Global wheat surplus shrunk by IGC: Grain Market Daily

Friday, 24 July 2020

Market commentary

- Chicago and French wheat futures dipped lower yesterday on concerns about these countries competitiveness against other major exporters, including Russia.

- UK feed wheat futures followed the global trend with the Nov-20 contract down £0.30/t to £167.25 and the Nov-21 contract down £0.65/t to £152.35/t.

- Meanwhile Paris rapeseed futures Nov-20 gained €00/t yesterday to close at €382.25/t on support from stronger soyabean and palm oil prices. Palm oil is being supported as heavy rain is expected to disrupt harvesting and reduce output.

- Sales of US soyabeans to China pushed Chicago soyabeans up and yesterday the Nov-20 contract closed at $9.00/bushel, testing an important key psychological threshold.

Global wheat surplus shrunk by IGC

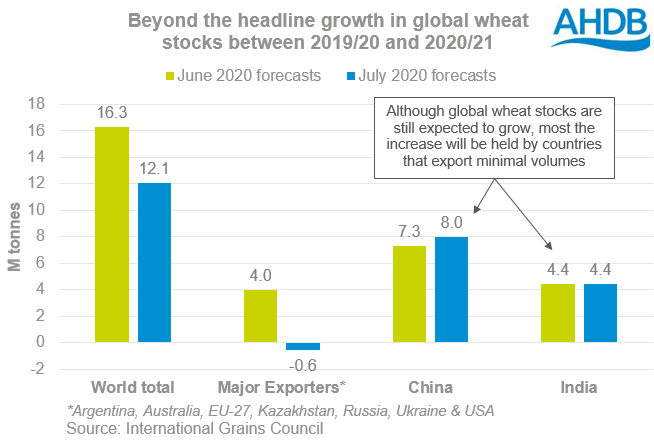

Yesterday, the International Grains Council (IGC) cut 5.6Mt from its 2020/21 global wheat production forecast. At 762.0Mt the global wheat crop would still be 12.1Mt above a trimmed demand prediction and a notably smaller surplus than the 16.2Mt forecast last month.

The cut to global production includes reductions for:

- EU-27 down 2.8Mt to 125.6Mt

- USA down 1.5Mt to 49.6Mt

- Russia down 1.0Mt to 78.0Mt

- Argentina down 0.6Mt to 20.4Mt

Total stocks would still be large and increase by the same amount as the expected surplus during 2020/21, but the increase would be less than previously thought. Furthermore, most of the year on year increase in stocks is expected in China (+8.0Mt) and India (+4.4Mt). As these countries have minimal involvement in wheat exports, these extra stocks would not really be available to the wider market.

The smaller surplus gives the potential for greater volatility in prices, if harvest reveals better or worse yields than currently expected. It also increases our reliance globally on the Southern Hemisphere harvests. A bumper crop is predicted for Australia after end of the drought, but recent dry weather is causing concern about production potential in Argentina.

The IGC also cut its forecast of US maize production by some 12Mt. However, this brings it largely in line with the latest USDA forecast, and likely reflects the smaller than planned maize area announced on 30 June.

UK prices needs to stay high compared to world levels to attract imports because of the small crop we’re harvesting this year. Our prices are already at or close to these levels, though there will be regional differences in prices. As a result, the potential for more gains, or indeed falls, at a headline UK level depends on what happens in the wider world and the strength of sterling.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.