What difference does 2Mha make for maize? Grain Market Daily

Friday, 3 July 2020

Market commentary

- UK feed wheat futures dipped again yesterday, following Chicago maize prices, which declined as speculative traders booked profits ahead of US markets being closed today for US Independence Day. Maize prices rose earlier in the week in response to the larger than expected cut to the US maize area (more below).

- The EU tariff on maize imports has again been reduced to zero from €4.65/t, as global maize prices are above levels a few weeks ago.

- Paris rapeseed Nov-20 closed at €378.00/t yesterday, €3.75/t above last Friday’s close. Prices have been supported by a small pick-up in crude oil prices and the smaller than expected increase to the US soyabean area.

- The AHDB Planting and Variety Survey results, detailing the area and variety of UK crops for harvest 2020, will be released at 2pm on Wednesday 8 July.

What difference does 2Mha make for maize?

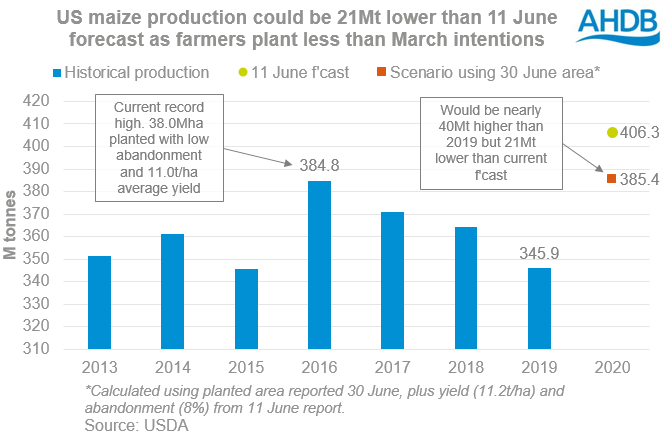

Earlier this week, the USDA reported that US farmers had planted 37.2Mha with maize for harvest 2020. This is 2.0Mha less than the farmers said they intended to plant back in March and likely reflects the drop in maize prices due to the coronavirus pandemic.

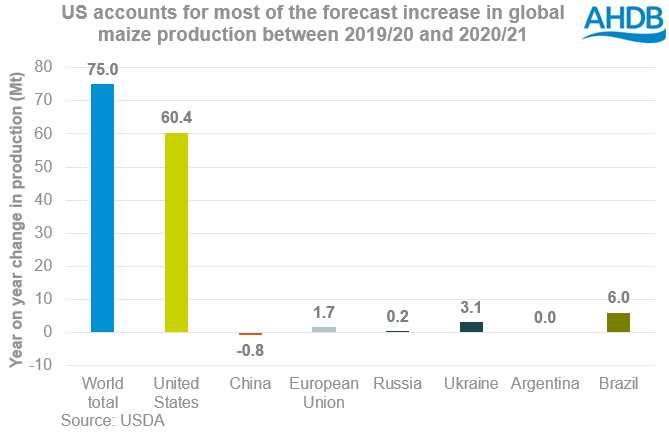

On 11 June the USDA forecast US maize production at a record 406.3Mt, up 60.4Mt from 2019 and 21.5Mt above 2016’s record. This is a key part of the large year on year rise in global maize production – which we’ll come back to shortly.

To look at the impact of the lower area, we can use the same yield forecast and same abandonment rate as the USDA. Both the abandonment rate and yields are based on historical trends at this stage in the season, but combining these numbers points to a cut of around 21Mt to the US production number.

Is 21Mt a small amount?

Also on 11 June, the USDA estimated global maize production to exceed demand in 2020/21 by close to 31Mt, with stocks rising to the highest level since 20217/18 as a result. The prospect of a well-supplied market has kept pressure on maize, and so feed wheat, prices.

The next USDA forecasts are out next Friday (10 July). Unless the crop forecasts for other countries are revised higher, or global demand is revised lower, there looks likely to be a smaller global maize surplus than in June.

This doesn’t vastly change the outlook yet, as stocks would still rise year on year. But is does put more pressure on yields and weather in the US Corn Belt, where crops are silking, over the next couple of weeks. Forecasts of hot, dry weather would pose a threat to yields and could give support to prices – including UK wheat prices. Conversely cool, wet weather would be beneficial for yields and could mean extra pressure on prices, as higher yields could offset some of the ‘lost’ acres.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.