Q4 Rabobank update – Global dairy supply surpasses demand

Thursday, 8 January 2026

Rabobank have forecast a continuation of milk production growth into 2026, pressuring dairy prices.

Production

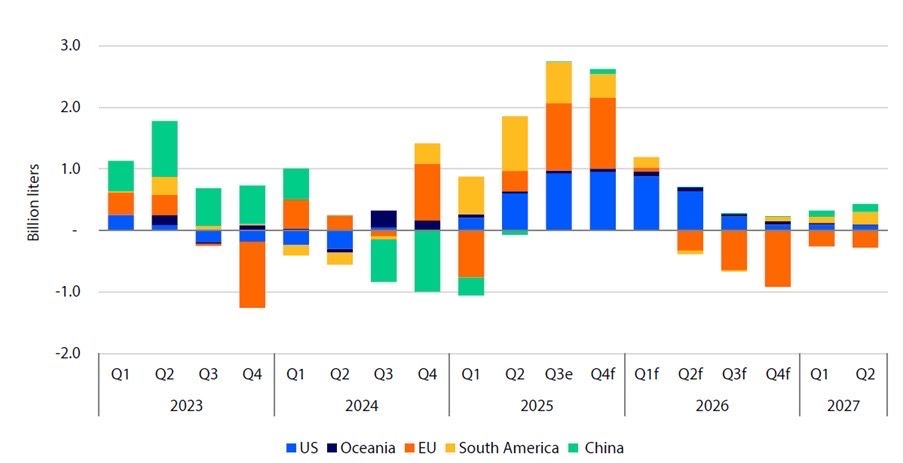

Rabobank estimated that total milk production from the big 7 dairy exporters* to have finished 2025 2.2% ahead of 2024. Global production peaked in Q3 of 2025, with Q4 volumes expected to finish not far behind.

With the surge of volumes also came large increases in milk solids. Feed costs were generally favourable, keeping margins positive even while prices declined.

The EU and UK milk flows reached new records as the year progressed, while New Zealand posted its third highest October on record.

Low producer prices in China continue to intensify. Demand remains sluggish and production is forecast to stabilise in 2026, with any growth driven by large-scale operations.

By 2027, production could begin to gain pace again after consolidation, efficiency gains and market development.

The US has seen very strong growth and, though farm gate prices are now weakening, low feed costs are likely to continue to support producers to some extent.

Large investments in cheese and whey processing is set to increase capacity to service domestic consumption and export markets. Additionally, increased production of dairy beef is supplementing margins.

Milk production growth: The Big 7 exporters and China

Source: Rabobank

Rabobank predicts that all major exporters will remain in production growth for Q1 of 2026, with most slowing down into Q2, while the US and Oceania are expected to remain in growth for the full year.

Together, all regions are forecast to increase by 0.12% year-on-year in 2026, annualising on a strong 2025.

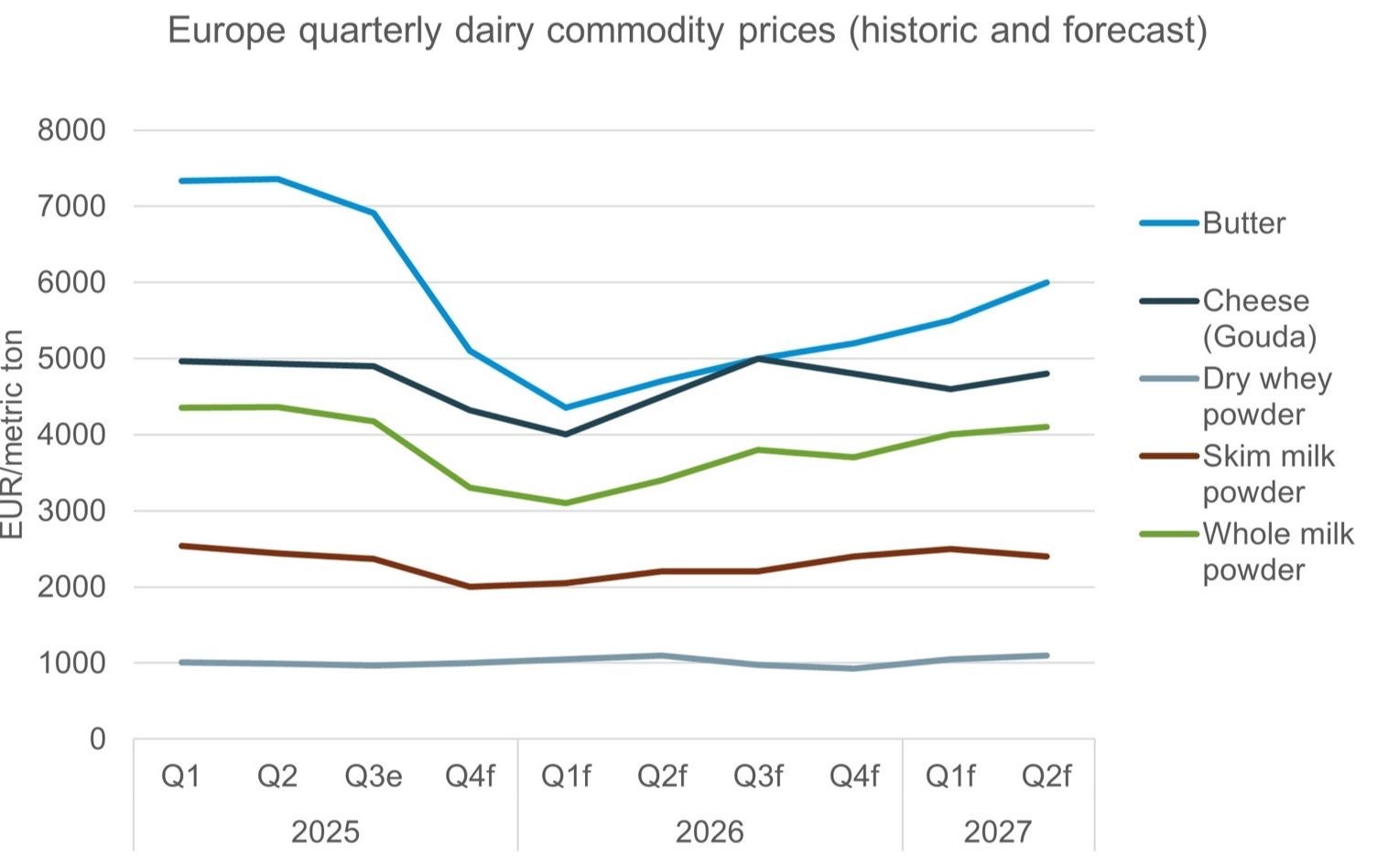

Commodity prices

Source: Rabobank

In the EU, butter led the decline of commodity prices as stocks continue to rise, exports are under pressure and imports increasing. These recently announced Chinese dairy tariffs on EU dairy could add further pressure.

EU cheese prices are forecast to recover sooner as production growth is less strong but Rabobank warns that large inventories of SMP and butter must be cleared first, due to the interlinked production system.

While international competitiveness has now narrowed, 2025 is set to mark a record high for US export of cheese and butter. The forecasted increase in production and huge developments in processing capacity poses a challenge for 2026.

Global weakness in dairy commodity prices are expected to continue into 2026 amid strong supplies and fragile demand. While weaker prices should begin to boost some demand recovery, this is not expected to be a quick process.

Butter is to regain momentum but not to recent highs seen in 2025.

Overall, producers are likely to see tighter margins and steady price recovery, feeling the effects of global oversupply, from both increasing yields as well as milk solids growth.

However, lower prices will support steady recovery in demand and Rabobank expects commodity prices to return to historical averages by the end of 2026.

*The Big 7 includes the EU, the US, New Zealand, Australia, Brazil, Argentina, and Uruguay

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.