Gap in feed wheat and barley prices widens: Feed market report

Thursday, 30 July 2020

By Charlie Reeve

Grains

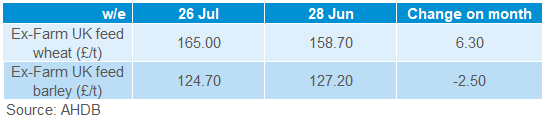

The gap in ex-farm prices for feed wheat and feed barley has widened during July.

Ex-farm feed wheat prices steadily increased week-on-week throughout the month, reaching £165/t towards the end of July, an increase of £6.30/t on the previous month. Ex-farm feed barley hasn’t followed the same trend and is down slightly on the previous month, at £124.70/t. This now leaves a gap of £40.30/t between the two.

After high temperatures towards the end of June, July started much cooler. Moving towards mid-July, the temperature began to rise slightly as harvest got underway. The crop conditions did begin to generally improve, although this was also accompanied by heavy rain in some regions and scattered thunderstorms. This unsettled weather throughout this growing season has impacted yield potential in many regions and while it is still too early to say, it might be reasonable to expect lower yields than we have seen in recent years for many growers.

In the UK, a large barley crop and reduced wheat crop is still anticipated, based on plantings earlier in the year, and this is beginning to be reflected in the price.

The barley price has already begun to show early signs of decline. With more pressurising factors, including an increased 2019/20 carry out, potential front loading of exports to circumvent possible Brexit export tariffs and a heaviness of maize in the global market, there is little support expected for barley.

Adjustments to the global wheat surplus by the International Grains Council (IGC) have shown declines in the global wheat production forecast. Russia, the EU-27, Ukraine and Argentina have all seen reductions in the anticipated size of their wheat crop. While this has offered some support to wheat prices, the fairly large global wheat surplus and expected bumper Australian crop could keep a lid on any significant gains.

With the UK moving to be a net importer during the next marketing year, domestic markets will be capped at import parity. Dynamics in the global wheat markets and the value of sterling will have a greater impact on the price the UK can market its wheat.

Proteins

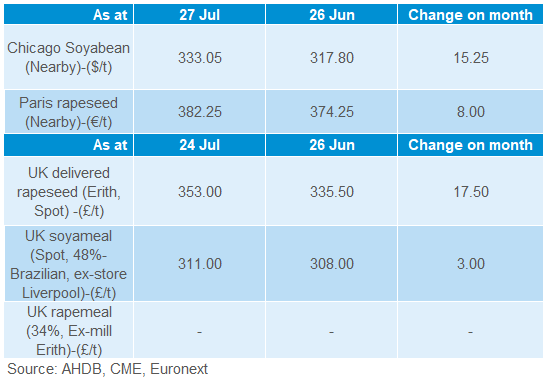

Although the USDA reduced its global oilseed production estimate for 2020/21 in its June report, at 604.2Mt it will still be up on the year. Global consumption is also set to rise to around the same levels.

Meanwhile, Oilworld forecast that rapeseed meal production will decline to a nine-year low in 2020/21, to 12.7Mt..

With current estimates for UK OSR production hovering around 1Mt, the UK will be heavily reliant on imports within the oilseed sector this season. The challenging weather conditions this season, plus persistent pest damage have severely impacts the OSR area in the UK, and the dry spring conditions continued to compromise an already challenged crop. As harvest moves forwards, we will see how this has played out in yields. However, while this may offer some support to prices they will be capped at import parity, keeping prices in line with some of the major exporting countries including Ukraine.

Erith processing plant is likely to remain closed for some time, so the availability of crushed meal for use in animal feeds may be limited. This is likely to be a factor increasing imports of crushed meal from other countries.

Currency

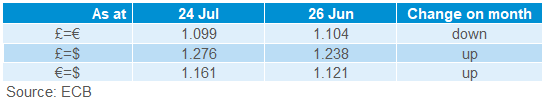

A weaker sterling has continued to help make UK exports more competitive. UK Sterling has continued to remain at low levels against the Euro for most of July, although gaining value against the US Dollar. Looking forward, politics is likely to dictate further changes in currency, as negotiations for the UK’s withdrawal from the EU step up again in Autumn.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.