NI milk prices: continuing the downward trajectory

Thursday, 19 October 2023

Milk prices in Northern Ireland are continuing the downward trajectory and there is a question in people’s minds; how far will it go? According to the Ulster Farmer’s Union (UFU), many farmers are getting prices below the cost of production. Higher input cost, inflationary pressures, weaker global demand are all adding up to the woes of the farmers. Rising interest rates on loans and farm overdrafts is also another major concern.

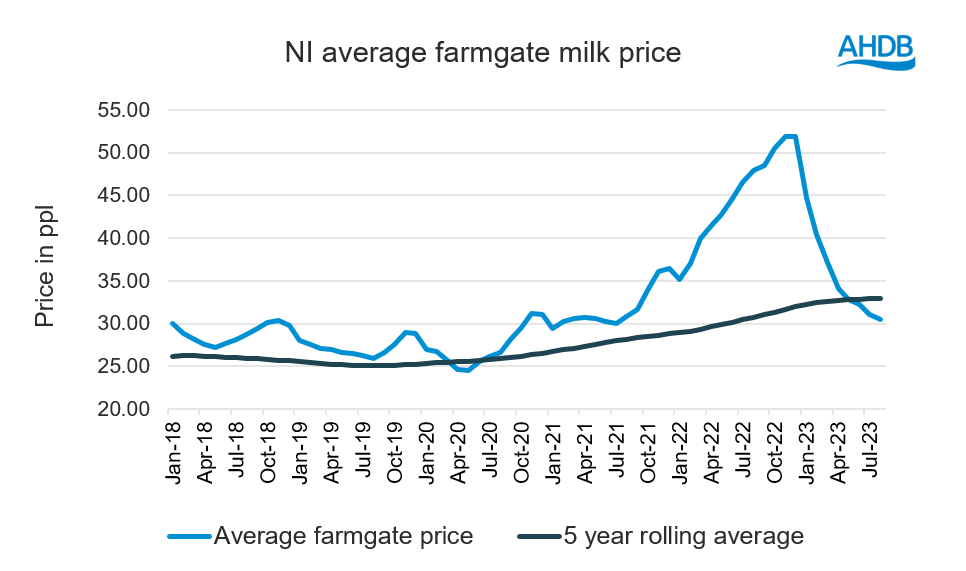

The average farmgate milk price in August was reported by DAERA as 30.53 ppl, a decline of nearly 36% year-on-year. During the current year, prices have fallen by more than 40% and are continuing to decline. According to industry sources, the milk base average price was reported to be around 28.47ppl in August. The UFU estimates the break-even price as 35–36ppl. According to the union, returns for milk are down by 40% compared to this time last year and most of the dairy farmers are not earning enough to cover production costs. The chart below shows the price trend during last five years.

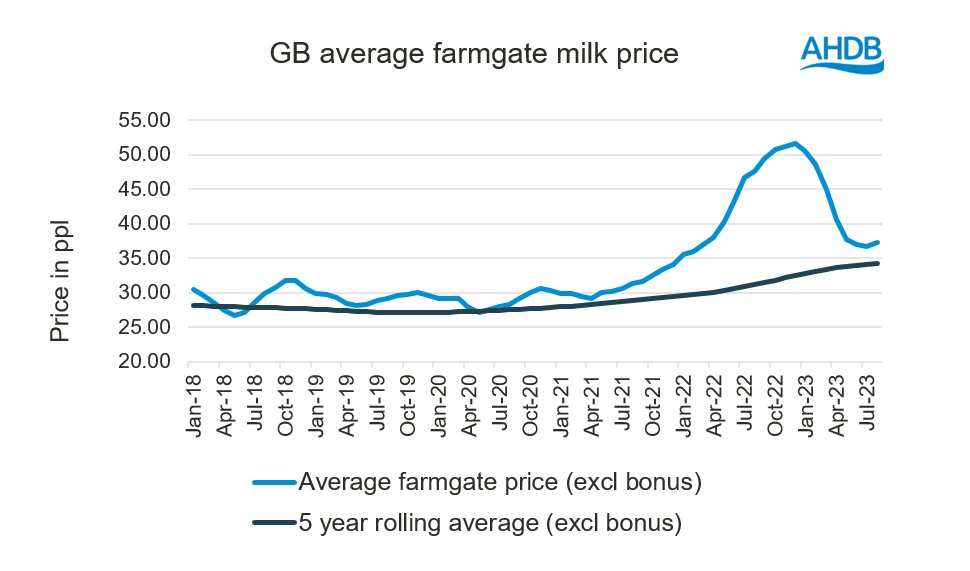

The current price levels have now dropped below the 5-year rolling average price, whereas GB milk prices regardless of the recent declines are still holding above the 5-year rolling average price of 34.23 levels. This means the gap between NI and GB prices currently sits at 6.80ppl. Last year, average NI prices were in premium over GB milk prices at 0.93ppl.

Dairy farmers in Northern Ireland export around 80% of their products and are therefore even more exposed to the vagaries of global markets. In Great Britain, more milk goes into liquid processing and more is on aligned retailer contracts which are based on the cost of production and do offer some insulation from market driven price changes. The current price differential between GB and NI prices have widened following weaker demand overseas.

With prices still sitting at such low levels, many will be hopeful for tightening supplies and a recovery in demand. Currently some farmers have reduced milking to twice a day to save labour costs. This could help in mitigating cost to certain extent and balancing the supply-demand scenario. The current situation of tightening margins will be a difficult road and we may see further exits from the sector. However, much also depends on the overall macro-economic situation. Encouraging signs from four consecutive periods of growth on the GDT could point towards a warming of global winds.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.