H&I usage down last year, but what to consider for 2021/22? Grain market daily

Friday, 6 August 2021

Market commentary

- UK feed wheat (Nov-21) gained £0.15/t yesterday, to close at £183.65/t. The May-22 contract lost £0.15/t to close at £188.85/t and Nov-22 gained £0.50/t to close at £171.00/t.

- There is support from global supply concerns for wheat crops. Crops in Russia, the US and Canada are all under question, and there are fresh concerns from temperature swings in Argentina.

- This was met with higher-than-expected US maize export net sales for 2021/22. Sales totalled 830.2Kt, up 57% from the previous week.

- US weather continues to be considered favourable, with rains arriving, or due, in many states. However, some concern has arisen from the recent drought map extending extreme drought conditions into parts of Iowa (a key maize and soyabean producing state). The trade now waits for the next USDA world agricultural supply and demand estimates on Thursday next week.

H&I usage down last year, but what to consider for 2021/22?

Yesterday, we saw the release of the full season usage statistics for the human and industrial (H&I) sector and animal feed sector. James reviewed the animal feed figures, finding wheat usage was down. Today, I review the H&I data.

2020/21 - cereal usage down in H&I sectors

Brewers, maltsters and distillers (BMD)

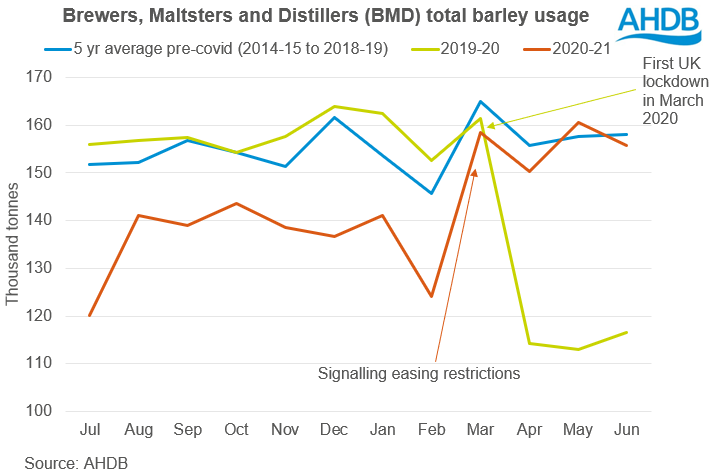

Total barley usage for 2020/21 amounted to 1.71Mt. This was down 3.2% from 2019/20 and 8.3% below the 5-year average pre-Covid (2014/15-2018/19). At the end of 2020/21, usage looks to be near pre-Covid levels. If this pace continues, it may boost total usage in 2021/22 (covid allowing).

Barley closing stocks were down 11.6% in June 2021 from June 2020, tightening the H&I barley 2021/22 stocks from last year. But, the stocks remain 4.4% higher than the 5-year average pre-Covid.

Meanwhile, 2020/21 wheat usage by BMDs increased 12.4% from the 5-year average pre-Covid to 818.9Kt. This is the highest usage recorded electronically (since 1990/91). Higher usage months for the year included October 2020 and March, April, and May 2021.

UK flour millers

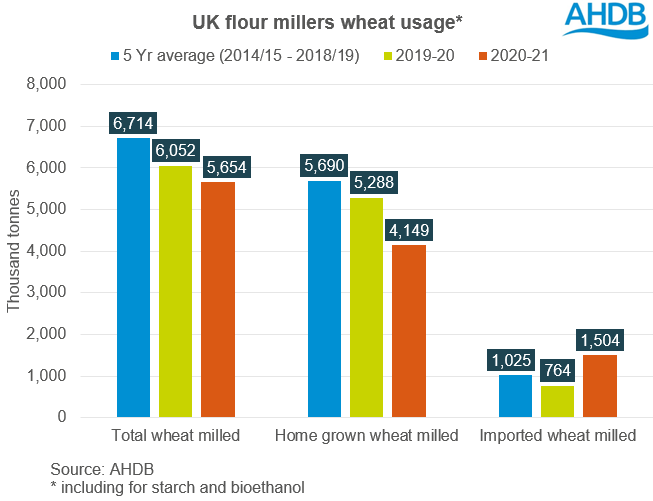

The UK milled 5.65Mt of wheat in 2020/21, including for starch and bioethanol production. This was down 6.6% from 2019/20 and 15.8% from the 5-year average pre-Covid. Flour production (bread, biscuit, household, and food ingredients) followed a similar pattern, down 2.8% from 2019/20 and down 0.7% from the 5-year average pre-Covid. This shows that although Covid affected flour demand, the main reason for the big year on year drop was lower starch production.

Home-grown milling wheat usage fell 21.5% on the year to the lowest since 1993/94, due to low UK wheat availability. Imported wheat usage increased 97% from 2019/20 as a result.

Considerations for 2021/22 – points to take away

- Barley – Supply and demand may be tighter in 2021/22 than seemed earlier in the year.

Barley usage in feed rations is expected to remain strong this season. This is due to a healthy discount to feed wheat, and there is arguably an improved outlook for BMD usage too. Friday’s harvest report indicated variable winter barley yields so far, so this is one to watch.

- Watch domestic milling wheat quality

Home-grown usage is expected to rebound with increased UK production. But, UK quality remains a consideration to meet the volumes required. If quality is in line with the 5-year average, GB milling wheat meeting group 1 and 2 specifications (including reduced specification) may total 5.4Mt. This would be sharply up on last season and similar to 2019/20 availability. In 2019/20 the UK imported 1.05Mt, the lowest volume since 2011/12. Last year, millers needed more imports to meet their requirements.

This season, the availability from key import origins is under scrutiny. Concerns remain around the quality of EU wheat and the size of the Canadian spring wheat crop for this season. If global and/or domestic milling wheat supplies are tighter than expected, milling premiums may gain further.

Watch out for rain in the EU, which may affect quality, and the USDA August WASDE on Thursday. This may give more indication of how global milling wheat supply looks for 2021/22.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.