How Argentinian drought could affect global markets: Grain Market Daily

Wednesday, 22 July 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £167.00/t, up £0.50/t on the day, but down £0.90/t on the week.

- US soybean conditions surpass expectations, the USDA have announced 69% of U.S Soybeans are now classed as being in “good” or “excellent” condition. This now matches U.S. maize conditions also at 69% in “good” or “excellent” condition.

- USDA report continued demand from China for US Soybeans. China has now purchased 1.30Mt of Soybeans and 3.26Mt of U.S maize since July 10.

How Argentinian drought could affect global markets

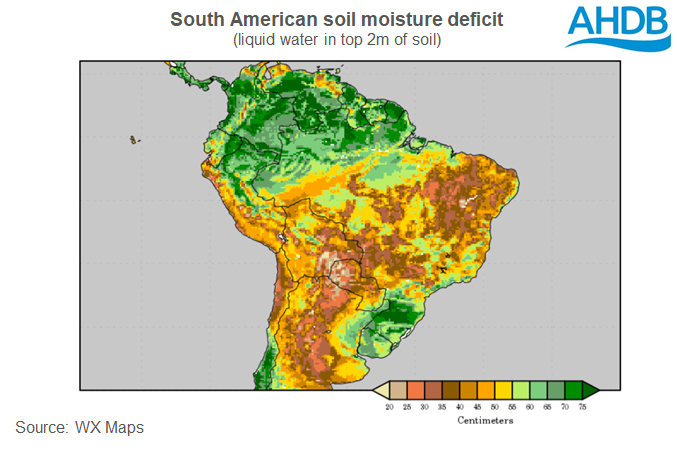

Argentina’s production estimates for both wheat and maize in 2020/21 have been reduced due to lack of rainfall, causing major droughts across the country.

Bolsa De Comercio De Rosario (BCR) have revised their wheat production area down to 6.6Mha for the 2020/21 production year. This is a notable decrease in the planted area, with their previous estimates suggesting a planted area in excess of 7Mha. This new figure is also down on the 2019/20 figure of 6.8Mha, which produced 19.5Mt.

Furthermore, the Buenos Aires Grain Exchange have pegged the wheat planted area at 6.5Mha.

There are prolonged droughts in two of Argentina’s three main growing regions, Cordoba and Santa Fe. The third key region, Buenos Aires, did have minimal rainfall in early July, but this offered very little respite.

It’s not just wheat currently being planted that is being impacted. Crop conditions for wheat planted in May and June are also at risk. In the north, 1Mha is currently classed as “fair to poor” and this is only likely to worsen as the drought continues.

The dry conditions also bring an additional worry, with the risk of La Nina in Argentina increasing. Reuters suggested last week that ‘Persistent dry conditions associated with La Nina are most likely to occur in Argentina’.

Maize area estimates for 2020/21 are now at 6.75Mha, this down from 7.26Mha in 2019/20, According to BCR.

How does this impact the UK?

With tighter wheat outlooks for many Northern Hemisphere exporters, Southern Hemisphere production is likely to be increasingly important this season. A further tightening of potential in South America would likely support global prices.

Furthermore, the USDA forecast Argentinian exports of 37Mt of Maize and 13.5Mt of wheat in 2019/20. HMRC data suggests that in 2019/20 the UK imported 164Kt of maize from Argentina, in the season to May.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.