Sheep meat update: what’s driving deadweight prices?

Thursday, 22 February 2024

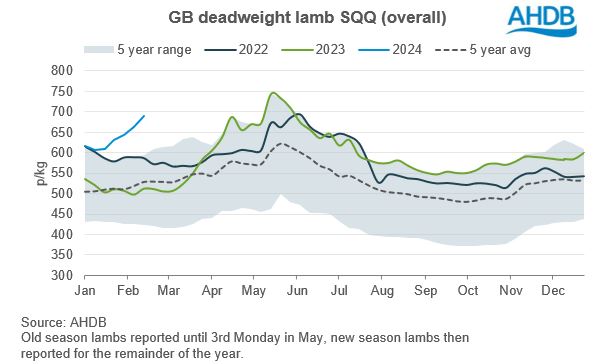

GB deadweight lamb prices have seen a storming beginning to 2024, as we explore drivers behind this growth, focussing on retail demand following Christmas.

Key points

- Deadweight SQQ reaches new seasonal heights during the first seven weeks of the year.

- Throughputs are lower on the back of smaller carryover.

- Retail demand benefited from Christmas promotions but remains threatened by cost of living pressures.

Prices

GB deadweight SQQ lamb prices continue to increase, with significant jumps of up to 28p in recent weeks. The current price for the week ending 17 Feb sees the SQQ at 689.9p/kg. Prices have never seen such an elevated period during January and February.

GB deadweight lamb SQQ (overall)

Source: AHDB

AHDB estimated throughputs through 2024 have been lower than previous years. For the first seven weeks of 2024, estimated throughputs have totalled 1.4m head, which is a fall of 4% on average from the same period in 2023. Both estimated slaughtering’s and AHDB’s deadweight sample show much greater pressure on numbers into February (YOY), reinforcing the tight lamb supply at present. Our agri-market outlook for 2024 predicts a 10% fall in the number of lambs carried over from the new to old season, a fall of around 400,000 head. This could see further pressure on domestic supplies in the first half of the year before new season lambs start to come forward. Other market factors, like uncertainty around disease (such as Schmallenberg and Bluetongue) and its impacts on the new season lamb crop, remains a longer-term consideration.

With demand for sheep meat robust at the farmgate, how does this compare with the retail landscape?

Retail demand

In the 12 weeks to the 21 January 2024, retail volume sales of lamb reached 22,296 tonnes, up 7.3% on the same period in 2023 according to Kantar. This growth occurred mainly in the 4 weeks leading up to Christmas and came from primary and added value lamb such as marinated and sous vide products. See our full article for more details on Christmas sales.

The increased demand for primary lamb was driven by leg roasting joints which saw a 23% increase in volumes purchased, lamb mince and steaks also saw volumes purchased increase (source: Kantar, 12 w/e 21 January 2024). For full cut details, see our lamb retail dashboard. Promotional activity, including some retailer’s half price offers, during the 12-week period was important for the volume growth of these cuts. Deals offered by retailers were in fact so influential that we saw all three cuts benefit from a decrease in average prices paid. This drew in over half a million new shoppers for primary lamb, and as a result buyers increased by 7.4%. Existing shoppers also bought more with trip volume at 0.8kg per shop (up 8.2%).

News that the UK has officially entered a recession shows the economic situation is still uncertain. This means that there may still be challenges ahead for lamb in the first half of the year due to its high price point. However, looking ahead, Easter and Eid al Fitr, could provide an additional opportunity for lamb demand. Both are strongly associated with lamb, and it is anticipated that retailers will take a similar approach to last year with strong promotional activity which should help boost sales.

What does this mean for the UK market?

As consumers continue to struggle with their budgets, lamb as the most expensive protein, remains vulnerable to consumer switching into cheaper alternatives. How this long-term demand trend balances against lambs’ robust performance around key seasonal events remains a real watch point. Our outlook is predicting some pressure on retail demand across 2024 as a whole, however with the current supply limited and further potential demand peaks on the horizon, domestic supplies may remain challenging to secure.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.