- Home

- News

- Analyst Insight: Regional wheat deficits could support delivered premiums going into 2020/21

Analyst Insight: Regional wheat deficits could support delivered premiums going into 2020/21

Thursday, 16 July 2020

Market Commentary

- London Nov-20 wheat futures closed up £1.80/t yesterday at £169.70/t, an increase of £2.80/t from Monday’s close. This rally has been led by firming international markets off the back of reports of poor Russian and French wheat yields.

- The domestic price has also been helped this week by a weakening pound against both the euro and dollar. It has traded lower again this morning, after firming slightly yesterday, following the release of UK unemployment figures.

- US commercial crude oil inventories stood at 531.7m barrels at the week ending 10 July. This is a decrease of 7.5m on the previous week and has lent some support to crude oil markets.

How could a smaller wheat crop affect your delivered premium?

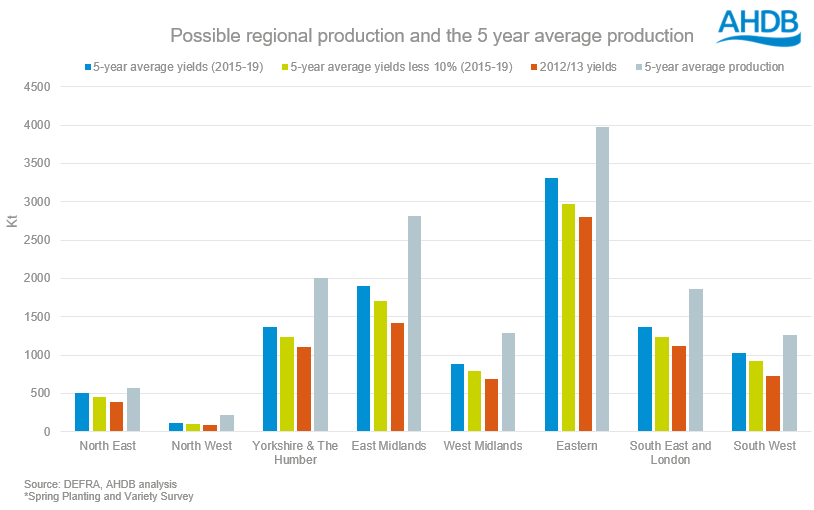

Last week we published the results of the 2020 AHDB planting and variety survey (PVS). Unsurprisingly, estimated wheat areas were down year-on-year across all regions of GB. The extremely wet autumn prevented much of the intended area for winter wheat being drilled, being replaced by spring cropping in many cases. Now that we have the results of the PVS, it gives us an opportunity to look at regional wheat production, using three different yield scenarios.

The three scenarios are:

• A 5-year average wheat yield per region

• A 5-year average less 10% per region

• A 2012/13 wheat yield per region – another season of challenging growing conditions

Given the challenging climatic pressures this season, plus the insight from the May Crop Condition report, yields could well be average to below average. The 2012/13 season is the most comparable weather wise; therefore, these three factors have formed the basis of the scenarios.

The Eastern region is the UK’s largest wheat producing region. However with an estimated 384kha drilled this year, production could range between 2,804kt and 3,305kt based on these 3 scenarios. A 5-year average yield would achieve 3,305kt, this is 23% lower than last year’s production of 4,267kt.

Yorkshire & Humber’s planted area looks set to be 32% lower than last season (160kha). An average yield this season would see production c.1,368kt, some 150kt less than the regions previous lowest production back in 2001/02. With a 2012/13 yield, it could be as low as 1,104kt, 49% lower than the 2,142kt achieved 2019/20.

In the East Midlands a 2012/13 yield would see production 1,424kt, almost 1000kt lower than in 2012/13. Should this be realised, it would be less than half of last year’s production (2,945kt).

The South East produced 1,745kt in the 2012/13 season. If this season yields similar, then just 1,121kt will be cut. With a 5-year average yield there may be 1,368kt available, still almost 650kt less than 2019/20.

With area back 20%, the South West could see production levels between 728kt to 1,028kt, while in the West Midlands, an average yield would produce 880kt, 400kt back on the 5-year average and the first time it has been sub 1000kt since 2013/14.

The North East is forecast to range between 384kt and 503kt, although even an average yield would produce 22% than last season. With just 18kha planted, the North West may well produce a sub 100kt crop, which could mean that wheat would need to be incentivised to deliver to this region.

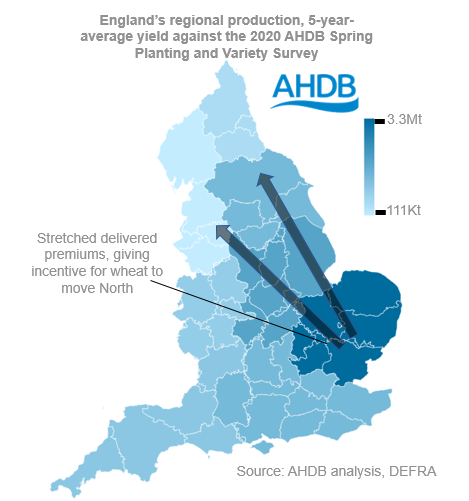

So, despite prices for the coming year likely to be capped at import parity, we may see more flex in delivered premiums to encourage wheat to move up the country.

Poor regional production supporting delivered premiums?

Even without the prospect of hindered yields, the area reduction forecast in the PVS survey will lead to a wheat deficit for the 2020/21 marketing year. Large producing regions, such as Yorks & Humber and the East Midlands, are showing sizeable decreases in the wheat area. This, in theory, will extend our delivered premiums as we move North.

Although the UK domestic market is ultimately held within the prices bounds of imports, there will be a degree of fluidity within the physical cash market through delivered premiums into the North throughout 2020/21

To what extent those premiums extend will depend on nearby supply and demand. For example, if you are a feed mill that requires an excess demand of 1Kt, you would be unlikely to charter a 4Kt vessel to be imported onto the East coast. More likely, you are going to dip into the domestic market, which depending on your geographical location, will depend on your potential price.

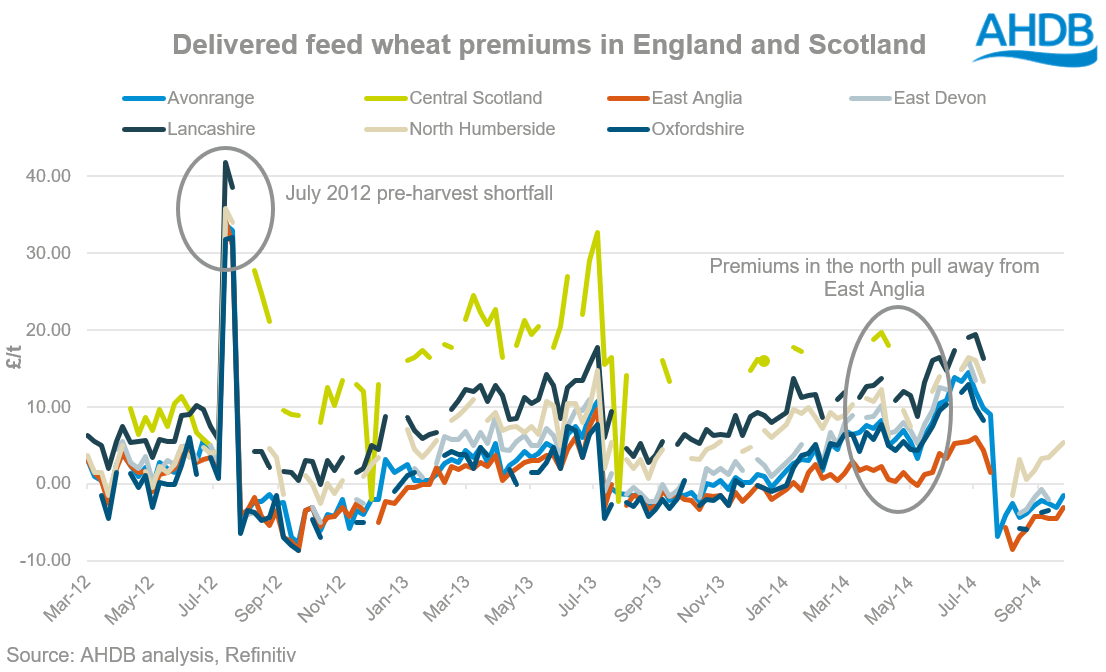

Between March 2012 – September 2014 was also a period where weather events caused successive poor productions. During this time, the premiums in the North significantly extended where there were wheat deficits.

For example, during the first week (wc: 01/07/13) of July 2013, delivered feed wheat premiums extended as far as £32.75 in Scotland, £17.75/t in Lancashire and £14.75/t in North Humberside, while only moving £9.75/t over futures in East Anglia.

In summary, we are moving into a wheat deficit in a relatively well-supplied global picture, capping gains at import parity. However, as we progress throughout the marketing year, we could see delivered premiums over futures significantly extend into the North and West, as buyers look to encourage more wheat up the country.

This could result in the domestic cash market not following the logical pattern of futures. Knowing where your wheat is delivered will help your marketing strategy, planning and potentially increase profit in some scenarios.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.