Bulls charge on acreage and stocks report: Analyst's Insight

Thursday, 1 July 2021

Market commentary

- UK feed wheat futures (Nov-21) closed up £4.00/t yesterday, at £172.70/t. The rally in prices was led by USDA acreage (read more on maize below) and stocks reports.

- UK wheat futures tracked the move in the wider global grain price complex. Chicago maize futures (Dec-21) gained 7.5% by the end of the day and is making further gains in early trading this morning.

- US stocks of corn and soyabeans were below the average of industry estimates and 17.8% and 44.5% below year ago levels, in yesterday’s USDA stocks report.

Bulls charge on acreage and stocks report

For much of the recent fall in prices, the potential for some more volatility on 30 June has been a key point to watch. In that regard, yesterday did not disappoint.

With the publication of US stocks figures and US acreage statistics by the USDA, Chicago maize futures (Dec-21) went “limit up”, undoing the previous twelve days of trading. Both maize acres and maize stocks came in below average trade estimates in a pre-report Refinitiv poll.

With balance of supply and demand for all grains tight coming out of the old season (2020/21) and into the new season (2021/22), any data highlighting the potential for the market to be tighter than expected is going to drive increased volatility.

What does the acreage report mean for US maize supply?

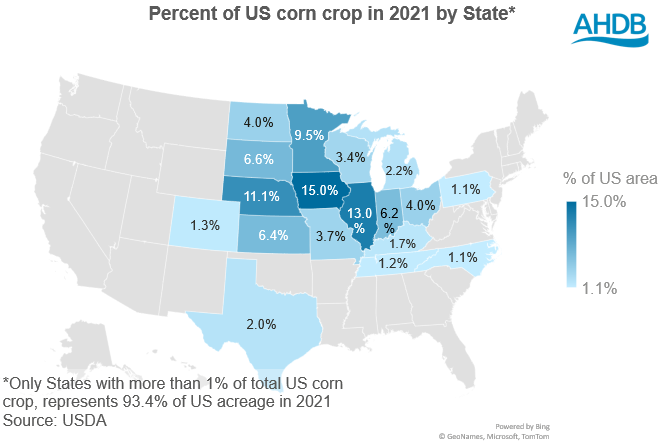

Looking at the acreage report first, the planted area for maize is estimated at 37.5Mha, with 34.2Mha expected to be harvested. The acreage estimate represents a 2.1% increase in planted area, and 2.5% increase in harvested area, year-on-year.

Applying the trend yield from the USDA June supply and demand estimates to the forecast harvested acreage suggest a crop of 385.3Mt. This is 4.5Mt greater than the USDA’s June forecast. While this would seem to be a bearish factor for markets, we need to consider a couple of key factors.

Industry expectations

As mentioned above, the figures for maize and soyabean planted area and stocks came in below the average of industry expectations. The reduced area estimates, relative to trade expectations, tightens the balance sheet of those trading the market, and so dictating the price.

Yields

This is a key factor, and one that will not be determined for some time. The current yield used in the USDA report is a record 11.3 t/ha, the five-year average yield for the US maize crop is 10.9 t/ha. If we are to see a record the crop will need excellent conditions as we move through silking (July).

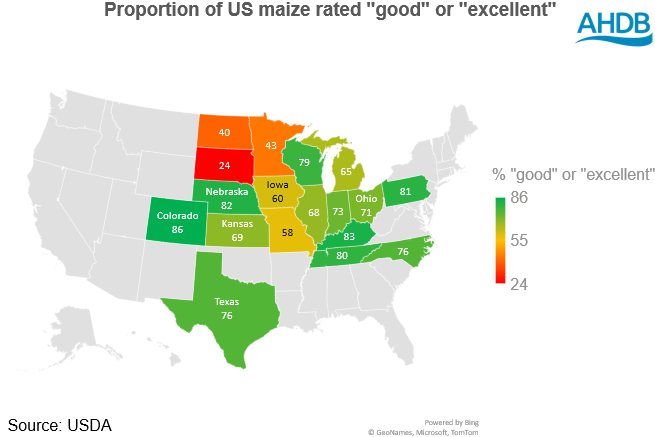

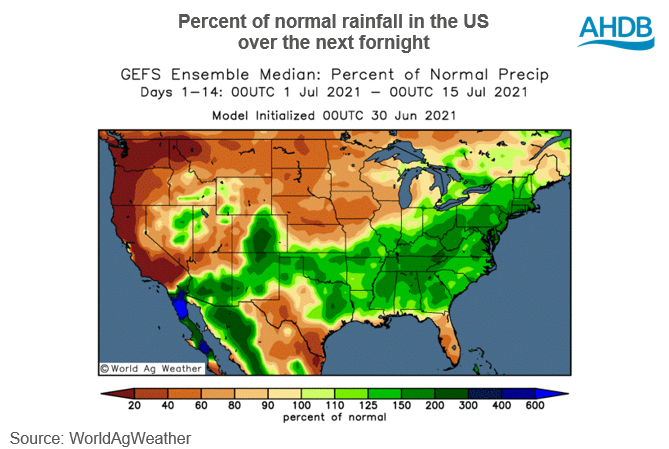

Crop conditions will continue to be watched closely over the course of the next month. While conditions in many states are positive, some of the northern states, namely North Dakota, South Dakota and Minnesota remain a concern. For now, the current weather pattern in the US looks set to stay. Conditions remain positive for the Midwest but are a concern in the more northern states.

What happens next?

If the bulls are to continue their run, they will need feeding.

Now the acreage data is known it will quickly be priced in, forecasts over the coming weeks, and crop conditions next Tuesday will be the next signal for prices. Beyond that, the next point of key production data will be the crop production estimates due on 12 August.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.