EU dairy product availability: lower in Q2

Thursday, 12 October 2023

Key points

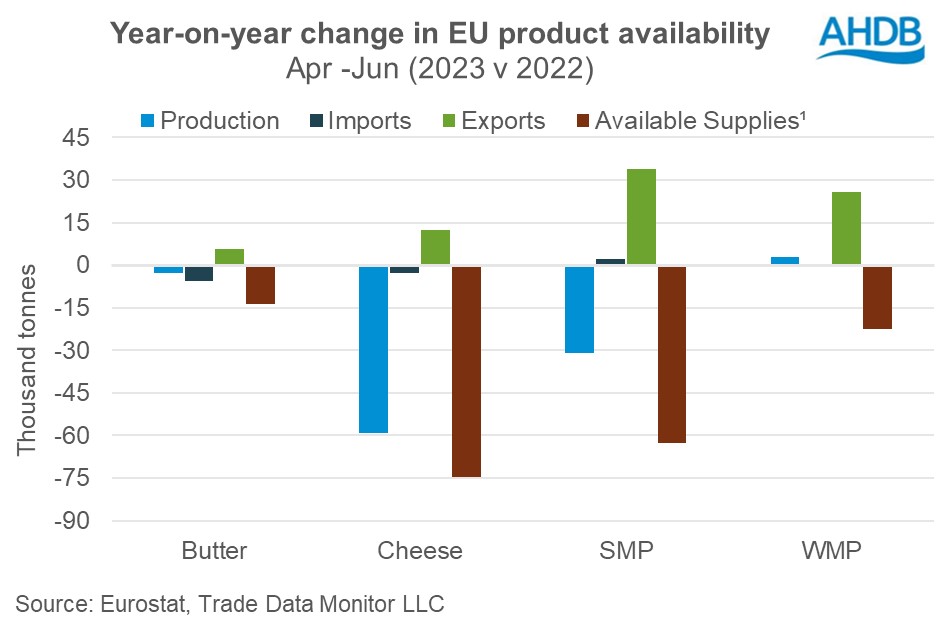

- EU’s dairy product availability remains lower across the board in Q2 2023, driven by lower production and higher exports

- Available supplies of cheese recorded the largest volume decline, with higher processing and storage costs

- Domestic demand continues to weaken

- Limited demand from China for powders was largely compensated by exports to Middle East and North Africa (MENA), Brazil and Mexico

Overview

EU dairy product availability remained lower in Q2 2023 compared to the same period in 2022. Despite marginal growth (0.6%) in milk deliveries in the EU during the quarter, weakening consumer demand led to lower production of dairy products. Domestic demand continues to be challenged by reduced consumer purchasing; however easing prices made EU dairy products more competitive on the export market.

The decline in available butter supplies resulted from an increase in exports and declining imports. Though milk deliveries were higher during the period compared to the previous year, production of butter was 0.5% behind as seasonal domestic demand was not up to the mark due to cooler temperatures in spring.

Available supplies of cheese were remarkably lower in Q2 2023 year on year, driven by a significant decline in production and easing import volumes. Higher processing and storage costs negatively impacted production. However lower prices improved the EU’s competitiveness on the global market, resulting in an uptick in exports during the period.

Like cheese, available supplies of SMP saw strong year-on-year decline. This was driven by a large decline in production and good growth in export volumes as subdued EU pricing supported trade.

Higher milk deliveries added to WMP production volumes. Although this uplift was limited by increases in processing and storage costs, processors were reported to be producing in line with contractual agreements. Imports remained on a par with the previous year while exports recorded volume growth, supported by newer markets. The absence of expected demand from China was compensated largely by exports to MENA, Brazil and Mexico. Overall, this drew available supplies downwards.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.