First 2021/22 GB Harvest Report suggests yields close to average: Grain market daily

Friday, 30 July 2021

Market commentary

- UK feed wheat (Nov-21) closed up £4.15/t yesterday to £181.55/t owing to reductions for Russian wheat production and concerns for a potentially record low US spring wheat crop. Similarly, the May-22 contract gained £3.60/t to £186.60/t.

- The French soft wheat harvest progressed well last week up 14% to 47% as of 26 July, aided by drier weather conditions according to FranceAgriMer. Though good progress has been made, the harvest remains behind progress rates seen last season (87% complete by this point). The French winter barley harvest is almost done at 98% complete as of 26 July.

- The European Commission raised its soft wheat production forecast for the EU-27, now at 127.7Mt from 125.8Mt last month. EU-27 barley production was cut to 52.6Mt, down 0.9Mt.

First 2021/22 GB Harvest Report suggests yields close to averages

Today, AHDB published the first harvest report of the 2021/22 season. This report gives how harvest is progressing, plus initial indications as to yields and quality.

The report shows the delay to the beginning of harvest for many. In the week ending 20 July, just 2% of the GB winter barley area had been cut. However, with the bright hot days, this then jumped to 47% complete by 27 July.

A similar jump has not yet begun for winter oilseed rape (WOSR), with crops slow to ripen. GB progress is estimated at 9% complete as of 27 July, the second slowest start since 2014.

The rainfall forecast over the next few days could further hinder progress and delay OSR desiccation for those who have yet to complete fields.

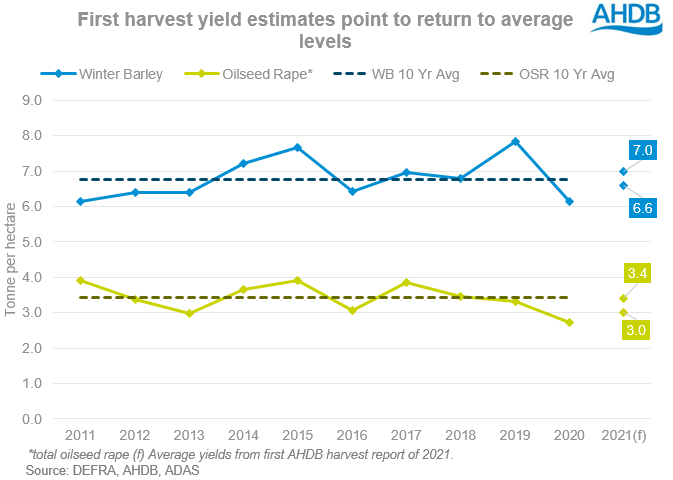

Yields look to be in a better condition and closer to the five-year average than was the case in 2020/21. But, yields have been highly variable so far. The below ranges are likely to change given the large unharvested area, especially for OSR.

For GB, the first yield indications show that:

- Winter oilseed rape crops harvested to 27 July are averaging 3.0 – 3.4t/ha. This is within the boundaries of the five-year average (3.3t/ha).

- Winter barley crops harvested to 27 July are averaging 6.6 – 7.0t/ha, with this midpoint matching the five-year average (6.8t/ha).

Harvest pressure on prices

The winter barley harvest advanced well for some regions in the week ending 27 July. The North West (85% cut), South West (79%), and West Midlands (90%) all made good progress and are fast approaching completion.

As such, harvest pressure has affected feed barley and straw prices, both of which faced supply tightness before harvest began. Across the UK, spot ex-farm feed barley averaged £147.00/t in our Corn Returns in the week ending 22 July. This is a £33.00/t drop from the week ending 24 June. Meanwhile, GB barley straw prices (big square baled) dropped £33.00/t in the week to 25 July, quoted at £74.00/t. The duration of harvest pressure may depend on the continent for direction as the IGC reports French barley export prices have risen daily since 22 July. Today, 2021/22 EU-27 barley production forecasts were cut to 52.6Mt, down 0.9Mt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.