the grain.

This can be seen in the feed production statistics released earlier in October. In the two opening months of the season (Jul - Aug), barley usage in GB animal feed production (compound and integrated poultry units) was up 21.0% compared to the July – August 2019. Over the same period, wheat usage was down 4.6%, perhaps as a result of the reduced availability.

The 10.1Mt provisional wheat production figure means the balance sheet is perhaps the tightest it has been in a number of decades. Total wheat availability is forecast at 14.7Mt, a 23% decrease from last season. Wheat imports are forecast to be more than double last year’s volume, as a result of the low domestic production figure.

Proteins

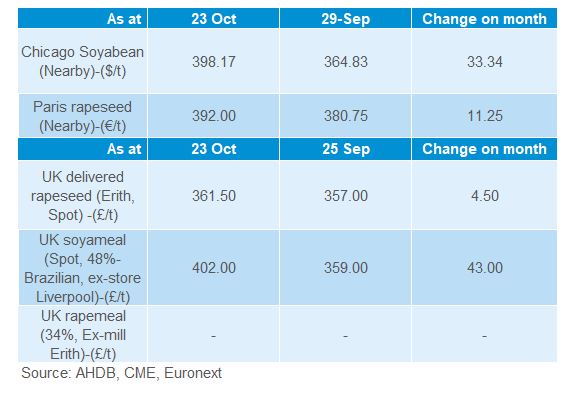

Reported feed protein prices increased across the board this month, from prices at the end of September. Rapeseed, delivered Erith, was quoted at £361.50/t on Friday 23 October, up £4.50/t from the 25 September. UK rapeseed values have followed moves in Paris rapeseed futures which gained €11.25/t over the same time frame.

Brazilian 48% protein soyameal (ex-store Liverpool) prices saw a substantial rise of £43/t from the end of September, quoted at £402.00/t on 23 October.

The driving force behind these price rises is the continued pressure of Chinese soyabean demand. Recovery of the Chinese third-quarter pig herd is clear, with pork production predicted to have risen by 18% from last year to 8.4Mt. Around 24M pigs were expected to be slaughtered in October, a rise of 8% from September. This increase in demand is expected to continue into coming months, as this number of slaughtered pigs remains below the 45M that is typically required each month.

Changes to the US soyabean production forecast for 2020/21 have also supported prices. The October USDA supply and demand estimates downgraded production by 1.2Mt to 116.2Mt.

Dryness in Brazil has also contributied to the bullish soyabean sentiment, with dry weather reducing moisture levels and hindering germination of newly planted crops, rainfall is forecast for central and southern Brazil in the short-term. These push factors for soyabeans overshadowed any pressure on crude oil prices faced from possible changing US energy policy, should we see a change in administration in the US.

Currency

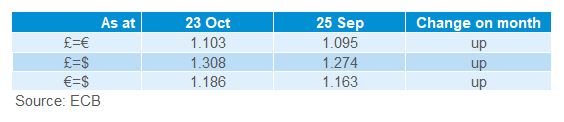

October has seen sterling vary heavily against the euro, though sterling has strengthened overall by 0.5%, from 1 Oct to 26 Oct. Uncertainty around Brexit continues, impacting on currency movements given the close proximity to the final deadline. As such, a greater degree of uncertainty could be seen over the next few months in currency markets.

Better gains have been seen for sterling against the dollar, appreciating 1% over the same period. Uncertainty is also seen in this market, given the upcoming US election in November.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.