Latest look at GB animal feed production

Monday, 7 March 2022

Our latest GB animal feed production statistics have just been released. These figures show the volume of animal feed produced by manufacturers in GB and the amount of raw materials used in the process.

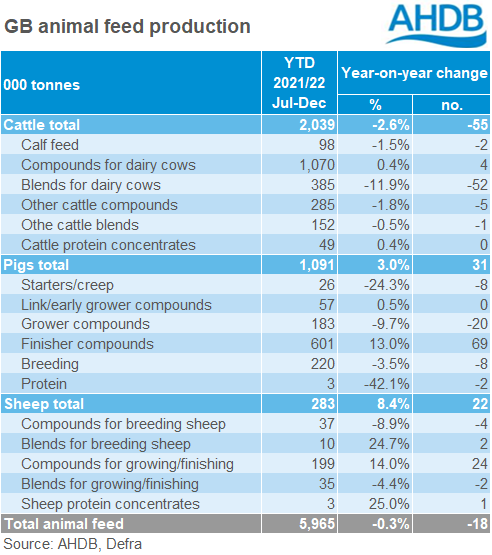

During the season to date (Jul-Dec), total GB animal feed production stood at 5.96 million tonnes, largely unchanged (-0.3%) compared to the same period a year ago.

Within this total, cattle and calf feed production stood at 2.01 million tonnes, down 2.6% year-on-year. Pig feed production stood at 1.09 million tonnes, up 3.0% year-on-year, while sheep feed production grew by 8.4% to 283,000 tonnes.

For cattle, a 12% fall in production of feed blends for dairy cows was the main driver of overall lower production. This could be reflective of higher input costs, also perhaps higher forage stocks produced last season.

For pigs, much of the overall uplift in feed production came from a 13% increase in the amount of finisher feed manufactured. This reflects supply chain issues within the sector, with more slaughter-ready pigs on-farm. Production of grower feed fell by 9.7%, while starter/creep feed production fell by 24%, suggesting fewer younger animals are entering the supply chain. The amount of feed for breeding pigs also fell by 3.5%, again suggesting some contraction in the number of sows. This aligns with our forecast.

For sheep, a 14% increase in compound production for growing/finishing lambs was the main driver of the overall rise in feed production. This potentially reflects strong market returns for lambs seen in 2021, with producers keen to push lambs onto finish. While Defra slaughter figures show particularly low lamb slaughter in the second half of 2022, there are reasons to believe lamb kill in 2021 was higher than recorded. The above feed production statistics would support this.

Looking at raw materials, wheat inclusion increased by 8% year-on-year. Use of oats and field beans also increased; these feeds being largely home-grown and cheaper than alternatives. On the other hand, use of barley and soya cake & meal decreased. Maize use fell by 33% year-on-year, again likely a reflection of increased costs.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.