Future UK product standards: Issues and implications of change

Friday, 27 March 2020

As we progress through the transition period, the UK remains fully aligned with European standards as if it were still a member of the EU. Product regulations passed in the EU parliament are applied in the UK with immediate effect and apply to all goods produced in the UK and those imported from overseas.

For some, one of the key prizes awaiting Britain once the transition period is complete is the freedom to diverge from European regulations and standards. This could grant the UK a competitive advantage against EU products and allow it to access trade deals with countries such as the US or China who have different standards for their products. But what are the trade-offs and what could it mean for British agriculture?

Roll-over trade deals

The EU has agreed 40 free trade agreements (FTAs) covering 70 different countries including Japan, Mexico and South Korea. From 1 January 2021, these agreements will no longer apply to the UK, though the government is working to negotiate roll-overs and has achieved 20 such agreements, covering 50 countries or territories. We published analysis of the importance of such deals in October 2019. Since then, agreements have been signed with Georgia, Jordan, Kosovo, Morocco and Tunisia.

However, these agreements are based upon the UK’s regulations as they currently stand i.e. in-line with the EU’s. Should the UK diverge substantially from this baseline, partner countries may wish to re-examine the terms of their FTA and reopen discussions on equivalence of standards.

Level playing field

Aside from product standards, some aspire to diverge from EU regulations governing factors that affect the cost of doing business. Rules around state subsidies, environmental legislation, taxation and labour protections make up a set of common rules and standards that ensures members of the EU cannot undercut each other by, for example, lowering any of these standards.

Given the UK economy’s size and geographic proximity, the EU is anxious to avoid a situation where divergence from these standards gives the UK a competitive advantage. Officials have expressed that the level of market access achieved in the EU-UK trade agreement will rely on the degree of alignment agreed. Access to European markets is vitally important for some agricultural sectors, particularly sheep. In 2019, 92% of sheep-meat exports went to EU countries, worth a total of £380m. Explore trade data here.

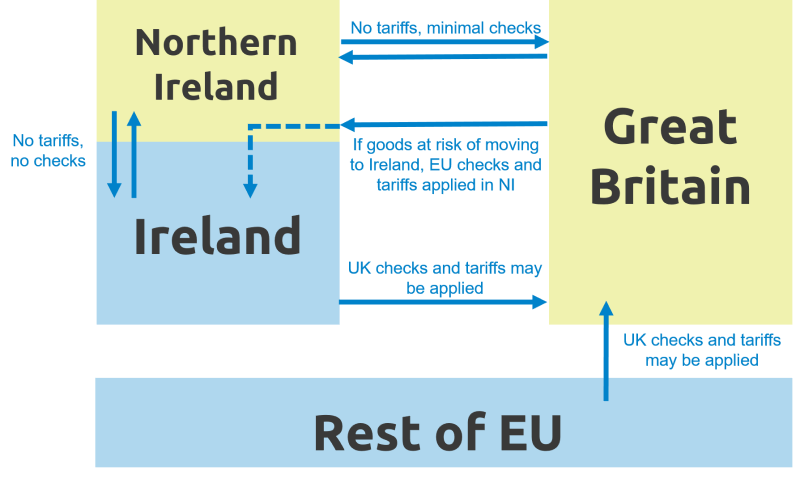

The Northern Ireland Protocol

To respond to the unique situation on the island of Ireland, the Protocol foresees that Northern Ireland will remain aligned to a limited set of rules that are essential for avoiding a hard border between Ireland and Northern Ireland, e.g.:

- The Union’s Customs Code (UCC) and other customs legislation;

- EU rules on VAT and excise in respect of goods;

- EU rules on product standards and sanitary and phyto-sanitary rules;

- EU state aid rules.

This means that;

- All goods entering Northern Ireland from outside the EU will have to undergo the same procedures and controls as goods entering a Member State from outside the EU

- Similarly, all goods departing from Northern Ireland to Great Britain or a third country will have to undergo the same procedures as exports from Member States

- All goods produced and marketed in Northern Ireland will have to comply with EU standards

However, this poses potential difficulties for businesses in Northern Ireland should the rest of the UK diverge substantially from EU rules. Northern Ireland sends £10 billion worth of goods to Great Britain every year (half of its sales outside NI). According to analysis from the Treasury, 98% of businesses sending goods to GB are small or medium sized enterprises, food and drink being the top traded goods. Many businesses will need to produce goods for two different regulatory regimes and face a dual regulatory burden.

Goods travelling from GB to NI will be subject to checks to ensure they comply with EU product standards, particularly important for food because of its perishable nature and because of rules on sanitary and phytosanitary standards which require physical checks at the border. As divergence grows, the depth of compliance checks needed is likely to increase.

Choices to be made

The EU is currently our biggest market and close alignment eases the flow and cost of trade. Divergence from EU standards would introduce friction but it may also help us to secure trade deals with countries in the rest of the world, where economies are growing more quickly and new trade opportunities lie. Cutting red tape to increase our competitiveness is a tempting proposition but will bring difficulties, particularly for those businesses in Northern Ireland. Difficult choices lie ahead.

Topics:

Sectors:

Tags: