Q3 2025 dairy trade review: Total exports on upward trajectory

Thursday, 20 November 2025

Key trends

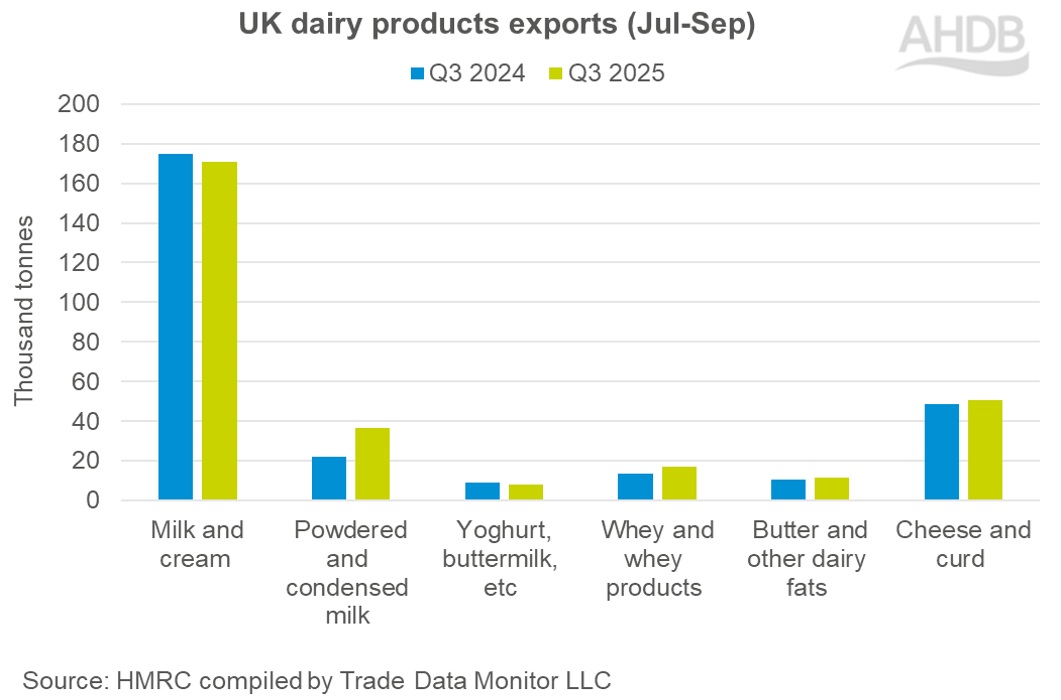

- Total UK dairy export volume for Q3 2025 increased 5.5% year-on-year totalling 294,000 t, driven by powders, whey and whey products, cheese and butter

- Total UK dairy export value stood at £529m, up 13.7% year-on-year

- Export volumes of milk and cream and yoghurt shrunk in volume but grew in value

- Exports of cheese are at the highest level for Q3 seen in the last six years

- Imports declined slightly during the period due to lower imports from Ireland and New Zealand year-on-year

Powders, whey, cheese and butter scale up while others roll down

Total export volumes of dairy products from the UK for Q3 2025 are up year-on-year. Exports of dairy products to the EU increased by 12,000 t and that to non-EU nations increased by 3,400 t.

This was largely driven by an increase in the exports of powders, whey, cheese and butter.

Powders saw the biggest year-on-year increase, with supplies boosted by record highs in milk deliveries. Milk powder export volumes were up by 14,400 t: bound for both EU nations such as Netherlands, Denmark, Belgium, France and non-EU nations like Nigeria, Indonesia, Pakistan, Saudi Arabia and New Zealand.

This was followed by the exports of whey and whey products, which increased by 3,500 t, cheese by 1,500 t and that of butter by 900 t.

However, a decline in the exports of milk and cream by 3,900 t (2.2%) and yogurt by 10.7% (1,000 t) weighed on overall exports. Although exports of milk and cream declined in volume terms, it picked up (6.3%) in terms of value year-on-year.

Europe

Overall exports to the EU constituted around 90% of total UK exports. In Q3 2025, exports to Netherlands increased by 36% to 23,300 t, Denmark increased by 65% to 5,500 t, Belgium increased by 26% to 9,000 t and that to France increased by 19% to 10,900 t.

Conversely, exports to Ireland, the biggest recipient of UK dairy products declined by 1% to 187,000 t. Of non-EU nations, exports to like Nigeria saw the biggest increase of 1,800 t followed by Indonesia and Pakistan at 1,200 t and 1,000 t respectively during the period.

Q3 exports of cheese were the highest seen in that quarter for six years. Exports of total cheese increased by 3.1% (+1,500 t) year-on-year. However, there has been varied performances across categories.

Exports of cheddar increased by 12.2% (+3,100 t) while exports of mozzarella cheese declined by 6.4% (-700t) and that of other cheese nudged down by 6.8% (-800t) during the period. Overall demand remained good despite higher prices of UK cheese in the global market.

Lucy Randoph, AHDB Head of International Trade Development for dairy said:

"We have had a busy year supporting the dairy sector at events around the world and the figures for Q3 2025 demonstrate how much progress we have made.

"Our aim is to continue supporting our exporters to help build on what has been achieved to date. Our goal for the next financial year is to help ensure our world class dairy produce continues to develop its global potential."

Globally, the largest increase in cheese volumes came from European nations: Germany (+1,100 t), the Netherlands (+700 t), Belgium (+600 t) and Spain (+500 t).

This was followed by increase to Asia and Oceania: China (+500t) and Hong Kong (+200t). Conversely, exports to the Middle East and North Africa declined (-1,000 t), Sub Saharan Africa (-70 t) and Latin America and Caribbean (-40 t).

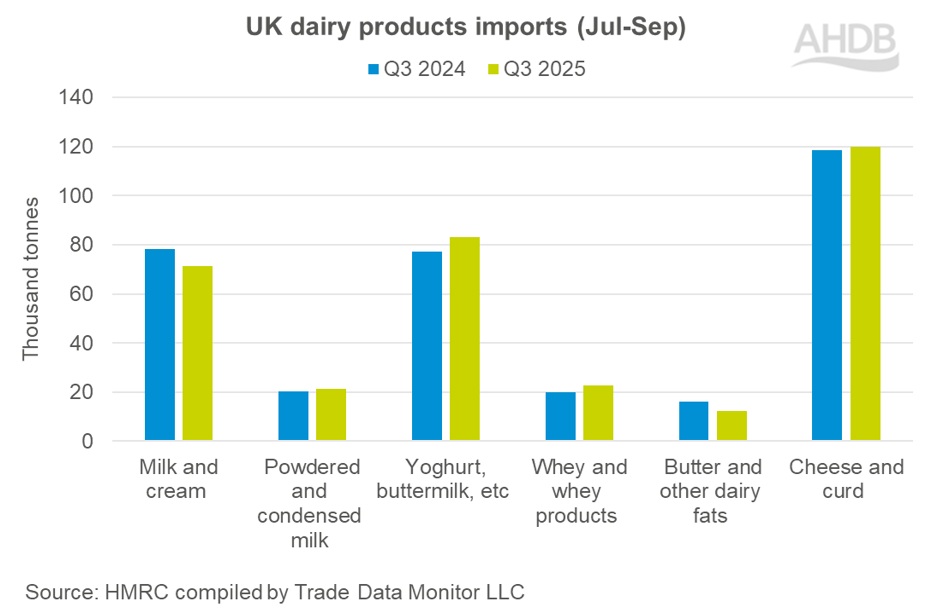

Imports saw marginal decline

Total import volumes are down by a marginal 100t (0.03%) at 330,600 t in Q3 2025. It is the first quarterly decline seen during the last three years. Imports from EU nations declined by 2,900 t (1%) on Q3 2024. Imports from non-EU nations declined over 2,900 t (58.6%).

Imports of milk and cream saw a decline of 8.7% to 71,300t in Q3 2025 year-on-year. Imports of butter declined by 24.3% to 12,300 t during the period.

However, an increase in imports of other dairy products limited the downside movement. Imports of yoghurt and whey and whey products increased by 7.4% and 13.8% respectively to 83,000 t and 22,900 t in response to growing demand.

Cheese and curd increased by 1,400 t (1.2%) while powders also saw a marginal increase of 900 t (4.2%) year-on-year in Q3 2025.

Imports from Ireland saw the largest decline of 8.7% to 119,200 t in Q3 2025 compared to the same period in the previous year. Imports from the Netherlands and Denmark declined by 15.1% and 7.6% at 15,500 t and 16,800 t, respectively.

Imports are expected to be lower in the near-term amidst comfortable supplies in the domestic market.

Roadmap for the UK

The AHDB dairy exports team has been hosting events round the year and flying the flag for British dairy.

Although the EU remains our major trading partner, extending our foothold in the emerging markets like the Middle East and Asia will be a step towards leveraging exports in these markets.

It will also be an opportunity for our producers to utilise the excess milk in the markets currently. However, currently British products are relatively expensive on the global stage. We will need to emphasise quality and heritage credentials to justify that premium.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.