Could delivered premiums in the North grow for 2021/22? Grain market daily

Wednesday, 14 July 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £166.00/t, up £1.25/t on Monday’s close. The May-22 contract closed at £171.60/t, up £0.85/t on Monday’s close.

- Sovecon agriculture consultancy yesterday announced the downward revision of 2.3Mt to the Russian wheat crop. Production is now estimated at 82.3Mt. The key reason is that average winter wheat yields have started lower than anticipated.

- Brent crude oil closed yesterday at $76.49/barrel, gaining 1.8% after announcements from the International Energy Agency suggesting tighter supplies should be expected due to disagreement within OPEC+ on outputs.

Could delivered premiums in the North grow for 2021/22?

A new trading relationship

With the publishing of the Planting & Variety Survey confirming a resurgence of wheat in all areas of GB, our production for this harvest is expected to increase year-on-year.

This will have an impact on our domestic trading relationship to Paris futures. Trading 2020/21 at import parity, this new marketing year could change that especially if producing over 15Mt of wheat.

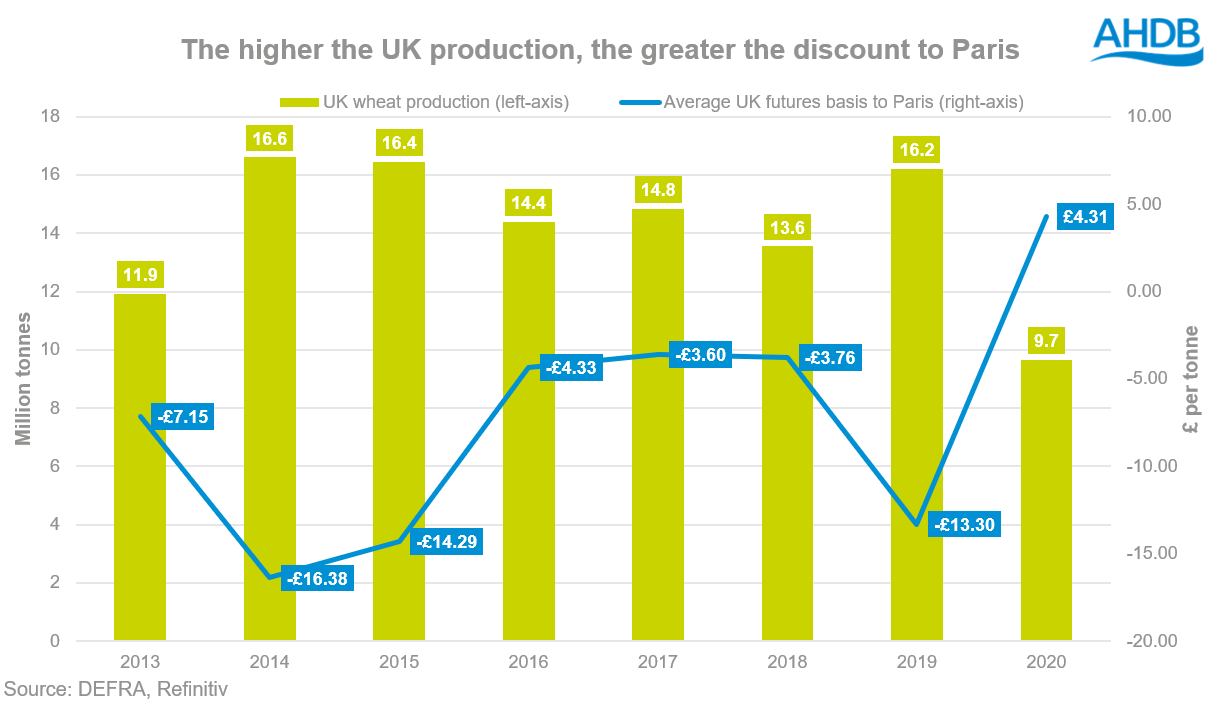

As displayed in the graph above, when our domestic production is high, our discount to Paris wheat futures is greater.

For example, in 2014, 2015 & 2019 we produced over 16Mt of wheat and on average our nearby discount to Paris ranged from £13.00/t-£16.50/t. However, this is in contrast to 2020, when our sub 10Mt crop meant we traded at a premium of £4.30/t on average for the marketing year.

Place matters

With nearly 40% (653Kha) of the total area grown in the East and South East for 2021, our domestic market will still offer a premium to the Northern regions of England, giving grain the incentive to move North instead of being exported.

Yorkshire premiums to be supported in 2021/22?

With the introduction of E10 this marketing year, combined with the future prospects of two bio-ethanol plants running in the North East, premiums in the North could still have room to grow.

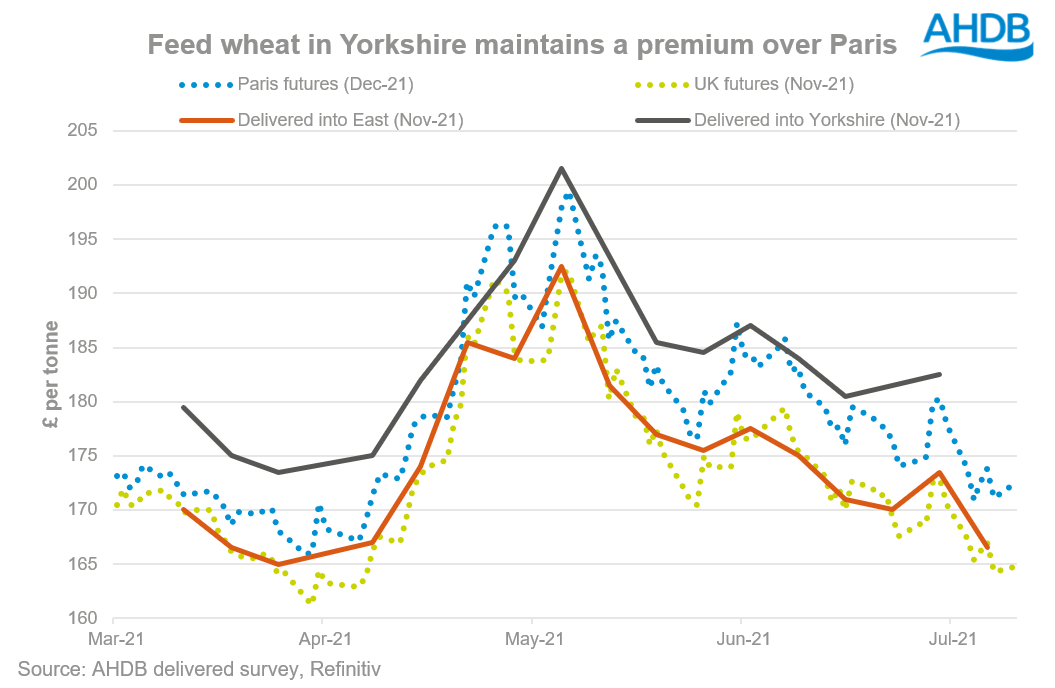

As the graph shows above, in March our new crop (Nov-21) futures (at the time), were at a c.£1.50/t discount to Paris (Dec-21). Since then, crop conditions have significantly improved, and that discount has widened to over £7.00/t with price moving more towards export parity.

With grain concentrated in the South East, this has meant that wheat delivered into the East for November has maintained a strong relationship to UK wheat futures, and if a large crop is realised our domestic futures discount could increase.

However, delivery into Yorkshire has always maintained that premium over Paris, to give incentive for grain to be imported/trucked to the North.

For 2021/22, that premium could increase if our domestic market discount basis is to grow in order for the South to be at export parity.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.