Farmbench results: past, present and future

Friday, 25 November 2022

Mark Topliff, AHDB Lead Analyst – Farm Economics, uses Farmbench data to illustrate how crops performed in 2021, and provide costings estimates for 2022 and a forecast for 2023.

The analysis

Conventional combinable crop enterprise performance results (11,584) were analysed in Farmbench (ahdb.org.uk/Farmbench) for the 2017 to 2021 harvest years.

Results are presented across three performance groups: top 25%, middle 50% and bottom 25% – based on full economic net margin.

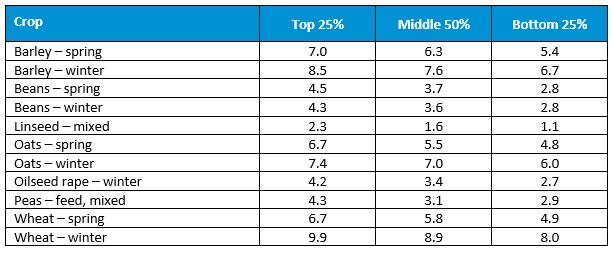

Yields

Across the crops, there was significant yield variation in the enterprises and over the years – in response to weather and disease pressures. However, 2021 yields were close to the previous four-year averages. The top 25% consistently averaged higher yields (Table 1).

Table 1. Five-year (2017–21) average yield (tonnes/ha)

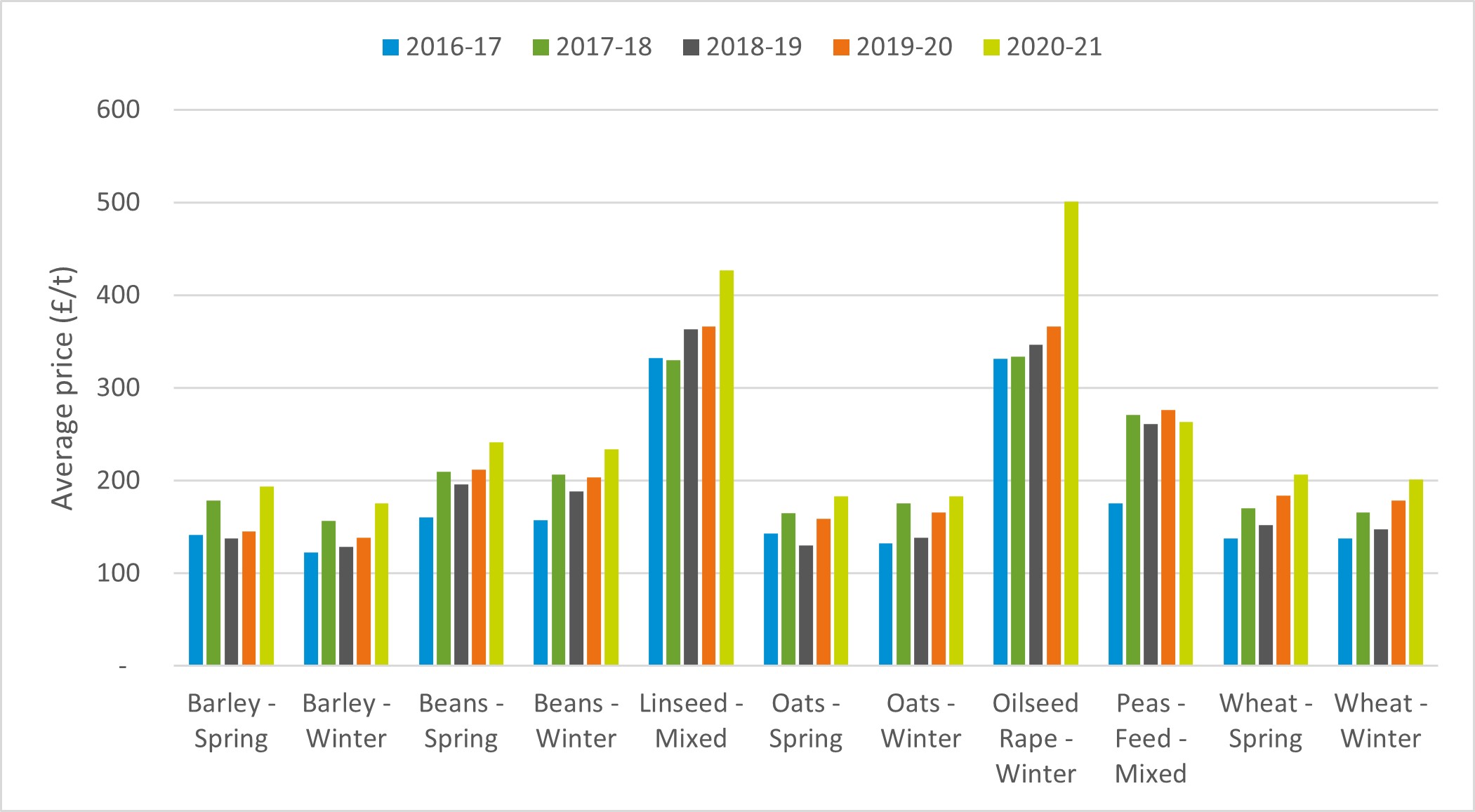

Prices and income

There has been an upward trend in reported prices received for most crops since the 2019 harvest year (Figure 1).

Figure 1. Five-year (2017–21) Farmbench reported crop prices (£/tonne)

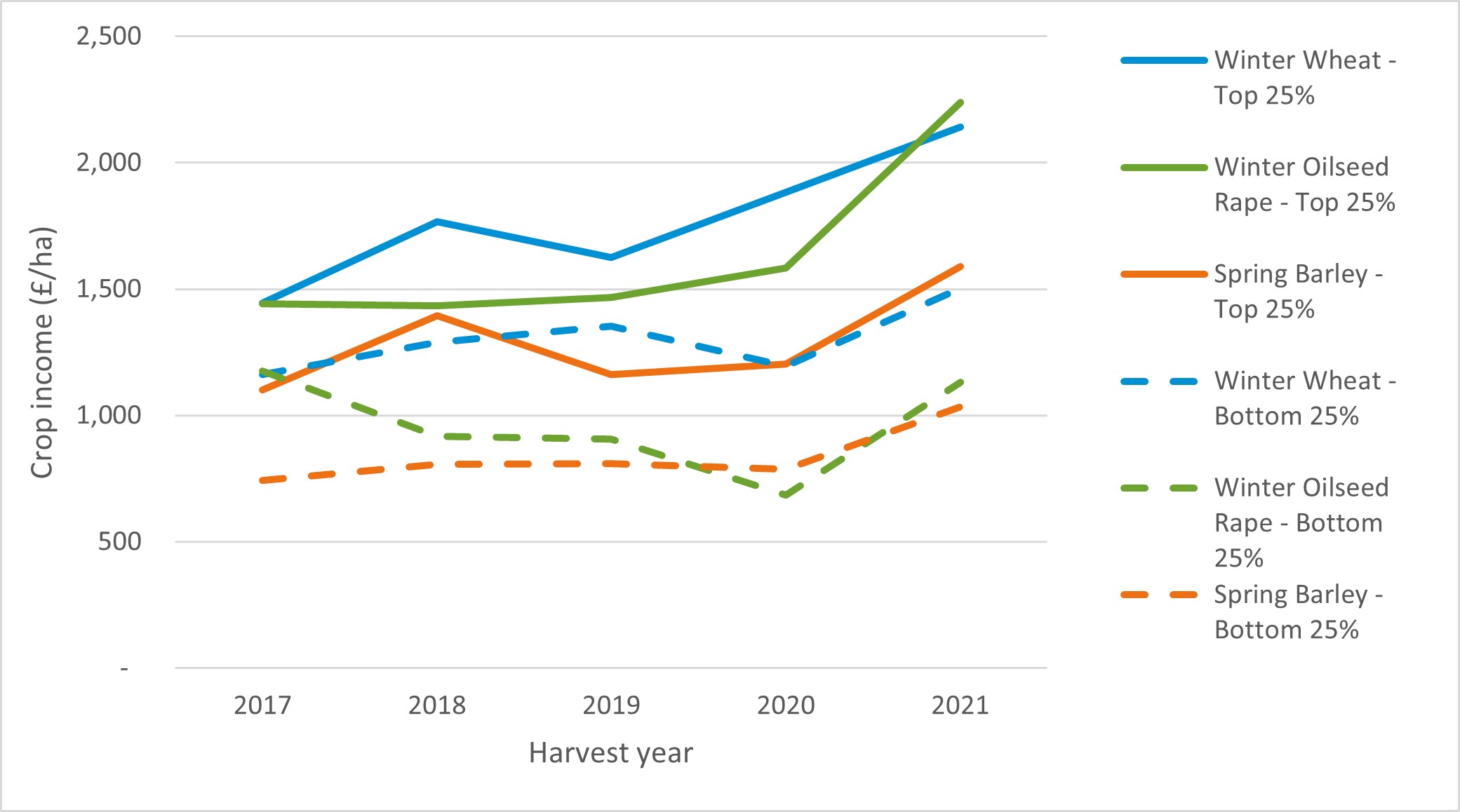

Income data reveals the combined impact of yields and prices, with data (2017–21) shown for winter wheat, spring barley and winter oilseed rape (Figure 2).

For the top 25% performers, income increased by around £500 to £800 per hectare (crop dependent), largely due to higher prices.

Conversely, income changes in the bottom 25% were much smaller, by around -£40 to £340, due to relatively low yields and higher costs.

Figure 2. Five-year (2017–21) crop income (grain and straw sales) for winter wheat, oilseed rape and spring barley (£/ha).

Although a relatively small proportion of the cereal crop income, the top 25% typically received double the income from straw than the bottom 25%.

Five-year average spring and winter barley straw sales were 8% to 9% of the crop income in the top quartile. But, half this proportion in the bottom 25%.

Variable costs

Variable costs include seeds, fertiliser, crop protection, agronomy services and sundry variable items.

On average, the lowest variable costs (2017–21) were associated with beans, linseed and oats. The highest were associated with winter barley, oilseed rape and wheat. Variable costs are estimated to increase in 2022 and again in 2023 (Table 2).

Even if a modest reduction (10%) in usage is assumed, fertiliser costs could still be more than three and half times higher in 2023 than in 2021. This could double the variable costs in heavy-input crops.

Table 2. Variable costs (£/ha) by crop for Farmbench middle 50%

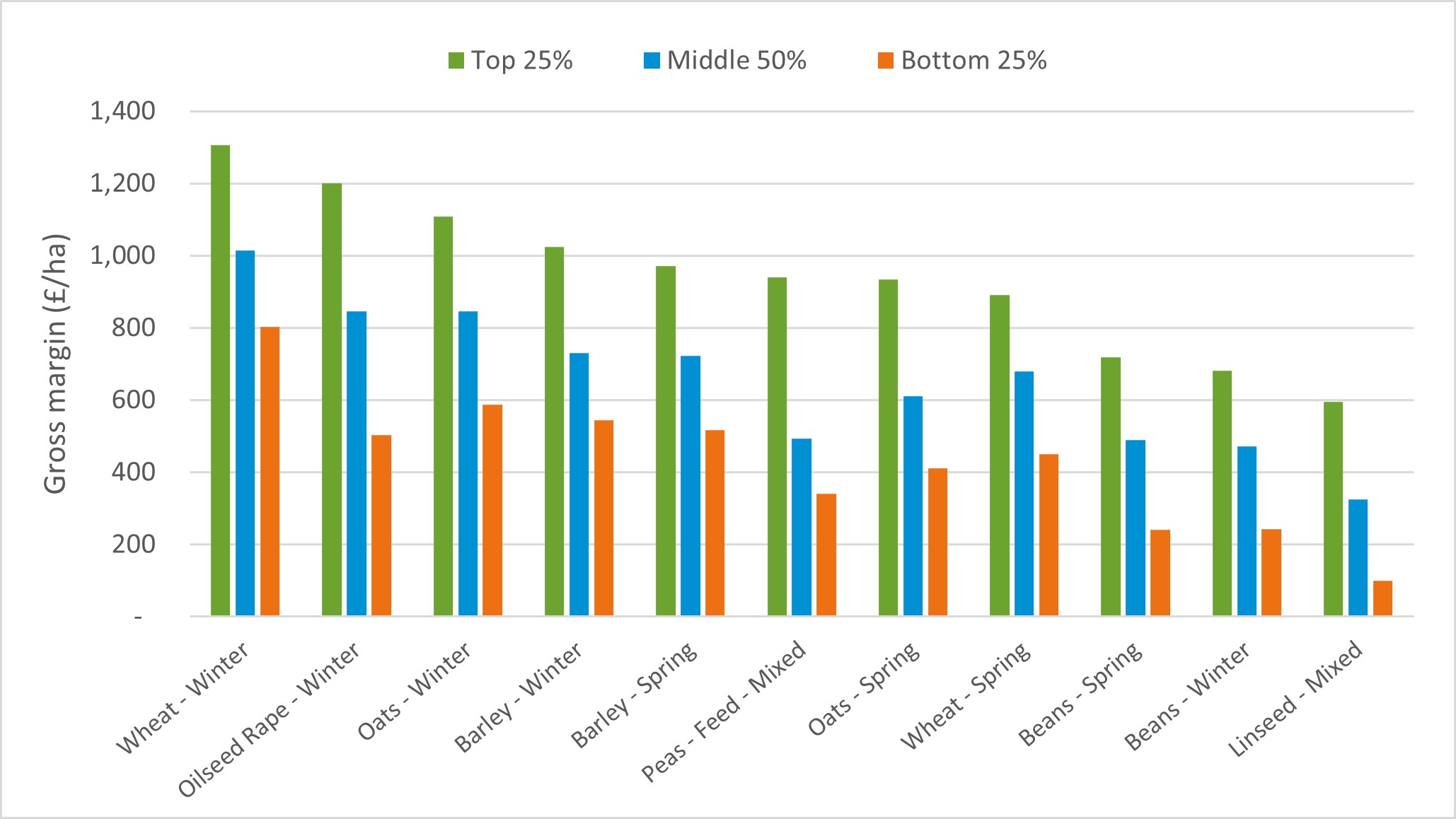

Gross margins

Winter wheat always produced the highest gross margin (2017–21), followed by winter oilseed rape or winter oats (Figure 3).

The middle-performing group's gross margins were usually 40% lower than the top performers. The bottom quartile had around 45% lower gross margins compared to the middle group.

Figure 3. Five-year (2017–21) average gross margins (£/ha) by crop and performance group

Overheads

Total overheads include a value for unpaid labour, the rental value of owned land, depreciation, and finance charges.

Wheat and winter oats had the highest total per-hectare overheads, with a 2% increase over the five years. Most crops saw an 11% to 15% rise over the period.

Table 3. Overhead costs by crop for Farmbench middle 50% (£/ha)

Generally, overheads account for two-thirds of the total cost of production. They are key drivers of profitability, alongside yields.

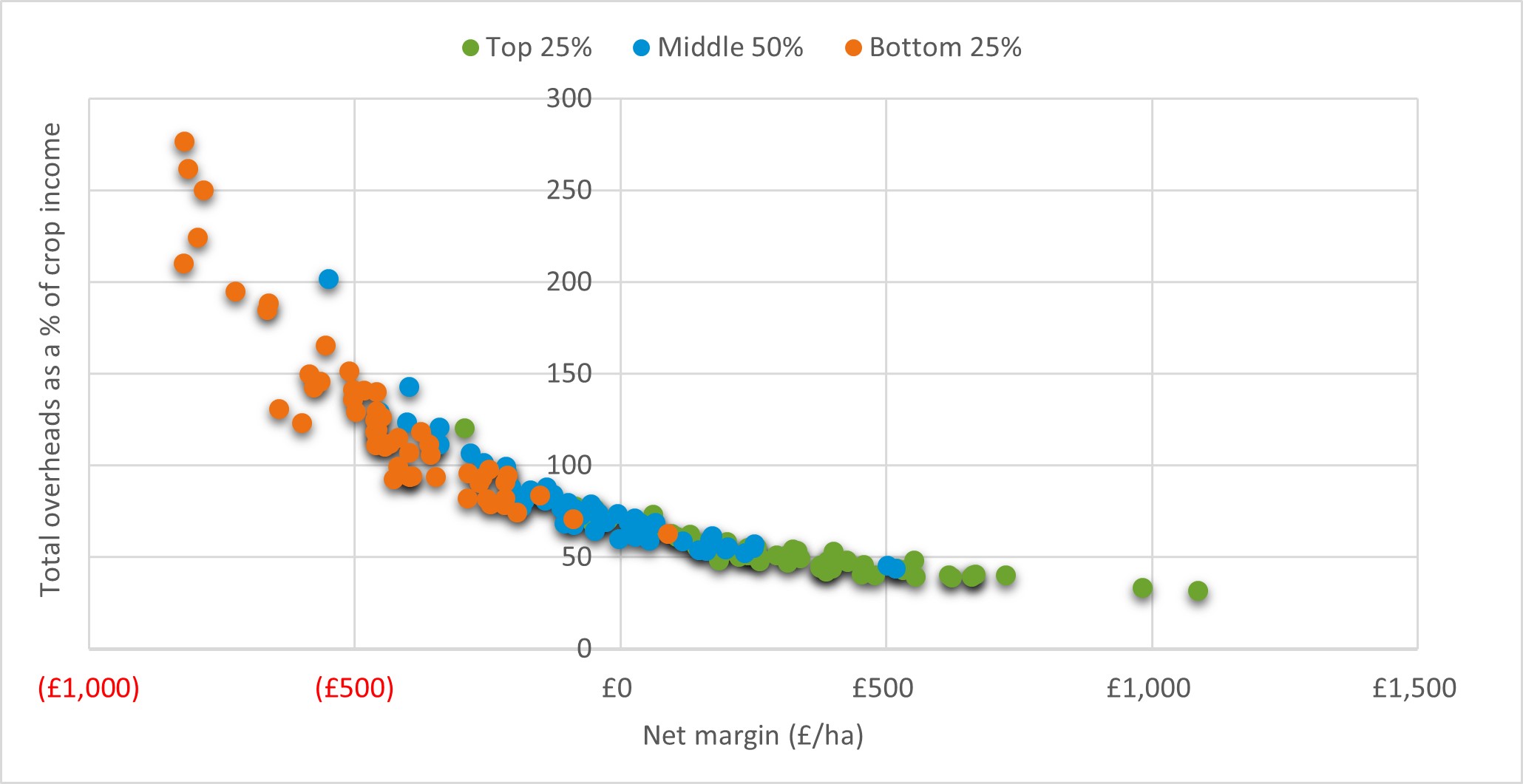

When total overheads are calculated as a percentage of total income (a function of yield), there is a strong association with net margin (Figure 4).

As overheads as a percentage of income reduce, net margin increases.

For most crops, the top 25% group has total overheads that are less than 60% of the crop income – for wheat, barley, and oilseed rape this falls to under 40%.

Figure 4. Total overheads as a % of crop income versus net margin (£/ha) by performance group for all crops (2017–21)

Energy and machinery costs have been the key influences on the higher overheads. Fuel, for example, doubled in price during 2021/22.

Cost of production

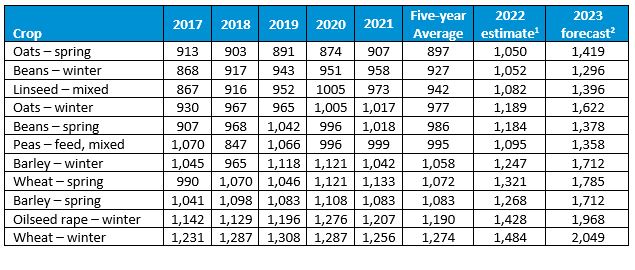

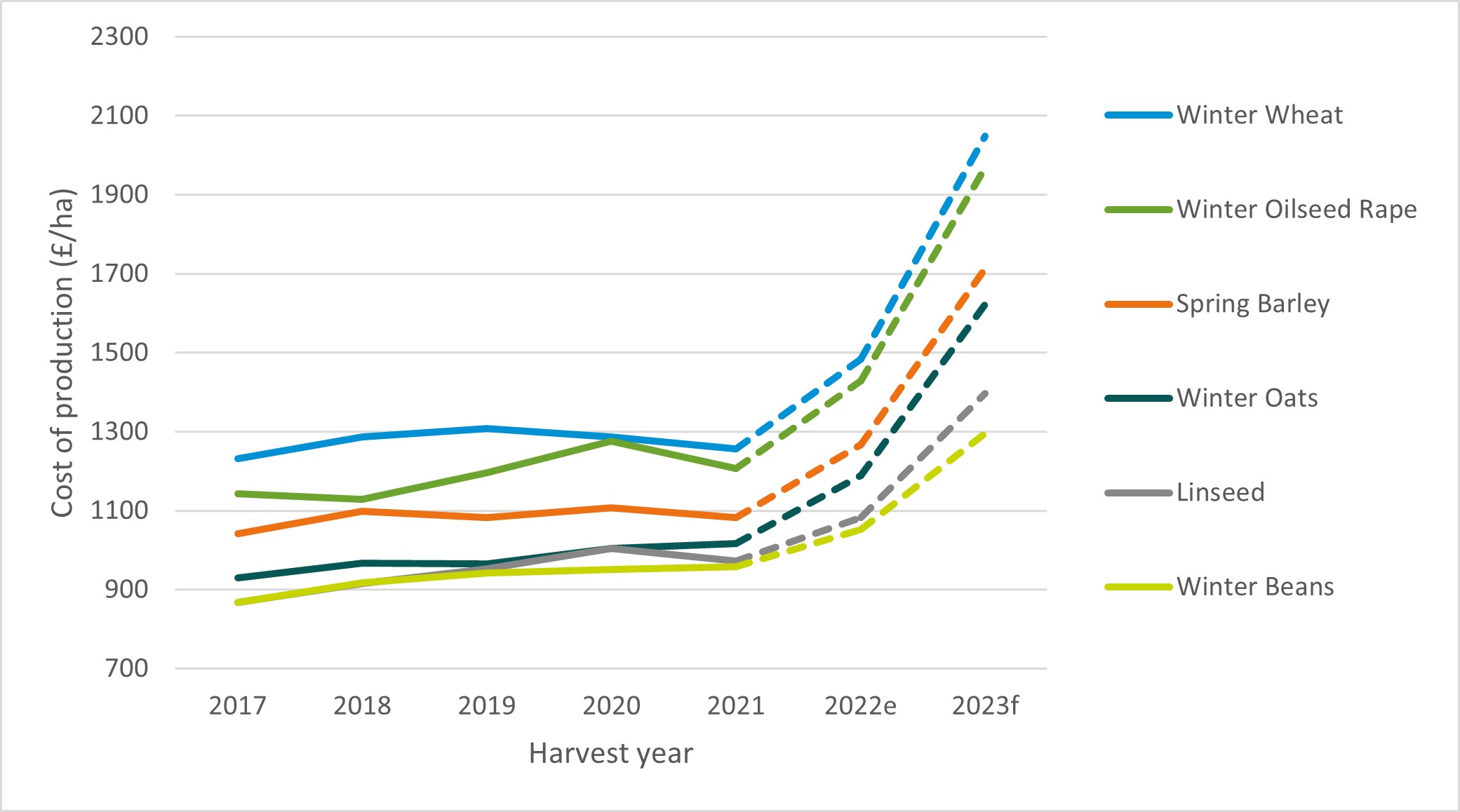

Generally, total costs of production have gradually increased (2017–21), on average by 6% for the middle 50% (Table 4 and Figure 5).

Spring oats and feed peas had lower costs, but winter wheat and spring wheat costs were 2% and 14% higher respectively.

Averaging across all crops, 2022 costs are estimated to be 15% higher followed by another hike of 32% for harvest 2023.

Table 4. Full economic cost of production by crop for Farmbench middle 50% (£/ha)

Figure 5. Full economic cost of production for Farmbench middle 50% (£/ha)

Net margins

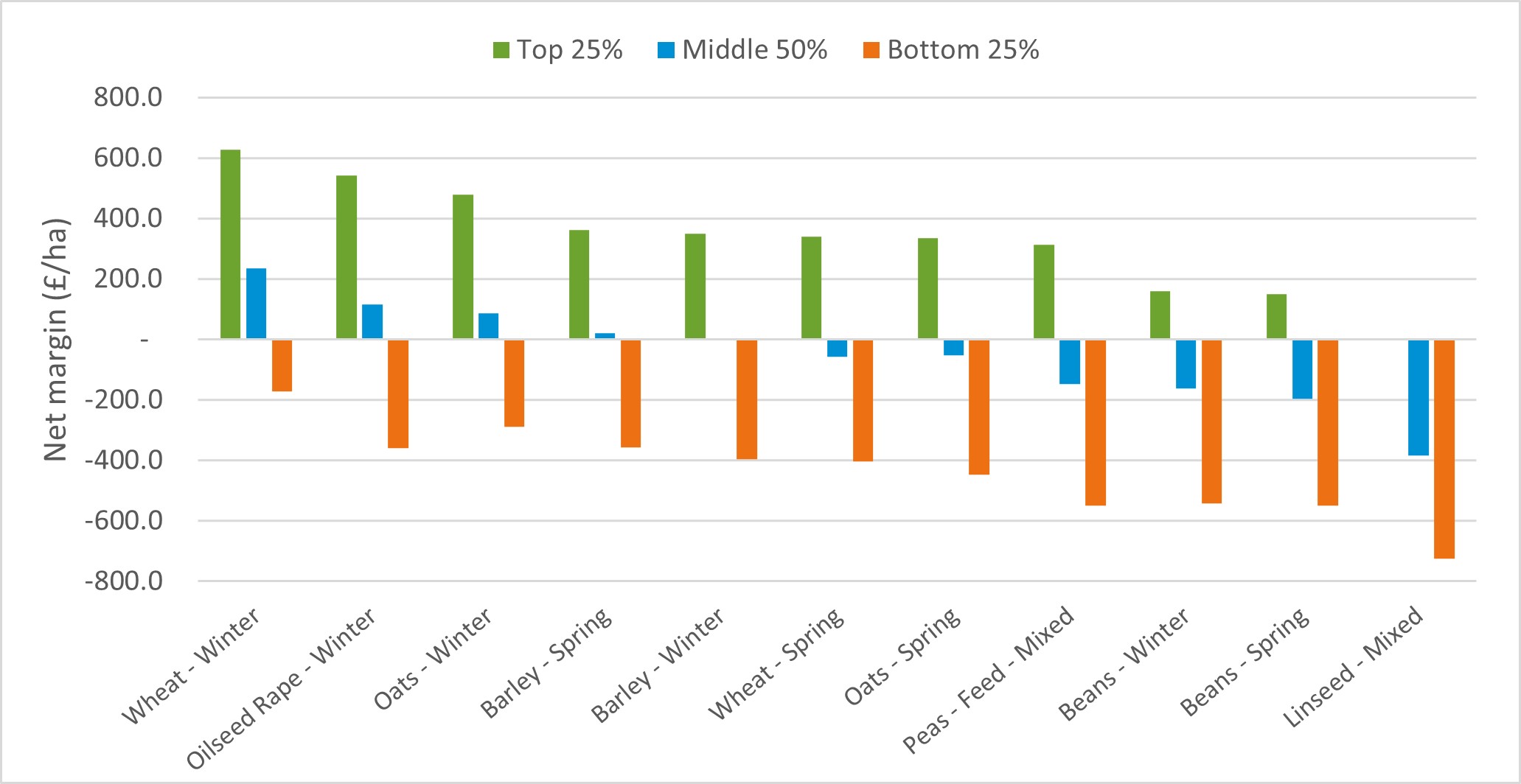

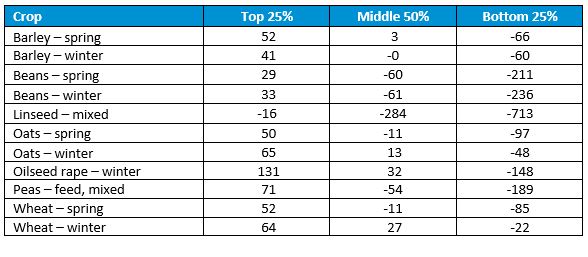

In all performance groups, winter wheat, oilseed rape and oats returned the best average net margins (2017–21).

In line with crop income trends, full economic net margins also improved in 2021. Unsurprisingly, the top 25% had the greatest increases. For example, a rise of nearly £300/ha with winter wheat.

In 2021, all crops for the top quartile and most crops for the middle 50% returned a positive net margin. Apart from winter wheat, no positive net margins were observed in the bottom 25%. In fact, the five-year average showed no positive net margins for that group (Figure 6).

Figure 6. Five-year (2017–21) average net margins (£/ha) by crop and performance group

When yield is considered, the order changes slightly. In the top quartile, oilseed rape has the highest net margin (Table 5). On average, linseed delivered the worst results for each performance group.

Except for barley, winter crops outperformed their spring equivalents – by £4–£15/tonne in the top quartile, and £1–£38/tonne in the middle 50%.

Table 5. Five-year (2017–21) average full economic net margin (£/t) by performance group

High cost impact

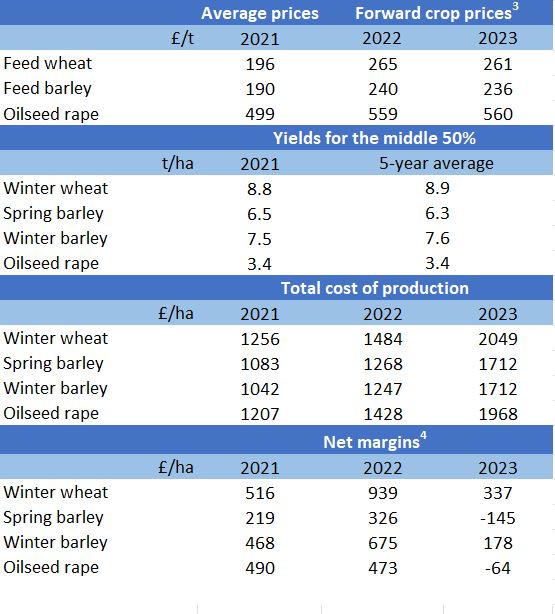

Table 6 shows an analysis of the middle 50% group to indicate the potential margin impact of higher costs on wheat, barley and oilseed rape. It uses forward crop prices and average yields to estimate income in these crops, with 2022 and 2023 cost of production estimates deducted.

Table 6. Full economic net margin analysis (2021–23) for three combinable crops for the Farmbench middle 50% group

AHDB

AHDB

For winter wheat, margins could increase around 82% in 2022, if forward prices are realised. Spring barley is not expected to have such a big increase and oilseed rape is estimated to be lower than in 2021, due to higher costs.

However, based on current futures prices, the impact of the higher costs will bring all margins down dramatically in 2023. Possibly into negative territory for spring barley and oilseed rape.

Conclusion

Until recently, the general upward price trend has largely kept ahead of gradual cost rises. Now inflationary pressures on farm-input costs will impact heavily on net margins in 2023.

Holding on to 2022 profits will prove difficult, with generally higher working capital required to purchase inputs for harvest 2023 crops and, in England, the reduction in Basic Payments.

Grain prices are likely to stay volatile into the 2022/23 marketing year, with marketing strategies having an even greater influence on margins in 2022 and 2023.

Options to optimise income and mitigate cost increases can be explored in Farmbench – from crop rotation changes, to locking into futures prices, to evaluating potential inputs and equipment investments. If not already considered, environmental schemes should also be investigated on whether they can fit into the farming system and provide a useful steady income.

Access our Tools page for a range of support on cost of production and crop inputs

Take a look at our farm business planning section

Notes

1Based on year-on-year change in Defra Agricultural Price Index average of 15%.

2Based on forecast aginflation average of 32% and assumed reduced usage of inorganic fertiliser.

3 Futures prices as at 4/11/22. Deductions accounted for in total costs

4 Including straw income for wheat and barley

2022 estimates based on changes in Defra agricultural price indices applied to the 2021 results. Some reduction in fertiliser usage is assumed.

2023 forecast figures based on a full crop year at current inputs inflation rates. Some reduction in fertiliser usage is assumed.

Net margin is crop income minus all costs, which includes all non-cash costs to the business – depreciation (machinery and buildings), unpaid labour and the rental value of owned land. Subsidies are excluded.

Full economic costs include a value for unpaid labour, the rental value of owned land, depreciation and finance charges.

All tables are ranked by five-year average data.

AHDB

AHDB