What do bumper Oz crops mean for your price? Grain Market Daily

Wednesday, 1 July 2020

Market commentary

- UK feed wheat futures (Nov-20) closed yesterday at £166.95/t, up £3.95/t on Friday’s close. UK markets have followed the move higher in Paris milling wheat futures and Chicago wheat futures, exacerbated by the recent weakness of sterling.

- Yesterday evenings release of the USDA crop acreage report offered further support for grain markets, with a 2Mha cut to US maize plantings on March’s intentions report, to 37.2Mha. Despite this maize plantings remain 2.1% ahead of the five-year average.

- Soyabean plantings are estimated at 33.92Mha, up 0.1Mha on the March intentions report, but 0.6% below the five-year average.

- The AHDB Planting and Variety Survey results, detailing the area and variety of UK crops for harvest 2020 will be released at 2pm on Wednesday 8 July.

What do bumper Oz crops mean for your price?

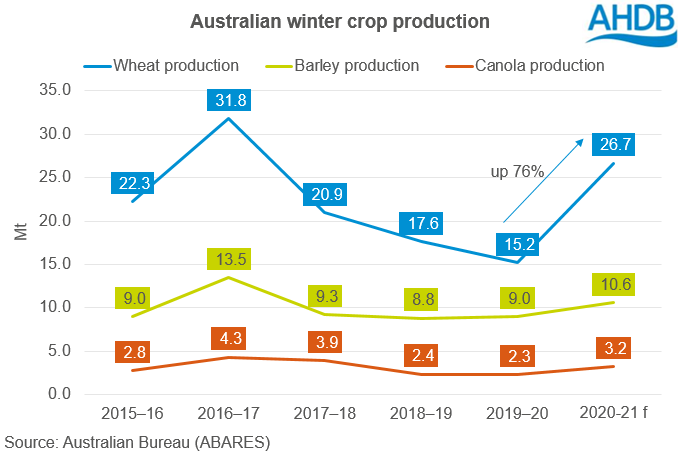

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) estimates that Australia’s wheat production for 2020/21 will reach 26.6Mt, up 11.5Mt on the year. The year-on year increase is driven by an expected recovery in both yield and area after several years of extreme drought.

Production in 2020/21 is also expected be elevated for barley, canola and oats compared to recent years. This increase in predicted Australian production leaves them with a large exportable surplus.

According to USDA data, during 2020/21 Australia are expected export around 65% of their total wheat production, an increase of 7.8Mt year on year at 17.0Mt. There is also expected to be 4.2Mt of Australian barley available for export, up 1.0Mt year-on-year. The return of large exportable surpluses for Australian crops has added pressure to the global grain and oilseed markets.

Australian production is likely to have significant implication for UK prices too, with the UK also having a large barley crop anticipated this year. It is likely that the domestic market will be operating at export parity in order to be competitive with in a well supplied global market. Especially with the large Ukrainian barley crop that is also expected.

The UK is likely to import canola (rapeseed) from Australia, especially with the low levels of OSR production currently taking place in the UK. Furthermore, UK wheat is expected to be priced at import parity, further pressure to the global picture from increased southern Hemisphere production will depress UK grain prices.

Looking ahead, longer-term weather outlooks in Australia will be an important watchpoint. Current forecasts anticipate more rain to continue in the coming months. Australia’s Bureau of meteorology currently anticipate a wetter than average period for August to October, this will likely continue supporting crop development.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.