- Home

- News

- Will barley’s large discount to wheat continue for the 2021/22 marketing year? Analyst Insight

Will barley’s large discount to wheat continue for the 2021/22 marketing year? Analyst Insight

Thursday, 29 July 2021

Market commentary

- UK wheat futures (Nov-21) closed yesterday at £177.35/t, gaining £2.35/t on Tuesday’s close. May-22 futures closed yesterday at £183.00/t up £2.65/t on Tuesday’s close.

- Support in the domestic markets follows gains in Paris and Chicago wheat markets. Driving this is the recent crop tour in the U.S., which showed that key wheat producing states are showing signs of crop damage due to the ongoing dry weather. Further, in Europe, wet weather is hampering harvest and potentially threatening crop quality.

- SovEcon reduced its forecast for Russian wheat exports for 2021/22 marketing year by 1.3Mt, exports are now forecast at 37.1Mt.

Will barley’s large discount to wheat continue for the 2021/22 marketing year?

2020 a year for discounted barley

The 2020/21 marketing year was one like no other. The UK produced the smallest wheat crop (9.7Mt) since 1981, at the same time barley production, at 8.1Mt, was the largest since 1997.

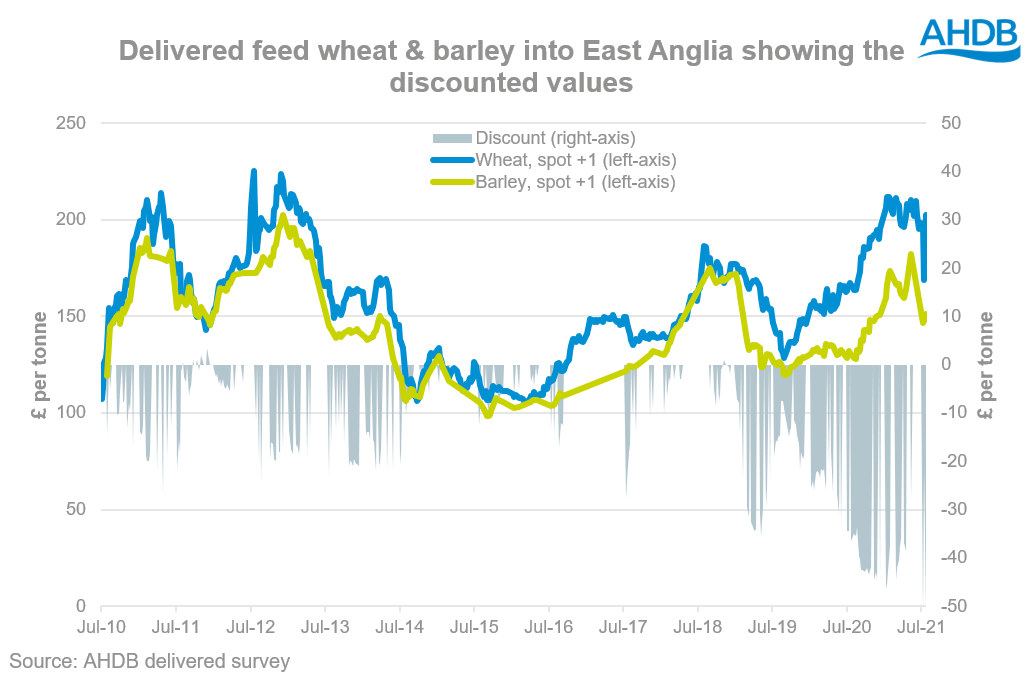

As a result, barley delivered into East Anglia over the 2020/21 marketing year was on average at a £40.00/t discount to wheat. This is the largest average discount in the AHDB delivered survey (2010-2021).

Although there are many things that can drive barley’s discount to wheat. For the 2021/22 marketing year wheat production is estimated to increase year-on-year (+54%) to 14.9Mt. Barley production is estimated to decrease (-11%) year-on-year to 7.2Mt, read more on that analysis here.

What’s happened in previous years?

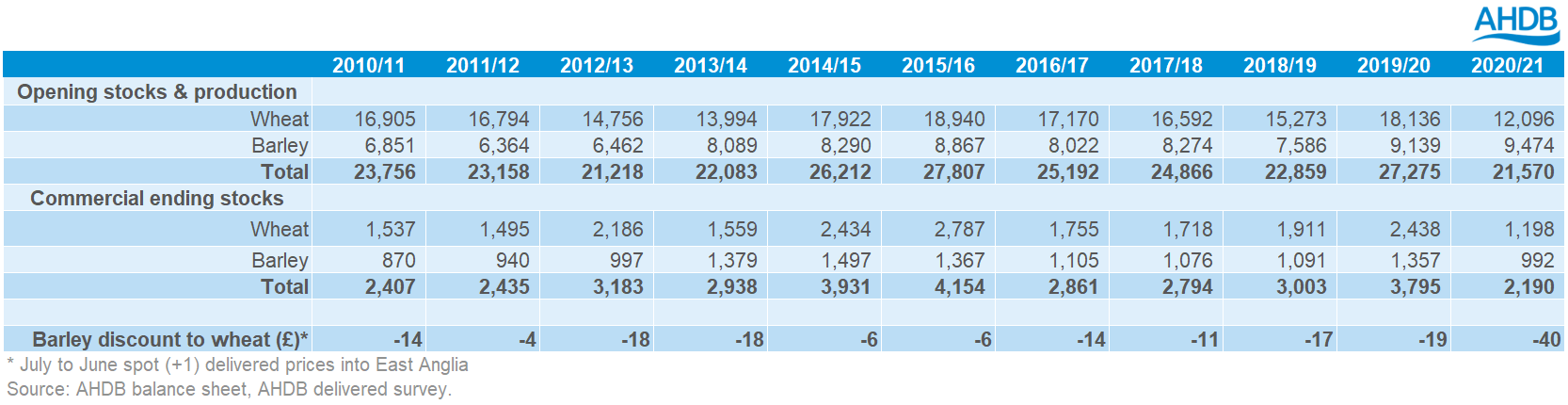

Changes to Pricing relationships are driven by stocks, production and usage of both wheat and barley.

As previous balance sheet data shows, when wheat is relatively better supplied than barley (i.e., 2014/15 and 2015/16) the discount of barley to wheat reduces.

Other factors that can reduce this discount is human & industrial consumption of wheat which was significantly down (6.8Mt) in 2011/12. This increased the need for wheat to price into export markets, erodes the premium over barley.

Conversely, when barley is relatively better supplied than wheat (i.e., 2019/20 and 2020/21), the discount grows.

2019/20 opening stocks and production of wheat were similar to 2014 & 2015 but the discount was significantly larger. This was due to barley availability largely exceeding demand.

What does all this mean for 2021/22?

Although this analysis isn’t a gospel for how the 2021/22 marketing year will play out it is an indicator of what could happen.

Despite increased wheat production and reduced barley production year-on-year, the balance of supply looks set to swing marginally in favour of barley. This is due to the relative tightness of opening stocks.

This would lead to the suggestions that barley, while not at the large discounts we have seen to wheat for the 2020/21 marketing year, will still be at a relatively strong discount.

Delivered prices through July, for Harvest and November delivery also support this. In the week ending 22 July, feed barley delivered East Anglia, was quoted at a £19.50/t discount to feed wheat. Between 2010/11 and 2019/20 the discount of barley to feed wheat averaged £13.00/t.

Of course, there is still time for this to change. Much will depend on the continued development of harvest and the quality of both crops. Further, with barley playing such a strong role in feed rations in 2020/21, the flexibility of diets to adjust back to increased wheat inclusions will also be a key watch point early in the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.