GB pig prices stumble into Christmas: Pork market update

Thursday, 18 December 2025

Key points:

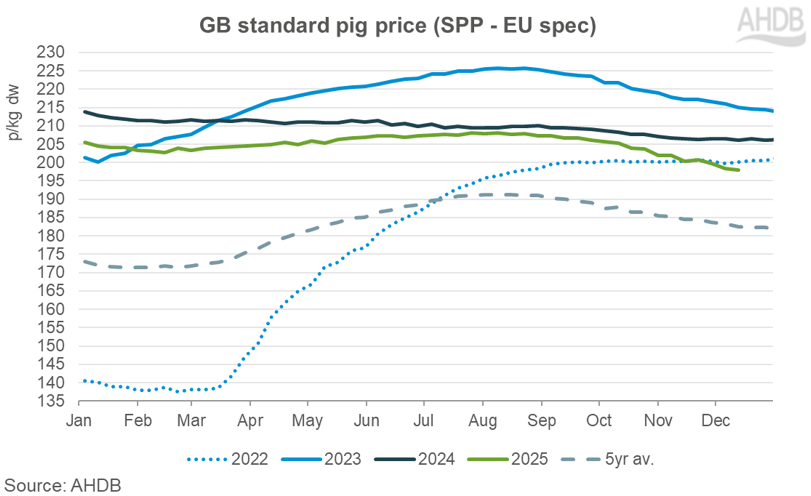

- The EU spec SPP now stands at lowest value since summer 2022

- Weekly pig numbers in the SPP sample have seasonally increased

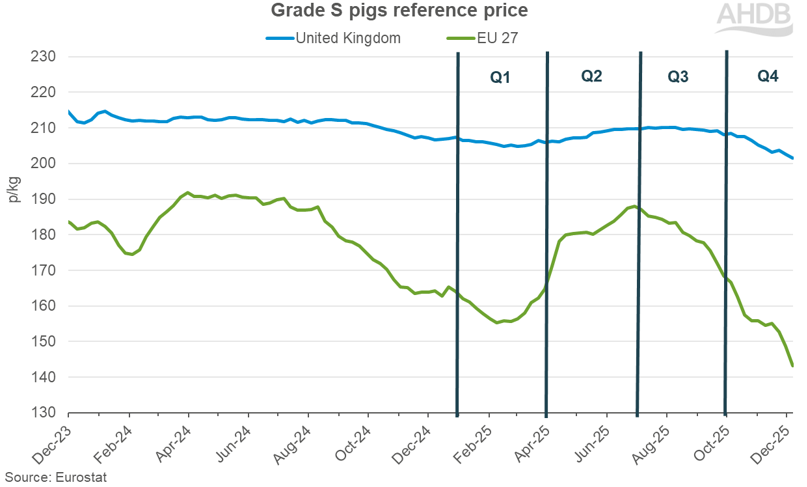

- EU pig prices are falling sharply, widening the price gap between the EU and UK

- British retailers maintain their British shelf facings and consumers continue to increase the volume of pig meat purchased

Although GB deadweight pig prices have been steadily declining since the end of August, weekly movements have averaged at less than a penny (-0.6p). The prolonged period of downward moves does however result in the EU spec SPP now sitting at the lowest value since summer 2022, at 198.03p/kg (week ending 13 Dec).

Throughput

With Christmas in sight, we have seen throughputs pick up. The number of pigs in the SPP sample has increased in the last two weeks (30 Nov – 13 Dec), averaging at 56,600 head, comparing to an average of 54,200 in the previous two-week period (16 Nov – 29 Nov).

Although this uptick in supply is usually driven by a seasonal increase in demand, some market reports are noting that processors are not pushing for additional numbers, indicating supply and buying demand may be more balanced this year. This is likely limiting some of the support we usually see in prices during the pre-Christmas period.

EU influence

In addition to the behaviour in the domestic market is the influence from Europe. EU reference pig prices have been dropping off at quite a pace since July, due to an increase in production and weaker demand. The price declines have accelerated in the last 2 weeks, reacting to the detection of African swine fever in wild boar in Spain. In the week ending 7 Dec the Spanish grade S pig price lost close to 15p.

The price differential between UK and EU references prices now stands at an all-time high of 58p. For some buyers this will make European product more attractive on a cost basis than the UK.

The latest monthly trade data available is October and shows that UK pig meat import volumes grew 6% month-on-month. During October, the EU-UK price differential averaged 47p.

Consumer demand

Despite the increasing gap between UK and European pricing, our latest facings survey for November showed that the majority of British retailers have continued to champion British product on their shelves.

In the 12 weeks ending 30 November, GB retail purchase volume of pig meat recorded growth of 1.6% year-on-year, driven by an increase in frequency of purchase and number of shoppers (Worldpanel by Numerator). Pig meat remains an affordable protein option for consumers with average prices up just 1.4% year-on-year, compared to 5.7% for lamb and 19.3% for beef.

Our Christmas predictions indicate 19% of consumers plan to purchase gammon or ham for Christmas day (AHDB/YouGov, November 2025).

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.