Q4 2025 dairy market review

Wednesday, 14 January 2026

Milk production

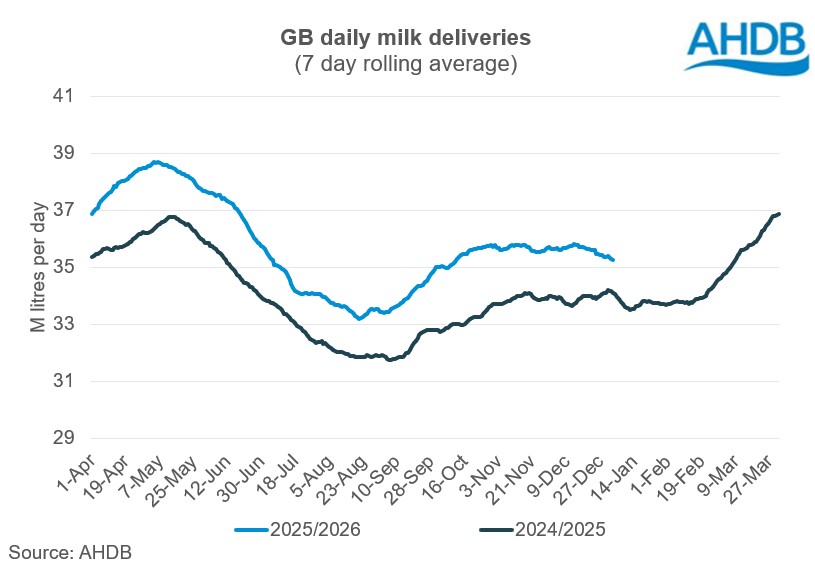

GB milk deliveries stayed high through Q4, reaching 5.6% up on the same quarter in 2024. October increased by 6.8%, November 5.2% and December by 4.8%.

We are now annualising against strong growth versus the previous year, generating a compound effect. We are up 7.4% for Q4 against the 5-year average.

For 2025 so far, higher farmgate prices and cheap feed, driving the highest milk-to-feed-price ratio in 20 years have meant record-breaking milk volumes were recorded.

Milk composition has been well above average all year as well with the latest butterfat at 4.44% and protein at 3.59% in October sitting 2.5% and 3.9% above the 5-year average respectively.

The increase in Q4 deliveries brings the GB forecast for the 2025/26 season to 13.05 bn litres, a significant increase of 4.9% compared to the previous season and a record high.

This growth is likely to continue until the spring flush despite recent falls in milk prices. Even though many milk prices have been cut substantially, those on retail aligned or organic contracts have not felt cuts.

Beginning in the next milk year, the momentum is likely to cool down as prices fall further and the impact of punitive B-price mechanisms is felt, and milk deliveries are likely to decline gradually.

The milk to feed price ratio remains firmly in the expansion zone, at an almost 20-year high, incentivising farmers to continue to push production.

Feed costs continue to decline, standing at 3.5% lower year-on-year (as of October-25) and are at the lowest levels seen since March 2022.

Forage availability will now be biting for some as we progress through the winter months and bought in forage costs have increased substantially due to last years drought.

Many will be hoping for a clement early Spring to facilitate turnout.

Cow numbers are declining, with the size of the GB milking herd in October 2025 0.9% lower than a year earlier. The GB herd total stood at 2.51 million head, a year-on-year decline of 1.3%.

A fall was seen across all age groups with the exceptions of over 4-year-old cows.

With milk prices now falling and commodity prices under pressure, farmers are likely to remove older and underperforming cows over the coming months and take advantage of strong cull cow prices.

GB producer numbers have held fairly steady over the past 6 months with only 30 producers lost between April and October 2026. We would expect to see an acceleration of the downwards trend in 2026.

GB organic milk deliveries have continued to recover since the nadir in production seen last year and production was up by 11% for the milk year to date.

Global milk production averaged 864.6 million litres per day in October, an increase of 35.1 million litres per day (+4.2%) across the selected regions, compared to the same period last year.

All regions recorded year-on-year volume increases except for Australia.

The USA rose by 3.6% driven by one quarter of a million extra cows and a boost to cheese production facilities, and NZ by 1.7%.

Argentina continued their economic recovery and production rose by 9.4%. Australian production looks questionable due to predictions of further poor weather.

The EU returned to strong growth (+5.1%) following last year’s Bluetongue outbreak which had the effect of delaying cow fertility and producing a late flush.

Germany were up 168.5 million litres (+6.8%), followed by France, up 109.4 million litres (+6.0%), and the Netherlands, up 83.7 million litres (+7.9%)

Rabobank estimate that milk supply growth for 2026 will be 0.12% before slowing to 0.7% decline in H1 2027.

They estimate that all major exporters will remain in production growth for Q1 of 2026, with most slowing down into Q2. They anticipate decline for the EU after Q1 2026 while the USA and South America will continue to grow.

Wholesale markets

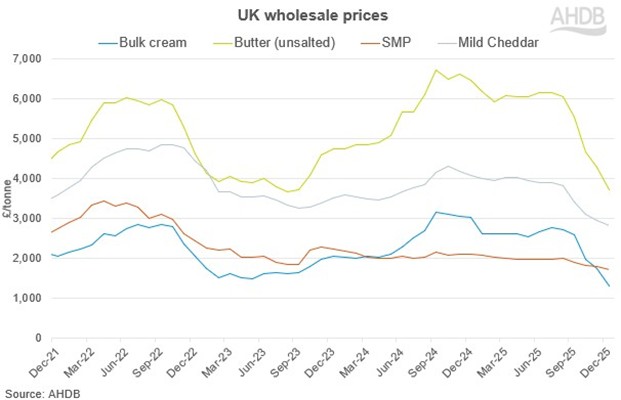

It is difficult to overstate the extent to which overall price movements on UK wholesale markets have slid over the quarter.

Continuing high milk volumes already started to pressure commodity prices in September but when the EU saw a huge spike in milk through the Autumn prices fell significantly.

Fats saw the worst losses with cream losing half of its value over the quarter and butter one third. Mild Cheddar’s losses were more constrained at 17% and SMP dwindled a further 9.4%.

December saw a continuation of bearish market sentiment with further substantive falls across all commodities. As with previous months, cream and butter took the force of the blow.

Bulk cream prices lost 25% of its value. Extremely high milk volumes combined with record-breaking solids content in the milk, as well as a series of breakdowns and planned maintenance in factories, meant even more cream was available.

Butter prices continued in a similar vein. Some processors with churning capacity found it more economic to churn cheap cream rather than come to the butter market, which limited demand.

Conversely, many sellers were seeking to pass on older stock before year-end, which led to some further downforce on prices.

Butter prices declined over the course of the month, starting the period in the low 4000s but dropping to the mid 3000s by the end. The average price for the month was £3,710/t, a decline of 14%.

Mild Cheddar continued to decline, although moderately and may have found a level. The average price fell £130/t to £2,830.

SMP prices are described as being in 'a race to the bottom' and eased £70/t month on month, falling throughout the month ending at an average of £1,730/t.

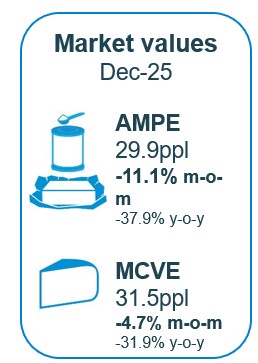

As of December, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements and typical milk utilisation) fell sharply to 33.1ppl.

AMPE declined by 11% to 29.9ppl, MCVE declined by 5% to 31.5ppl. AMPE and MCVE are now behind the peak by 40%. A fall in the MMV is generally predictive of a fall in farmgate milk prices three months later.

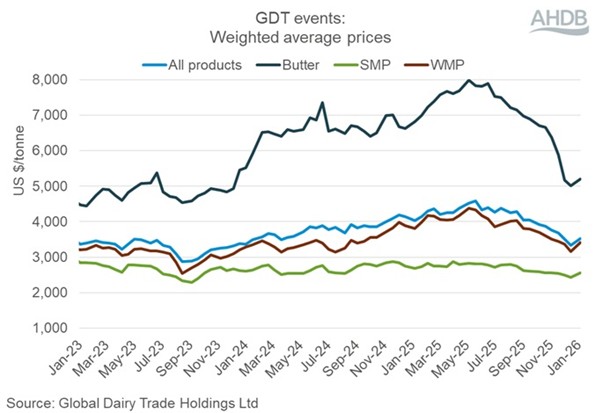

The GDT has shown continued weakness through the quarter, particularly for butter. However, may have shown some light at the end of the tunnel in the first period of the new year with a 6.3% bounce.

This could indicate belief from some buyers that a floor has been reached or may be a short-term blip. We should monitor this closely.

Farmgate milk prices

The latest published farmgate price was for October, with a UK average of 46.6ppl.

However, latest announced farmgate prices have plummeted since with some processors falling as much as 15ppl by February 2026.

For January, aligned liquid contracts were an exception to the overall bearish tone in milk prices with Müller, M&S and Sainsbury’s increasing their prices.

On non-aligned liquid contracts, all the buyers on the AHDB league table continued with price cuts for the month of January.

Pembrokeshire Creamery reduced their price by 0.4ppl, which is the fourth consecutive month of price decline. Grahams and BV Dairy cut their prices by 2.00ppl and 3.11ppl, respectively.

Crediton made a negative announcement of 2.00ppl while Freshways and Payne’s Dairies reduced their price by 3.00ppl each. Müller Direct made a reduction of 1.50, marking the third consecutive month of decline.

Announced cuts to cheese contracts were generally larger with most in the region of 3.00 to 3.60ppl (First Milk, Leprino, South Caernarfon and Wyke farms). Saputo announced a reduction of 4.00ppl.

Barbers Cheese and Belton announced price cuts of 2.50ppl and 2.00ppl respectively, declining for the third consecutive month. Parkham Farms made a price cut of 2.50ppl after holding steady in the month of December.

Manufacturing contracts also moved in line with cheese contracts. Meadow announced a reduction of 1.00ppl. This is the third consecutive month of decline in price.

Dale Farm GB and UK Arla Farmers Manufacturing reduced their price by 2.22ppl and 3.48ppl respectively.

Manufacturing contracts saw stability, with the exception of UK Arla Manufacturing decreasing their price by 1.66ppl. Pattemore Dairy has held on to their price for the last eleven months.

Meadow announced no change in price.

Demand

During the 12 weeks ending 27 December 2025, volumes of cows’ dairy declined 0.2% year-on-year (NIQ Homescan POD, Total GB).

Spend on cows’ dairy increased by 7.2% year-on-year, driven by a 7.5% increase in average prices paid.

Cows’ milk volumes saw 1.5% decline volumes purchased year-on-year while spend saw a 7.1% increase, driven by an 8.7% increase in average prices paid.

Declines were seen for semi-skimmed, skimmed, and other cows’ milk. Whole milk continued to see volume growth, with a 2.7% increase year-on-year.

Other animal sourced milk and plant-based also saw volume growth.

Cows’ cheese remained in volume growth, seeing a 1.9% increase year-on-year. Spend grew by 5.0% during this period, driven by volume gains and a 3.1% increase in average prices.

Cheddar, which represents a majority (44.8%) of all cow cheese volumes, saw a 1.3% increase. Other cows’ cheese (+9.8%), snacking (+8.9%), and specialty and continental (+0.1%) also saw growth.

This growth offset declines in British regionals, processed, and Stilton and British blue.

Cows’ butter saw a 0.5% decrease in volumes purchased year-on-year. However, spend saw a 6.4% increase year on year, driven by a 7.0% increase in average prices paid.

Block butter continues to be the only subcategory to see volume growth (+6.0%). However, this growth was not enough to offset the decline in cow butter spread volumes (-3.7%).

Cows’ yogurt, yogurt drinks and fromage frais volumes continue to see growth (+6.5%), with spend increasing 11.3% year-on-year. Average prices paid grew 4.5%.

Cows’ standard plain yogurt saw the fastest growth of 19.7% year-on-year, while cows’ fat-free yogurt saw the greatest actual growth, with an additional 4.2m kilos purchased year-on-year (+12.6%).

Cows’ cream volumes saw a 0.1% increase year-on-year, which combined with an 9.6% increase in average prices paid, resulted in a 9.7% increase in spend (NIQ, 12 w/e 27 December 2025).

Cream performed well due to Christmas. Growth in clotted (+12.2%), aerosol (+3.0%), crème fraiche (+2.2%), and sour cream (+0.4%) volumes drove this performance.

Whipping cream and single cream both saw volume decreases of (9.2%) and (-4.8%) respectively.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Pricing in retail is not always obviously correlated to changes in pricing on commodity markets. We have conducted some analysis looking at this issue finding a 7-month lag, and diluted transmission.

Trade

Total export volumes of dairy products from the UK for Q3 2025 increased 5.5% year-on-year. Exports of dairy products to the EU increased by 12,000 t and that to non-EU nations increased by 3,400 t.

This was largely driven by an increase in the exports of powders, whey, cheese and butter.

Powders saw the biggest year-on-year increase, with supplies boosted by record highs in milk deliveries.

Milk powder export volumes were up by 14,400 t: bound for both EU nations such as Netherlands, Denmark, Belgium, France and non-EU nations like Nigeria, Indonesia, Pakistan, Saudi Arabia and New Zealand.

This was followed by the exports of whey and whey products, which increased by 3,500 t, cheese by 1,500 t and that of butter by 900 t.

However, a decline in the exports of milk and cream by 3,900 t (2.2%) and yogurt by 10.7% (1,000 t) weighed on overall exports.

Although exports of milk and cream declined in volume terms, it picked up (6.3%) in terms of value year-on-year.

We have undertaken a detailed analysis of our export prospects into the MENA and other markets as part of this study: Prospects for UK agri-food exports.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.