Where next for sterling, and domestic prices? Grain Market Daily

Wednesday, 15 July 2020

Market Commentary

- UK feed wheat futures (Nov-20) closed yesterday at £167.90/t, up £1.00/t on Tuesdays close. Nov-21 feed wheat futures gained £1.10/t, closing yesterday at £154.00/t. The domestic market has continued to follow global markets higher.

- The German Farmer’s Cooperative Association (DRV) released its latest estimates of 2020/21 harvest production this morning. Total wheat production is estimated at 22.5Mt, down 2.6% year-on-year, but up marginally on the previous forecast. Winter wheat production is estimated at 22.1Mt, down 3% year-on-year.

- There were further cuts to Russian wheat production estimates yesterday, with SovEcon reducing its estimate by 1.1Mt, to 79.7Mt.

Where next for sterling, and domestic prices?

UK feed wheat futures (Nov-20) broke the previous two days of declines yesterday, ending the day up £1.00/t, at £167.90/t. The move see’s UK markets continue to track global markets, which have been responding to uncertainty around new-crop production.

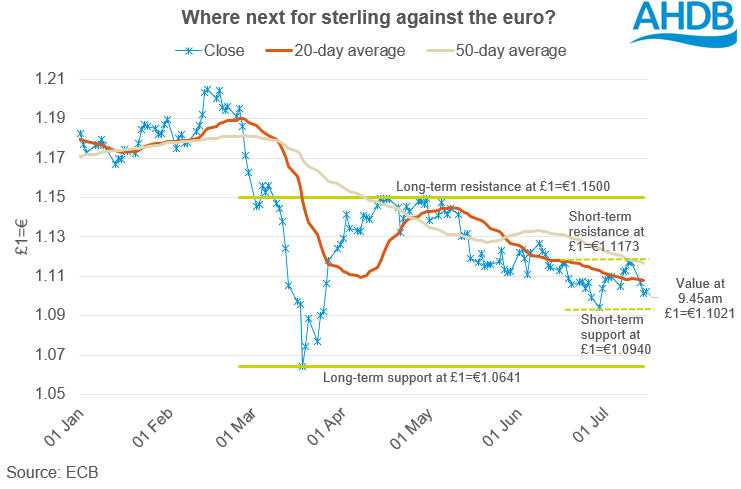

Another key component of yesterday’s support for UK feed wheat was the move lower in the value of sterling against both the euro and the dollar. At a time when domestic grain and oilseed production is uncertain, domestic politics and economics is equally volatile.

Yesterday’s release of UK economic output figures highlighted worse economic growth in May than many had previously expected. The UK economy did grow in May, but by just 1.8%. A pre-report Reuter’s poll had estimated 5.5% growth. As a result, year-on-year economic growth in May stood at -24.0% (Reuter’s poll -20.4%); the degree of difference resulting in sterling falling 0.50% against the euro.

Sterling has since gained some strength this morning, with UK inflation figures for May better than expected.

That said, further economic uncertainty could offer domestic price support later this week, with UK unemployment figures and claimant count numbers due tomorrow morning.

Furthermore, with UK retail sales data due a week on Thursday, and continued political uncertainty with regard to Brexit, currency is likely to play a key role in determining domestic wheat prices for the foreseeable future.

With the 30 June deadline long passed for agreeing an extension to the transition period, the UK is facing an ever-decreasing window in which to agree a Brexit deal before leaving the EU on 31 December.

However, the UK is far from the only nation experiencing economic turmoil at present. Moves lower in the dollar and euro could act to pressure UK grain values.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.