US hog futures drop to over seventeen year low

Wednesday, 8 April 2020

By Felicity Rusk

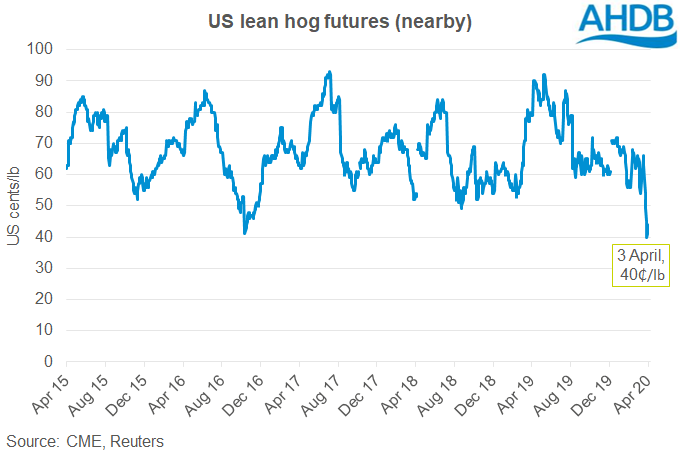

Last Friday (3 April), US hog futures fell to their lowest point since winter 2002. Chicago (CME) nearby lean hog futures settled at 40 cents per lb (72p/kg), about 5 cents below the previous day. Reports suggest this is the lowest spot contract price since October 2002.

The rapid drop off in futures prices was due to a combination of factors, although most were a direct result of the COVID-19 pandemic. The closure of schools along with restaurants means that demand from foodservice dissipated. In general, pork is not thought to be as dependent on the foodservice channel as other meats, but bacon is an exception. This creates carcase balance issues, and reports indicate the price of US bellies has been particularly hit, consequently.

Furthermore, the US economy has recorded a huge surge of citizens applying for unemployment benefits. A reported 6.7 million applied in the week ending 27 March alone. This is introducing uncertainty into the market due to concerns over future consumer spending power.

The recently released US hog census figures, showing a further 4% rise in the US pig herd probably also contributed to a weak market sentiment. Some market commentators are becoming less optimistic about the ability of Chinese exports to relieve the US of excess pork supplies.

This drop off in futures prices was also echoed at the farmgate level. On 6 April, USA (Iowna/Minnesota) prices fell to $88.87/100kg. This is the lowest price since August 2018.

Futures prices have shown some recovery in the days since. However, on 8 April, it was announced that Cargill, one of the largest meat processing companies in the US, would shut a facility in Pennsylvania until further notice. This plant mainly processes beef and pork products for retail.

Cargill now joins other companies including Tyson Foods Inc and JBS USA who have closed facilities across both Iowa and Pennsylvania. Reduced processing capacity risks market-ready pigs building up on farm. How the supply chain copes with this, and any future disruption in the coming weeks could also be influential for market prices.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.