- Home

- News

- US spring wheat lowest in 33 years, will wheat be tighter than expected? Grain market daily

US spring wheat lowest in 33 years, will wheat be tighter than expected? Grain market daily

Tuesday, 13 July 2021

Market commentary

- UK feed wheat prices (Nov 21) increased £0.45/t yesterday to £164.75/t. The market squared up whilst awaiting the latest USDA WASDE report yesterday. Details on the report explained below.

- The latest USDA crop progress report as up to 11 July was released after markets closed last night. The report pegged ‘good’ to ‘excellent’ for soyabeans as 59% (no change), maize 65% (+1pp), spring wheat 16% (no change). Winter wheat harvested was at 59% as at 11 July. This was up 14pp week-on-week, but 6pp behind the 5-yr average (2016-2020).

- Nov-21 Candian canola futures jumped CAN$45/t, to CAN$889/t a new contract high. This is due to hot and dry weather in Canada causing crop concern.

- Chinese soyabean imports increased 11.6% in June from May’s figures, as demand looks to surge for feeding China’s growing pig herd.

US spring wheat lowest in 33 years, will wheat be tighter than expected?

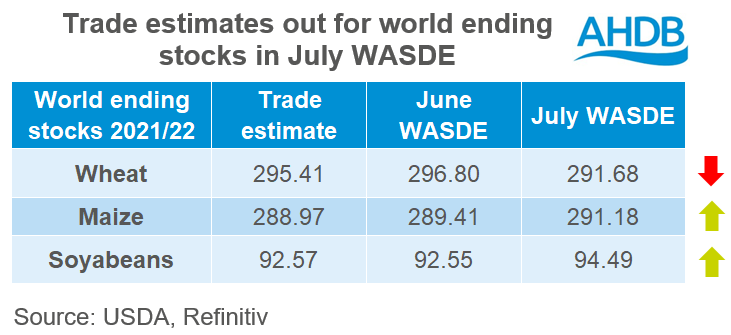

Yesterday, we saw the release of the USDA’s widely awaited world agricultural supply and demand estimates (WASDE) for July, after UK markets closed.

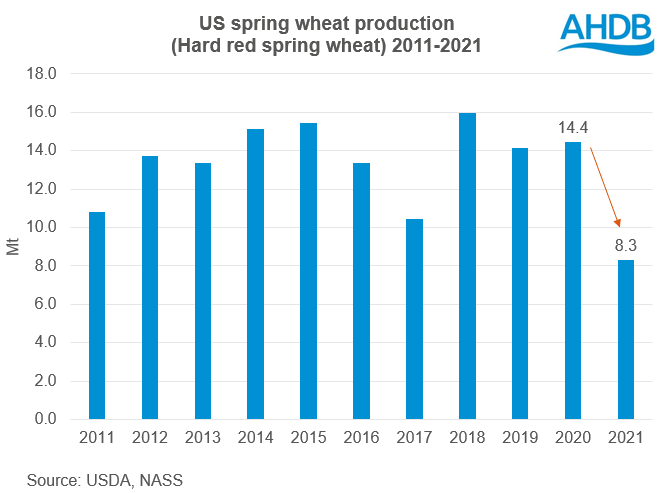

US spring wheat production was the big surprise for markets in this report, set to be the lowest since 1988 and 39% below the 5-year average (2016-2020).

Key headline changes in the July WASDE:

Maize

- 2020/21 Brazilian maize production was reduced by 5.5Mt to 93.0Mt, in line with Conab’s estimate.

- 2021/22 US maize production increased 4.5Mt to 385.21Mt.

- 2021/22 Chinese maize imports kept at 26.0Mt, despite forecasted higher domestic production.

Wheat

- 2021/22 world production excluding China reduced 2.0Mt to 656.4Mt.

- 2021/22 US wheat production reduced by 4.1Mt to 47.5Mt.

- 2021/22 US spring wheat – lowest in 33 years, with the first forecast pegged to be 8.3Mt. This is 42.5% less than 2020/21 crop estimates.

- 2021/22 Russian wheat production reduced 1.0Mt to 85.0Mt on account of early spring freeze, and Ukrainian production increased 0.5Mt to 30.0Mt.

Soyabeans

- 2020/21 ending stocks increased mostly on reduced Chinese imports and reduced world domestic crush, in part due to reduced US crush.

What does this mean for grains?

Maize

Private estimates have been trimming the 2020/21 Brazilian maize crop size for a while. Last week, AgRural forecasted 85.3Mt. Therefore, it is likely cuts have already been priced into the market.

As Helen forecasted on Friday, 2021/22 US maize crop increased in line with the new US area figures. The yield remained as 4.87t/acre (weather-adjusted 1988-2020), as typical for July estimates. Though, August may see the start of survey-based yields, which could see adjustment depending on crop condition. Chicago maize futures fell yesterday in response to the increased supply, but yield change is certainly one to watch in August’s WASDE.

The latest USDA crop conditions released last night increased ‘good’ to ‘excellent’ ratings for US maize 1 percentage point (pp), with rain arriving in many states. Though, initial yield estimates by US growers looks below 8-year averages (Reuters). Therefore, weather continues to be important during the important ‘silking’ stage, a watch point through July.

Wheat

Global wheat is still set as a record crop, but production and demand now look a little tighter. Global production was reduced by 2.0Mt on account of falls to US, Candian and Russian production offsetting rises to Australian, EU and Ukraine.

US spring wheat conditions ‘very poor’ to ‘poor’ increased 5pp to 55% in the progress report to 11 July. With hot and dry weather persistent, US and Canadian forecasts continues to be important for crop conditions and yield forecasts for the August WASDE too.

As explained by James, the availability of both Canadian and US high protein wheat may have mixed consequences for the UK. Canada is an important import origin for the UK and Canadian wheat follows US prices.

As harvested Black Sea grain enters the market, this may cause some harvest pressure on prices. Though, further cuts to the US and Canadian wheat crops could support milling premiums if high protein grain supply is tighter.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.