EU suggests the concern may be quality, not quantity: Grain market daily

Wednesday, 28 July 2021

Market commentary

- UK feed wheat (Nov-21) closed up £0.20/t yesterday to £175.00/t. However, this morning the contract found further support, quoted at £177.00/t at 12pm.

- As the Wheat Quality Council tour gets going this week, spring wheat yields in southern and eastern North Dakota (the US top producing state for spring wheat) are reportedly well below average due to severe drought conditions.

- US soyabeans are also finding support on US crop damage concerns from hot and dry weather, with crops rated ‘good’ to ‘excellent’ falling an extra 2 percentage points to 58% on Monday. These concerns contribute to a tightening picture for global supply and demand.

EU suggests the concern may be quality, not quantity

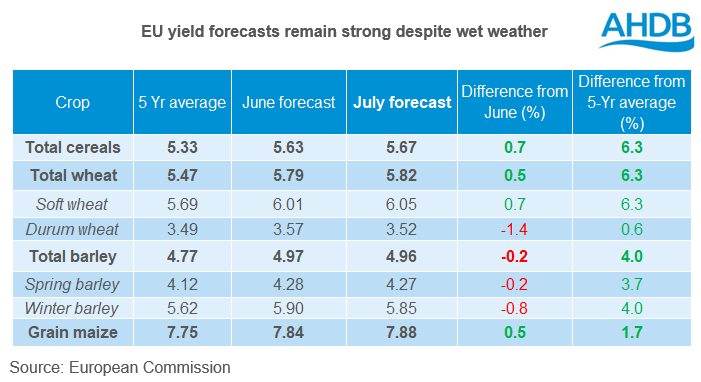

In recent weeks, parts of Europe have seen heavy rainfall causing floods. Despite this, EU yield forecasts remain above the 5-year average according to the latest EU crop monitoring (MARS) report. In some cases, the report on Monday increased forecasted grain yields.

Much of western Europe experienced average to wet conditions in June to July. Some storm events, followed by hail, caused severe damage to specific areas. In Germany, Belgium and the Netherlands wet conditions slowed down winter crop harvests, especially winter barley. The impact on barley yields has been negative, but limited.

Alternatively, southern and south-eastern Europe suffered hotter and some dry weather, which is turn has hampered yield forecasts for these countries.

However overall EU supply of cereals, and wheat overall, is expected to remain strong. It is quality that presents a concern, with durum wheat yields forecast down slightly on the month, but still ahead of the 5-year average.

Quality concerns, who may have them?

In France, stormy weather is expected to cause lodging losses especially in the Northeast. Overall, wet weather at grain filling is expected to cause winter cereals quality issues.

In Germany too, yields look strong. Though extreme rain has caused severe crop damage and concerns for grain quality. The report adds more unstable weather is forecasted for Germany too. Weather going forward in especially France and Germany will remain a watch point.

In Ukraine and eastern Romania, wet conditions into June have caused quality concerns. Specifically, around the spread of diseases and pests.

What does this mean?

This concern on EU winter cereal quality only adds to disquiet on global availability of high protein milling wheat. Canada and the US are facing large issues with hot and dry weather, expected to cause substantial yield loss to spring wheat crops. US spring wheat production is predicted the lowest in 33 years.

As James discussed yesterday, the quality of UK wheat needs to be watched closely too. Should the UK not meet demand for milling spec wheat this season, we could see milling premium increases. This is especially with concerns over availability in Canada and Germany, significant import origins for milling wheat.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.