Will better US weather or Brazilian maize cuts move markets more? Grain market daily

Tuesday, 6 July 2021

Market commentary

- UK feed wheat futures (Nov-21) fell £3.05/t yesterday to £167.40/t. Paris wheat also fell (€3.75/t on Dec-21), though US markets were closed for the 4th July holiday.

- Rains are due in the US and harvested Black Sea grains are now reaching the market, pressuring prices.

- Yesterday, Egypt’s state buyer (GASC) tendered for an unspecified quantity of wheat due for shipment in September, of which the lowest offer was for Romanian wheat for 60Kt at $237.94/t (free-on-board). Prices for Russian wheat exports are reportedly falling too, as harvest progresses, and yields look close to record.

- The latest USDA attaché report for Chinese feed grains increased 2021/22 maize production 4.0Mt to 272.0Mt, due to increased planted area. 2020/21 imports also increased by 5.0Mt to 20.0Mt, though still below official USDA estimates of 26Mt.

Will better US weather or Brazilian maize cuts move markets more?

Last Wednesday, we saw Chicago maize futures (Dec-21) ‘limit up’ in reaction to the USDA’S US stocks figures and US acreage reports. This was because the released figures came out below trade expectations.

The market is sensitive to ‘new’ news as the balance of 2020/21 ending stocks into 2021/22 is already tight for global grains, especially maize. These figures only added to concerns.

Yesterday, consultancy AgRural said the second Brazilian maize crop was 12% harvested but cut their second crop production estimate by 5.4Mt to 54.6Mt, due to frost damage. This brings their total 2020/21 Brazilian maize production to 85.3Mt, 13.2Mt less than the official USDA forecast.

Whereas consultancy Safras and Mercado said yesterday 8% of the second crop (est. 61.5Mt) had been harvested, less than half the area this time last year. Estimating 49% had been sold already.

Both delayed harvest and production cuts in Brazil add to tightening global supply. The next USDA world agricultural supply and demand estimates (WASDE) are due on Monday (12 July). Should the USDA follow lead and revise production figures, this could narrow 2020/21 ending stocks and possibly heighten market sensitivity before US physical crops arrive in September.

Weather is the biggest concern now

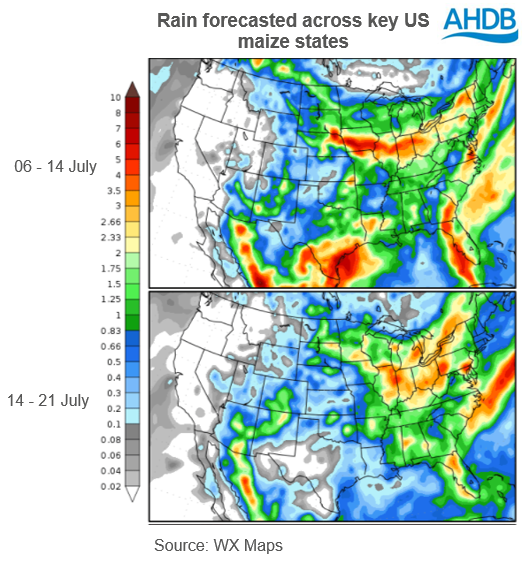

US weather forecasts will be important throughout July as crops enter the ‘silking’ stage, and the market will likely react to any changes in forecasts.

Though, crops are looking improved. Yesterday, the latest US crop watch information showed maize coming into pollination. Tassels are due to come out in Illinois this week, followed by Indiana, Nebraska, and Minnesota over the coming weeks. Updated USDA crop conditions are due tonight.

Current forecasts show rainfall and mild temperatures across these Midwest in the next few weeks, giving the opportunity for rain to cover areas in key maize states previously missed. This forecast likely added to cooling prices yesterday. If realised, this could boost US maize production and further pressure global new-crop feed grain prices.

Yet, spring wheat conditions continue to be a concern across the Northern Plains and Canada, with Canada suffering from the effects of a heat dome. The heat dome is expected to ease as it moves east this week, though still to set record temperatures. One to watch going forward.

So, which of these is more important, Brazilian crop cuts or improved US weather? Trade estimates have been falling for a while for Brazilian production and therefore I think is likely already factored into prices. Low stocks may mean the market is sensitive to change in news, but fundamentally with rain forecast in the US, this improves the outlook for US maize yields and good news for production. If the weather stays favourable, supply concerns should ease.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.