GB regional wheat production estimates 2021/22: Analyst Insight

Thursday, 15 July 2021

Market Commentary

- The November-21 UK feed wheat futures contract gained £3.90/t yesterday, to close at £169.90/t. It will be a watch point to see if the contract can hold ground above the key £170.00/t price point. Similarly, the May-22 contract gained £3.65/t yesterday, to close at £175.25/t.

- Stratégie Grains further improved their EU-27 production forecasts for wheat, barley and maize for the 2021/22 season in their latest report. It is estimated EU-27 wheat production will be at 133Mt, up from an estimate of 131.1Mt in June. Though harvests are looking to be late, yields are expected to be good. Soft wheat exports are expected at 31Mt up from 26.9Mt in 2020/21.

- Weather models from the National Oceanic and Atmospheric Administration (NOAA) indicate the potential for a re-emergence of a La Nina weather event over the next few months. If realised, this could aggravate further the severe drought felt in Brazil in recent months.

- Egypt purchased 180Kt of Romanian origin wheat in its international tender yesterday. Prices ranged from $262.19/t (£189.08/t) to $266.88/t (£192.46/t).

GB regional wheat production estimates 2021/22

Yesterday we published the final AHDB Crop Development report of the 2020/21 growing season, which gives a pre-harvest update into the condition of the main crops in Great Britain. Making use of the regional and national condition scores enables a picture of how 2021/22 production could shape up.

Additionally, our annual planting and variety survey (PVS), released last week, gives us an updated look at planted area figures. Using both of these releases, we can make some robust estimations into yield and therefore production for the upcoming harvest.

In order to produce these estimates the following rules have been applied for estimating yield from crop condition ratings*;

- Excellent –Maximum yield between 2015 – 2019.

- Good – 2015 - 2019 average yield plus 2.5%.

- Fair – 2015 - 2019 average yields.

- Poor – 2015 – 2019 average yields less 2.5%.

- Very poor – Minimum yield between 2015 – 2019.

*2020 yields have been omitted due to the large deviation from average because of challenging growing conditions

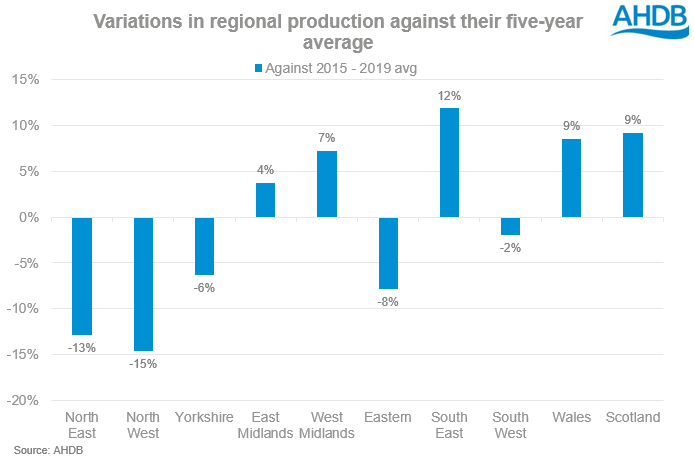

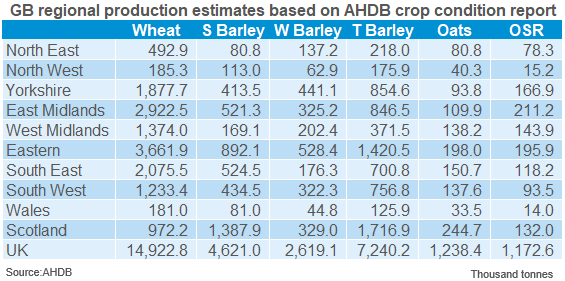

Starting with the domestic wheat crop, GB production could be pegged at 14.92Mt based on the GB condition score provided in our crop development report. This is 1% below the 2015-2019 average and 55% better than last season. Against published industry estimates, this sits within the range.

Condition scores differed across the UK, highlighting the effect of the dry April and wet May and June. Scores have trended typically towards the upper end of ratings, with the Midlands in particular recording a ‘good’ to ‘excellent’ score of 84% and 85% for East and West respectively. Using this, a production figure of 4.29Mt is forecast for the Midlands region, 5% above the 2015 – 2019 average if realised.

As we know, the North of England is facing increased demand prospects in 2021/22 with Ensus and Vivergo bioethanol plants restarting production. Production for the North East, North West and Yorkshire is forecast at 2.55Mt. Though the planted area at 301.5KHa is 21% higher than last season, it is 10.5% below the 2015 – 2019 average. Combined with more average crop ratings for Yorkshire, this results in a production figure 8% below the 2015 – 2019 average. Delivered premiums could grow further to incentivise the haulage of wheat into this region as Anthony discussed yesterday.

To avoid a potential reliance on imports for Northern homes, other regions will need to pick up the baton. The Midlands, as discussed above, is one avenue for this, though what about the Eastern region of England? Well, the ‘poor’ to ‘very poor’ ratings are seen highest in Southern and Eastern England condition scores, where typically light soils may have suffered worse from the prolonged dry spell in April. For the Eastern region, production can be estimated at 3.66Mt, 8% below the 2015 – 2019 average.

If we look at the condition scores, an estimated 1% of the GB winter wheat area is in very poor condition. In production terms, this is around 17.42Kha or 135.14Kt at risk of near crop failure or severe yield loss according to condition definitions. The production figure is calculated using a yield of 7.76t/ha (2018/19 yield) as per above methodology.

If we put these yield figures into an average gross margin calculator that I discussed last month, then a breakeven tonnage can be calculated. With Nov-21 futures closing at £169.90/t yesterday, the theoretical average yield of 8.56t/ha in this scenario creates a breakeven tonnage of 7.46t/ha without subsidies and storage values incorporated.

A tight supply end to the season has kept old-crop values high as the new-crop harvest looks to kick off a little later this year. Our delivered cereal prices as at 08 July highlights this, with E Anglia feed wheat quoted at £198.00/t for July delivery, Harvest delivery is quoted at £163.00/t, a discount of £35.00/t. Despite the return to a more average production figure, it remains likely the UK will require imports to satisfy an increased consumption demand.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.