Feed markets look to global harvests for incentives: Feed market report

Thursday, 25 February 2021

By Alex Cook

Grains

Feed markets have taken a breather over February, with grain prices falling from January highs. The majority of feed crops in the EU + UK have emerged from winter relatively unaffected by colder temperatures. Soft wheat production in the EU-27 is forecast 10.4Mt higher next season, at 129.6Mt according to Stratégie Grains, providing some price pressure as we move closer to harvest.

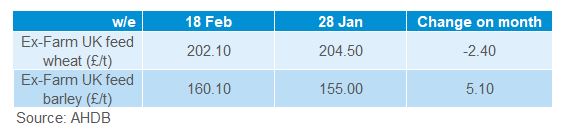

UK ex-farm prices declined over February. Spot UK feed wheat was quoted at £202.10/t, in the week ending 18 February. Spot UK feed barley was quoted at £160.10/t.

The February global supply and demand estimates (WASDE) from the USDA, detailed an increase of 2.7Mt to global maize ending stocks, forecast at 286.5Mt. This was due to lower usage in the EU, Japan and South Korea. Last season, global maize ending stocks were at 303.0Mt. The lower forecast figure this season has supported markets. As well, large Chinese purchases of maize have increased global prices but we are starting to see a degree of pressure appear.

US maize planted area is forecast to increase by 0.5Mha when planting begins in April. This comes as little surprise given the high market prices of maize currently. Chicago maize futures (nearby – 19 Feb) are quoted at $213.67/t, $63.87/t higher than this time last year.

The Brazilian second crop maize area is forecast to increase too to 14.35Mha, a rise of 4.4% compared to 2019/20, according to Conab. Strong domestic prices of maize have supported the increase in planting. Rainfall has slowed the Brazilian soyabean harvest taking place at the moment. This is important as the maize crop is planted following the soyabean harvest. Brazilian safrinha maize planting was 20.0% complete as of 19 Feb, compared to 51.3% this time last season. Persistent delays could reduce the final maize planted area. If this occurs then global maize prices could increase.

Weather is also having an effect on the US winter wheat crop. A severe US snowstorm has brought freezing temperatures to fields. The magnitude of crop damage is unclear, but temperatures approached winter kill levels in some areas. Severe damage to the winter wheat crop could see global wheat prices increase.

Protein

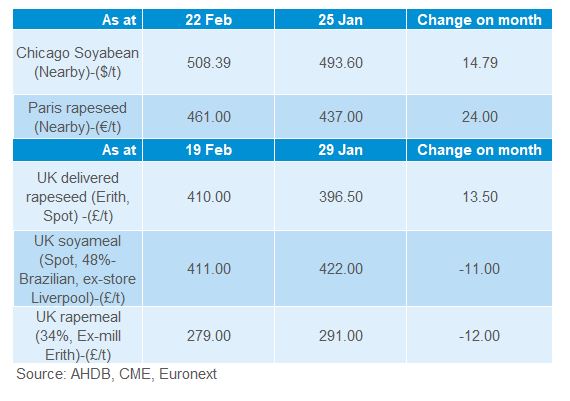

Oilseed markets have seen prices stabilise following the steep decline throughout January. This comes as delays to the ongoing Brazilian harvest lengthen the time for new-crop soyabeans to hit markets.

Soyameal prices have also declined over the month. Chicago soyameal futures (May-21) were quoted at $466.94/t (£333.20/t), this is down $3.09/t (£10.54/t) from 25 January. UK soyameal prices (48% protein, nearby ex-store Liverpool) also declined, down £26.00/t from 22 January, at £411.00/t

The February WASDE reduced global soyabean ending stocks, forecast at 83.4Mt. If we exclude China, then stocks are estimated at 54.8Mt, the lowest since 2013/14. The fall was due to lower US and Brazilian stocks amid a rise in global exports. Rampant Chinese purchases and imports have supported a rise in oilseed meal prices this season.

Initial estimates for US soyabean planting suggest a large increase in area when planting begins in April. Though early, planted area is estimated at 36.4Mha, up from 33.6Mha last season. If realised, this would be very close to the record 36.5Mha area in 2017. Weather conditions in the run up to the beginning of planting will offer a degree of market sentiment which could affect prices.

Inclusion of soya cake and meal in UK compound feed production this season (Jul-Dec)has increased 1.7%. This comes as imports of soyabeans into the UK have increased 44% over the Jul–Dec period, on the year. Pig feed production has increased 5.4% this season to December. This could be a result of animals reportedly remaining on farm for longer than expected, with abattoir backlogs.

Soyabean prices will depend on further Chinese purchases for support. As the presence of a record Brazilian crop and increases to US acreages could pressure prices.

Currency

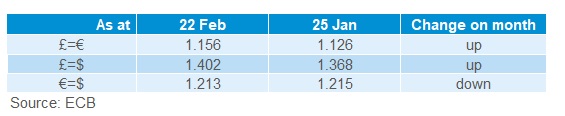

Sterling has strengthened considerably over the month with economic positivity around vaccination progress in the UK. It is hoped lockdown measures can ease ahead of other countries leading to a return in consumer spending. The US dollar has been trending downwards following expectations of inflation.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.