Will UK protein premiums grow? Grain market daily

Tuesday, 27 July 2021

Market commentary

- UK feed wheat futures (Nov-21) continued to undo last week’s gains, yesterday. The Nov-21 contract fell by a further £0.95/t yesterday to £174.80/t.

- Paris wheat futures (Dec-21) made a second consecutive day of gains, yesterday. The Dec-21 contract closed €0.75/t higher at €215.00/t. While yield expectations in Europe and Ukraine rose in the latest EU crop monitoring report, released yesterday, quality is expected to have suffered.

- While there has been talk in recent weeks about crop concerns in Russia, there are suggestions that some regions in Russia are seeing record crops. Krasnodar’s governor highlighted that the region has harvested 12.4Mt of grain including 10.5Mt of winter wheat (5-year average winter wheat production 8.8Mt).

Will UK protein premiums grow?

With the UK barley harvest progressing well, it won’t be long before attention starts to turn to the winter wheat crop. Until the crop is cut, there is a wide degree of uncertainty over quality. This year, arguably more than others, concerns about quality are also being fuelled by external factors.

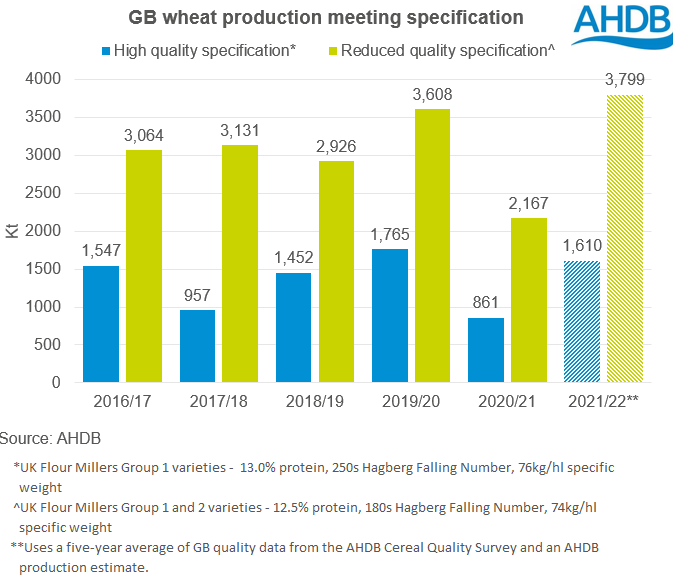

Alex gave an indication of the potential size of the wheat crop two weeks ago. We can use this to estimate the potential milling availability from the British (GB) wheat crop. To do this we can look at the quality splits from the AHDB Planting and Variety Survey.

Based upon this information the overall pool of milling varieties looks set to be the largest in recent years. Total production of UK Flour Millers (UKFM) Group 1 and 2 varieties in GB could reach 6.4Mt. This is up 63% from last season, and up 10% on 2019/20.

On the face of things, this might suggest reduced demand for imports of milling wheat this season. However, import demand will be as dependent on quality as it is on quantity.

We can take the UK overall proportion meeting a high specification (UKFM Group 1, 13% protein, 250 Hagberg Falling Number, 76kg/hl specific weight) from the AHDB Cereal Quality Survey for 2016-2020. Using this data suggests that GB Group 1 availability could be around 1.6Mt in 2021.

Looking to a reduced specification (UKFM Group 1 and 2, 12.5% protein, 180 Hagberg, 74kg/hl specific weight), a five-year average quality would result in availability of 3.8Mt. This would be up considerably on last year and up 191Kt on 2019/20.

Of course, we will not know the 2021 quality for some time. But it is important to gain an indication of potential supplies, given the uncertainty over global high protein wheat availability. Yesterday’s the USDA cut the US spring wheat condition score to just 9% good or excellent. While the UK is not an importer of US wheat on any great scale, the US spring wheat market acts as a proxy for the vital Canadian crop.

The Canadian crop is also suffering from dryness. In Alberta, 39% of spring wheat is rated good or excellent versus 80% this time last year. With Canadian crops likely to be at a higher premium this year, Germany will continue to be a key region to watch. A fortnight ago, Germany’s association of farm cooperatives, DRV, highlighted how quality was a growing concern.

What does this mean?

We will need to watch the quality of UK wheat closely this season. If we see lower protein in the UK crop, premiums stretch out further given the uncertainty over availability and quality from key origins.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.