How are the major meat producing regions coping with coronavirus?

Thursday, 30 April 2020

By Felicity Rusk

With coronavirus affecting nations all over the globe, it is difficult to keep track of the developments. Here’s what’s been happening in some of the key players in global meat markets.

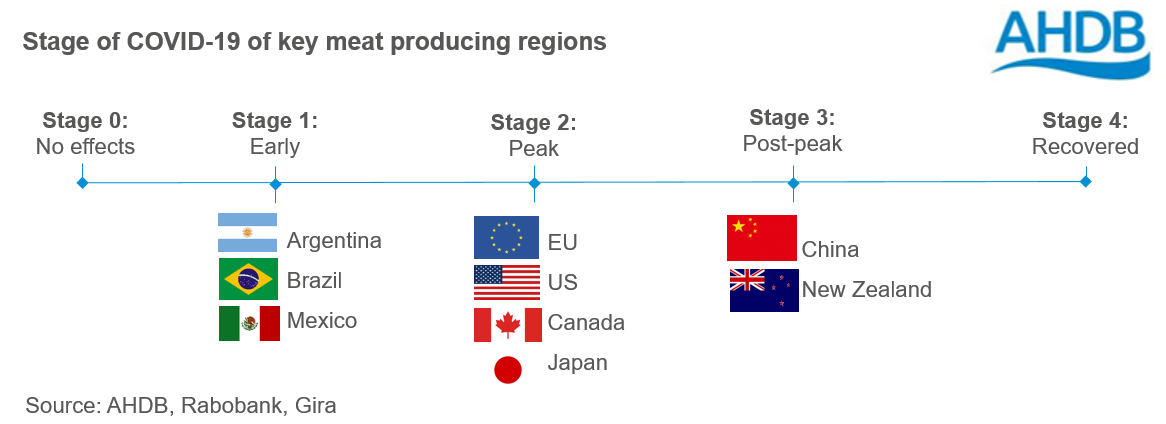

These key nations can be categorised based on their current stage of COVID-19 infection.

Stage 1- Early

During this ‘early’ stage, only a limited number of COVID-19 cases will have been reported. Social distancing regulations may be coming into effect and there will be some redirection of food from any closures in the foodservice sector into retail. There will likely be changes to consumer demand, as consumers stockpile goods.

- The government introduced nationwide mandatory quarantine measures on March 20. The nation experienced some logistical problems in the days following.

- The Government has made US$1 billion of finance available at reduced interest rate to support small and medium sized companies.

- Rabobank estimates that inflation could reach up to 40% this year and the Argentinian Peso to weaken against the US dollar by 20%.

- Grain and protein harvests are currently underway. Farmers have reportedly looked to expand on-farm storage capacity to avoid potential supply chain disruption. All ports are thought to be operating as normal, though the additional safety check are likely slowing processes.

- Exports of beef (including offal and processed products) slowed considerably this year. In the first quarter of this year, exports were 13% higher than in the previous year, although significantly lower than the 54% increase recorded in the previous quarter. This was predominantly driven by a slow-down in shipments to China due to COVID-19. Furthermore, exports of high quality beef to the EU27 fell by 6% in the first quarter of this year

- Reports suggest that beef processing plants continue to operate as normal, albeit with safety precautions in place.

- Quarantine measures were introduced in early March, however whether these are mandatory varies between states. There were a couple of isolated incidences of logistical disruption when measures were first introduced, however these mainly affected grain transportation. Ports have been reported as functioning as normal.

- Since the start of the year, the Brazilian real has fallen by 28% against the US dollar. This means Brazilian products are more price competitive on the export market, however it also reduces the spending power of domestic consumers.

- Foodservice demand has largely dissipated, and retail demand has reportedly slowed after the stockpiling surge. Consumers are already reportedly opting for lower-value cuts. As a result, reports suggest some more expensive beef cuts have had to be put back into freezer storage, affecting their value.

- Beef production is expected to drop considerably. Slaughter levels slowed in at the end of 2019, as the herd moved into a retention phase. Several processing companies have announced temporary closures to plants, particularly those that are tailored towards the domestic market. Gira suggests that production could fall by up to 25% in the first half of 2020 compared to the previous year, driven down by lower domestic demand and producers holding onto cattle.

- Domestic demand for pork is expected to fall, although demand from the China should continue to support production and prices. The decline in production may not be seen until the end of the year, when all the pigs currently in the system move through.

- Feed prices are a key concern to livestock producers, driven predominately by rising maize prices. In March alone, feed costs for pig producers rose by 21%.

- Social distancing measures were introduced in late March.

- Since the start of the year, the Mexican peso has fallen by 24% against the US dollar. This makes Mexican exports more price competitive on the export market, however reduces domestic consumer’s spending power.

- Weakness in oil markets and the expected decline of the tourism sector will likely supress economic growth further. With no announced financial stimulus program, the nation could see a longer-term impact on demand.

- According to the latest report from Rabobank, pork production reached record levels in Q1, supported by a larger breeding herd, improved sow performance and heavier carcase weights. However, production is expected to slow in the latter half of the year, due to the reduction in demand and rising feed costs.

Stage two- Peak

During the ‘peak’ phase, social distancing regulations may have been inforce for some weeks. Demand from the foodservice sector has largely disappeared and supplies are instead being redirected to the retail sector. Consumers have already moved through the ‘stockpiling’ phase and retail demand has begun to stabilise. A key challenge in the supply chain for these nations is labour availability. In some nations, producers and processors are starting to react to the rapidly changing environment by reducing production.

- Labour availability remains a key challenge within the EU. This has mainly affected meat processing lines, due to worker absenteeism.

- There are growing concerns around rising levels of product in cold storage, although these are now stablising. Challenges with exports have compounded issues, but now appear to be improving.

- The closure of the foodservice sector has particularly affected the beef and lamb sector, especially the higher value cuts. Although there is growth in retail sales, it is not offsetting the losses from the service sector.

- Money conscious consumers opting to buy lower value cuts of meat, which has caused carcase-balancing issues. This was particularly apparent in the panic-buying phase and has since abated slightly. It has however translated into lower carcase values for beef and lamb markets.

- On 22 April, the EU Commission proposed the opening of the Private Storage Aid (PSA) scheme for some agri-food products including beef and sheep meat. The practicalities of the scheme mean it will probably have little uptake among UK processors.

- There are expectations that there could be a backlog of cattle of farms, particularly after the grass-growing season. It will like take some time for these cattle to move through the system. The EU Commission expect EU production (excluding UK) to decline by 0.6% on the year.

- The EU Commission expect EU (excluding UK) sheep and goat meat production to remain stable in 2020, with contraction in flock size, a slowdown in production from Romania and improved export opportunities will also likely bring stabilities to supplies.

- The EU Commission expect EU (excluding UK) pig meat production to increase by 0.7% in 2020. This is based on the expectation of strong demand from China encouraging herd expansion in Spain and favouring higher slaughter weighs.

- African swine fever (ASF) remains a key concern for European pig producers, as the virus was detected at two commercial farms just 10km away from the German border.

- At the national level, the US is in the acceleration phase of the pandemic, with different states seeing varying levels of COVID-19 activity. Social distancing measures have been in place since mid-March, although the level of restrictions does vary between states and cities.

- The number of citizens filing for unemployment is expected to reach 20-30%. An estimated at 16 million citizens registered for unemployment in the 3 weeks to 12 April alone, which added downwards pressure on both beef and pork futures markets.

- Production of beef and pork remained elevated throughout Q1. However, in a bid to manage future disruption bought about by COVID-19, processors encouraged producers to bring animals forwards. This was particularly evident in March, as cattle and hog slaughter recorded an uplift of 10% and 11% on the year respectively, which was considerably higher than the growth recorded in the two previous months.

- However, throughputs during April reportedly dropped back, as some of the nation’s largest processing plants announced temporary closures or part closures of sites, due to labour force concerns related to COVID-19. This has caused considerable disruption to supply lines. An estimated 25% of pork capacity and 10% of beef capacity was offline in late April, according to the United Food and Commercial Workers.

- Due to concerns over a potential meat shortages, an executive order was signed by the President on Tuesday 28 April, to order meat processing plants to stay open.The order applies to all meat processing plants in the U.S. in an effort to prevent further disruptions to the food supply.

- Wholesale beef prices have picked up recently, although farmgate prices remain depressed.

- Export growth has been strong this year so far. In the first two months of the year, exports of beef (including processed and offal) and pigmeat (including offal) recorded an uplift of 10% and 40% on the year respectively. Looking ahead, the global economic disruption due to COVID-19 may affect import demand.

- Quarantine measures introduced in mid-March.

- As with the US, closures of some of the major meat processing plants is causing significant disruption to both pork and beef supply chains. As such, this has put downwards pressure on prices, along with the closure of the foodservice sector.

- Two plants in Alberta, which make up 70% of Canada’s beef processing capacity, are currently closed on a temporary basis. Reports suggest that some animals are being diverted to other processing facilities, which is incurring producers additional transportation costs. Traditionally, just under half of Canadian beef produced is exported, with three-quarters of this going to the US alone.

- The latest pig inventory revealed a smaller herd than expected. However, a slowdown in the movement of weaned pigs across the US border could increase animals available to slaughter on the domestic market in coming months. Nevertheless, the latest report from Rabobank estimates that the Canadian pig industry could decline by around 3% this year.

- Quarantine measure were introduced in gradual phases, which limited ‘stockpiling’ behaviour of consumers.

- The postponements of the Olympic and Paralympic games has caused major economic damage.

- Expected that a rise in unemployment rates will be fairly minimal and temporary, as not common practice within the culture.

- Consumers are switching to lower-value proteins and cuts. This switch is expected to hit premium beef lines, such as wagyu the most. However, this favours pork. Reduction in the tourism industry will likely affect volume consumed.

- Beef imports are expected to fall due to the slowdown of the foodservice sector, by up to 6%, according to Gira. Furthermore, domestic production is likely to show an uplift as calves were purchased and raised specifically for the original date Olympic and Paralympic games.

- Pork imports are expected to fall, due to the large volume of product in frozen stores. Though consumption has picked up due to COVID-19, import demand is expected to fall by around 4.2% in 2020, according to Gira.

Stage 3- Post-peak

These nations were some of the first to be affected by COVID-19 and so are furthest along the road to recovery. For the most part, labour and logistical challenges are largely resolved. The foodservice sector has begun to re-open, although progress is slow due to persistent consumer concerns. The longer-term impacts are likely to be trade related and driven by a slowdown in the global economy.

- In mid-April, the economy and trade are starting to recover. Reports suggest that 95% factories are back online, although operating on reduced hours. Universities and middle schools are beginning to reopen, and offices started to reopen to staff.

- Foodservice outlets are reportedly starting to reopen although social distancing measures are still in-place, although recovery is slow due to consumer cautiousness. Many smaller restaurants have had to shut down permanently.

- In the initial lockdown, logistics with feed and the movement of live animals provided some challenges. The government moved to prioritise this movement which eased problems. However, some feed additives such as amino acids could not be transported, as they were not classified as food. Therefore, we could see some reduction in domestic protein production due to reduced performance.

- The outbreak of coronavirus only slowed the nation’s attempts to rebuild its domestic pig herd following African Swine Fever. As such, pork production has slowed, and so poultry is temporarily expected to overtake pork as the most produced and consumed meat in China. However, large investments into new production facilities in Northeast China will likely put pork back into the top position.

- Official statistics show the number of new cases of African Swine Fever have picked up, following the easing of quarantine restrictions. It still remains a major risk factor to the nations pig herd.

- Pork demand is expected to bounce back relatively quickly, which should support imported demand. However, the economic disruption caused by the pandemic could affect consumption higher-priced proteins such as beef and sheep meat.

- The number of new cases of COVID-19 reported is fairly low, this maintains an ongoing threat of a potential second wave.

- The nation has recorded some of the lowest infection and fatality rates among reporting countries. Borders were closed for non-residents came into effect on 20 March and quarantine measures were introduced on 25 March. From 22 April, these regulations have started to ease.

- There has been recent recovery in the New Zealand Dollar exchange rate, reflecting the optimism around food exports and the nation’s potential quick recovery from the virus.

- Disruptions to processing lines has resulted in backlog of cattle and sheep on farms. According to the Farmers Weekly NZ, the wait time for killing space is around between 2 to 6 weeks, depending on the region. This backlog has put downwards pressure on lamb and beef prices. Processing capacity has reduced as plants comply with COVID-19 regulations.

- Exports of fresh and frozen sheep meat dropped back by 9% in the first two months of this year. This was driven by a sharp decline in shipments to China (-30%), when the nation was in lockdown.

- Exports of beef (including offal and processed products) increased by 8% in the first two months of the year. This was driven by an uplift in shipments to the US (+19%). However, this was partially offset by a 13% decline in product to China, when the nation was in lockdown.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.