October 2023 dairy market review

Thursday, 16 November 2023

AHDB review significant market movements for the month of October.

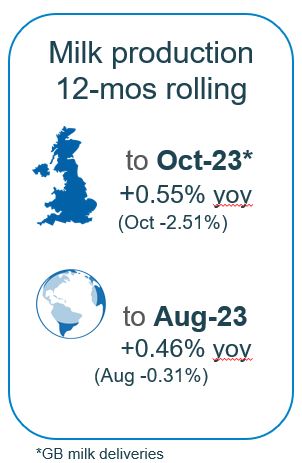

Milk production

GB milk deliveries reached an inflection point in October with GB milk deliveries declining by -2.8% year-on-year, an equivalent of a loss of 29 million litres. This year’s milk season (April-Oct) production totals 7,276 million litres so far, a slight drop (0.1%) compared to the same period of 2022. The Milk forecasting forum predicted a loss of 0.5% for the 2023/24 milk year.

While grass growth rates have remained exceptional for the time of year, too much precipitation in many areas has meant many cows have been brought into sheds sooner than expected so not able to capitalise on available grass. We are also now annualising against the Autumn of 2022 which saw exceptional production following great grass growing conditions after the summer drought, paired with rising milk prices.

Agricultural deflation on fuel, feed and fertiliser may have continued, but many input costs remain at high levels and generalised inflation on many other smaller inputs remains problematic. The increased cost of borrowing is especially difficult for many farms. Ongoing declines in milk prices are impacting on farmers' decision making, with little appetite to push yields beyond current levels.

Organic production has been particularly challenged with challneges in both growing costs, felling prices and availability of forage forcing many producers to scae back.

Global milk production in August began to decline, falling by 0.46% year-on-year, averaging 783 million litres per day. Only minimal growth in production was seen across EU and Australia with modest declines from New Zealand, US and Argentina, year-on-year.

In our latest survey of major milk buyers, it is estimated that there were 7,500 dairy producers in GB as of October 2023. Year on year, this is an estimated decline of 350 dairy producers (-4.5%), although no change reported from our previous survey in April.

Production outlook

As previously reported, The global forecast is now estimated to continue in the same vein with annual growth of only 0.1% expected, revised downwards from earlier expectations of 0.2% growth. Falling prices and difficult weather conditions across many regions could suppress performance in the second half of the year; this is reflected in final estimates.

In the latest EU short term outlook, the European Commission anticipates milk deliveries in the region to end the year up 0.3% year-on-year despite lower cow numbers and declining milk prices. Weather conditions have been reported as more favourable than those experienced last year, which has contributed to better feed quality and in turn supported milk yields (+1.0%). The forecast for 2024 is for milk deliveries to remain relatively steady (+0.2%) year-on-year.

AHDB's GB forecast for the 2023/24 milk year is at -0.5%, however this will be revised by the end of this year.

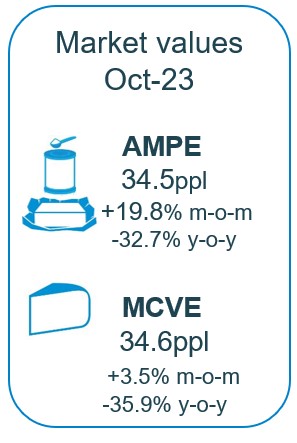

Wholesale markets

Overall price movements on UK wholesale markets moved towards a more optimistic direction in October. with an uplift in prices recorded in all product categories. Recent GDT events support these uplifts four consecutive positive periods. However, there was a wobble in the latest event. UK wholesale cream prices moved down up by £143/t, SMP up by £360/t, butter up by £360/t with mild cheddar up by a more modest £30/t.

EU wholesale prices saw the beginning of a much-needed period of recovery in October. Milk production is declining, as we expect at this time of year, which slows milk supplies into processors. Alongside this we see increased demand for butter and tightening inventory of powders, which has supported prices across the board.

Butter prices in Europe are firming up as consumer demand increases, with prices up 7% on last month, although still significantly down on last year.

SMP prices are also climbing steadily, and manufacturers report greater interest from buyers to fill both short and longer term commitments. Reports suggest that processors may look for firmer SMP prices to cover a potential increase in cost of production over the winter months.

WMP prices saw slight increases in October as inventories continue to diminish, albeit steadily, however globally prices are uncompetitive.

Average cheese prices lifted slightly from last month.

Farmgate milk prices

The latest published farmgate price was for September, with a UK average of 36.4ppl. Since then however, market-related farmgate prices have continued to decline in November response to the reduced market returns and higher milk availability. M&S dropped by 1.2ppl, Co-op –0.29ppl, JS –0.26ppl, Tesco –0.1ppl; Freshways –2.00pl, Graham’s -1.0ppl. Most cheesemakers held apart from First Milk –0.85ppl, Saputo –1.5ppl and Wensleydale creamery –0.26ppl.

Prices in NI have been reported as significantly lower which has put farmers in Ulster under significant difficulty.

EU product availability

EU dairy product availability tightened in Q2 2023 compared to the same period in 2022. Despite marginal growth (0.6%) in milk deliveries in the EU during the quarter, weakening consumer demand led to lower production of dairy products. Domestic demand continues to be challenged by reduced consumer purchasing; however easing prices made EU dairy products more competitive on the export market. With more exports and lower production, dairy supplies on the continent have tightened in the past quarter.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.